The excitement is electric, and the air is thick with anticipation as the digital currency sphere gears up for another monumental Bitcoin halving event. But what ripples does this seismic occasion send through the Bitcoin market in the lead-up and aftermath?

Dive into our thrilling SimpleFX analysis as we take a wild ride back and forth in time, exploring the twists and turns of Bitcoin’s journey around its halving events. Imagine cracking open a treasure chest of Bitcoin’s past, ten exciting weeks before and after its big halving moments. It’s all about unlocking the mysteries of the halving phenomenon—a journey with every investor and trader on the edge of their seat!

Understanding Bitcoin Halving

In the simplest terms, Bitcoin halving is a scheduled event that cuts the reward for mining new Bitcoin blocks in half. This mechanism, occurring roughly every four years, is Bitcoin’s way of enforcing scarcity, akin to gold mining becoming progressively harder. It’s a pivotal moment that can significantly influence Bitcoin’s value and the broader cryptocurrency market.

Check out why this event matters and its impact on trading.

Trends Surrounding Bitcoin Halving

Historically, anticipation and speculation have marked the weeks leading up to a Bitcoin halving. Our analysis reveals a pattern of particular price movements as the event approaches. Traders and investors often speculate on the halving’s potential to drive prices up, leading to a surge in activity. However, the extent of these trends can vary, influenced by broader market conditions and investor sentiment.

10 Weeks Before And 10 Weeks After: The Analysis

2012 Halving

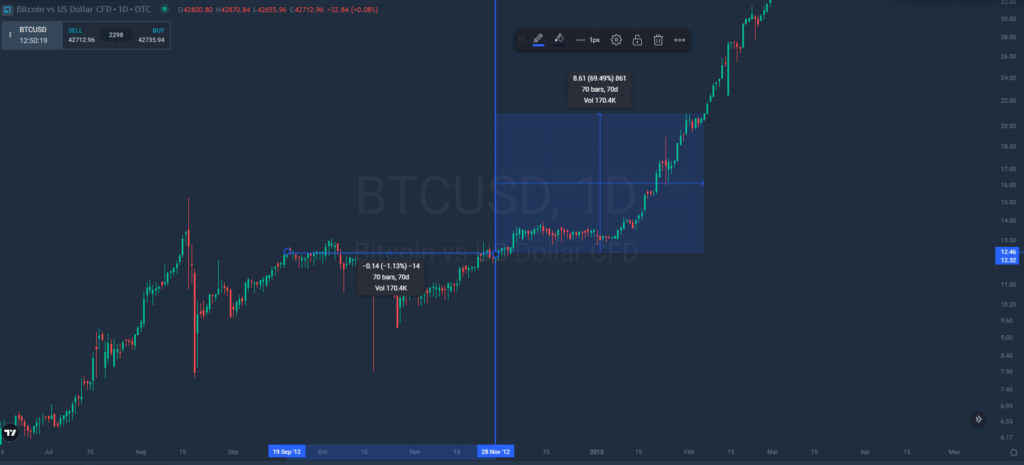

The first halving occurred on November 28, 2012, when the Bitcoin block reward was cut from 50 coins to 25 coins per block.

Bitcoin’s 2012 halving price action.

The price action of 2016 is different from other halvings. The change here is mainly that massive growth occurs immediately after halving, with no re-accumulation period. In the 10 weeks before the reward for the mined block was cut in half, the price virtually did not change, and after it increased by as much as 70%.

2016 Halving

The 2016 halving occurred on July 9th, 2016, at block 420,000. Before the halving, miners were rewarded 25 bitcoins for every block they successfully added to the blockchain. Post-halving, this reward was reduced to 12.5 bitcoins.

Bitcoin’s 2016 halving price action.

As you can see in the attached chart, the reaction forms a mirror image. The price 10 weeks before the halving increased by over 45%, while after the halving, it hardly moved (dropped by -6.5%). During the 2nd period, there were significant jumps in value, although the re-accumulation is clearly visible.

2020 Halving

In the 2020 Bitcoin halving, the Bitcoin block reward dropped from 12.5 to 6.25 BTC. The Bitcoin 2020 Halving took place on May 11, 2020.

Bitcoin’s 2020 halving price action.

2020 was much more special. The analysis is slightly disturbed by the outbreak of the COVID-19 pandemic, which caused a massive decline in bitcoin. However, the price both before and after the halving remained virtually unchanged. It moved 4.5% down and -7.5% up, respectively. The period after the halving was again a time of re-accumulation.

Insights and Implications

This analysis sheds light on the nuanced impact of Bitcoin halving events. Sometimes the price rose aggressively before the halving, sometimes after. During the last halving, it was essentially flat both in the 10 weeks before and after the event. Nevertheless, in each case, about 1 to 1.5 years after the halving, the price entered the new ATH.

After-halving PA.

The historical patterns suggest halvings can contribute to long-term price increases, but they’re not guaranteed short-term windfall. Investors should be wary of the hype and consider a diversified strategy that accounts for the inherent volatility of cryptocurrency markets.

Meanwhile 2024 halving kickstarts in…

Conclusion

As we edge closer to the following Bitcoin halving, it’s clear that these events are significant milestones in the cryptocurrency landscape. Our analysis offers a glimpse into the complex dynamics, highlighting the blend of anticipation, speculation, and market response characterising these periods.

Looking ahead, the historical trends provide valuable insights but are not a crystal ball. Each halving is unique, influenced by an ever-evolving market and global economic factors. For those navigating the cryptocurrency waters, staying informed, cautious, and flexible is critical to harnessing the opportunities of Bitcoin halving events.

This exploration into Bitcoin’s pre and post-halving trends offers a foundation for understanding the potential impacts of future halvings. As the cryptocurrency market matures, these insights will be invaluable for investors aiming to make informed decisions in a landscape where history often rhymes, if not repeats.

The information provided on this website does not, and is not intended to, constitute investment advice; instead, all information, content, and materials available on this site are for general informational purposes only.