Apr 20, 2024 00:09:27 UTC.

Historic date.

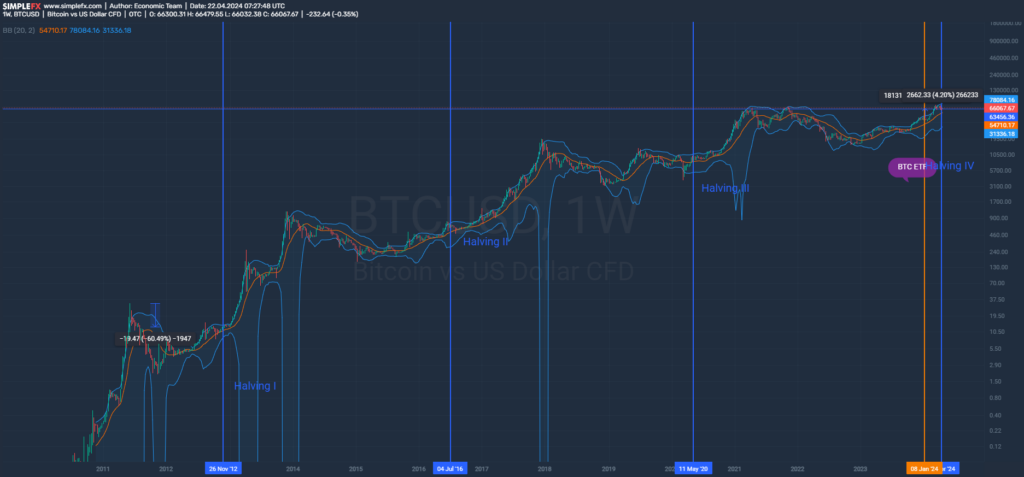

It was then that block number 840,000 was mined. Bitcoin’s 4th halving has occurred, marking a significant milestone in the timeline of the world’s leading cryptocurrency.

Immediate Market Reactions and the Halving Date

Interestingly, however, the date of April 20, 2024, will be recorded as the 4th Bitcoin Halving only east of London and will, therefore, cover Europe, Asia, Australia, and Oceania. Due to the time difference, for Americans, halving took place on April 19.

Analyzing the First Waves of Impact

Can we talk about any variability in such a short time?

BTC immediate PA.

Let’s start with the price. At halving, it was about $63,450, and at the time of writing the article, it is exactly 4.20% (take a look at the halving date, BTW) higher, hovering around $66,000. But let’s look a little deeper.

Bollinger Bands on a BTC.

One of the main tools for measuring the volatility of a given instrument is the Bollinger Band. It is constructed in such a way that a range of a specific number of standard deviations (here 2) is added to a specific SMA (here 20-period). Take a look at D1 chart. After the halving, the price returned to the moving average, and there was no significant increase in volatility…yet.

Long-Term Economic Implications

As the dust settles on the initial reactions, the focus shifts towards the broader economic implications of the halving. These longer-term effects are where the true significance of the halving comes into play, influencing everything from Bitcoin’s scarcity to its perception as a digital store of value.

Predicting the Macro Impact

By decreasing the rate at which new bitcoins are created, the halving enhances scarcity and potentially boosts Bitcoin’s appeal as a deflationary asset. Historically, such conditions have favored price appreciation over the years following past halvings.

Long-term PA with the Bollinger Bands.

As you can see, historically, the price has so far increased after the halving, but the bull run only started after some time. Why?

Implications for Miners and Network Security

The halving significantly impacts miners by slashing their rewards. It might prompt less efficient operations to shut down, temporarily affecting the network’s hash rate. This means that in the short term, miners may be willing to sell more bitcoins to cover the losses resulting from being awarded half the rewards they used to be given. However, if Bitcoin’s price rises, mining could remain profitable for efficient operators, thereby maintaining network security and integrity.

Conclusion

The 2024 Bitcoin Halving event ushers in a new chapter for cryptocurrency enthusiasts and investors. While the immediate market reactions offer a glimpse into potential future trends, the true impact of the halving will unfold over the next few years. Investors should stay informed and adaptable, ready to adjust their strategies based on how these dynamics develop. As we navigate this new era, careful analysis and strategic planning principles remain more crucial than ever. For everyone involved in cryptocurrency, whether trading, investing or simply observing, the post-halving period is a pivotal time.

The information provided on this website does not, and is not intended to, constitute investment advice; all information, content, and materials available on this site are for general informational purposes only.