The October Nonfarm Payrolls (NFP) report has been released, revealing significant departures from expected figures. It sheds new light on the state of the U.S. labor market. This latest data paints a picture of a labor market that is notably slowing, with far fewer jobs added than economists had predicted.

Detailed breakdown of the October NFP report:

Here’s an in-depth analysis of the October numbers, their implications, and what they might mean for future economic trends and monetary policy.

- Jobs Added: The economy added only 12K jobs, starkly contrasting the 106K forecasted and the 223K jobs added in September. This drastic downturn marks one of the most significant slowdowns this year.

- Average Hourly Earnings increased by 0.4% month-over-month, exceeding the expected 0.3% and the previous month’s growth rate. The reading indicates continuing inflationary pressure.

- Unemployment Rate: The unemployment rate held steady at 4.1%, in line with previous reading and forecasts, indicating ongoing stability in this metric despite the slowdown in new job additions.

Decoding the October Nonfarm Payrolls report

The Nonfarm Payrolls (NFP) report, released monthly by the U.S. Bureau of Labor Statistics, is a critical economic indicator that excludes farm workers, private household employees, and non-profit organization employees. It assesses employment trends across various sectors and is a fundamental gauge of economic health. Changes in job numbers provide insights into economic momentum and are closely monitored by the Federal Reserve to guide monetary policy.

Economic implications

Stable unemployment and rising wages typically signal a robust labor market. However, the dramatic decrease in new jobs could suggest underlying economic challenges. Policymakers will need to weigh these mixed signals carefully to determine the trajectory of future monetary policy, particularly concerning interest rates.

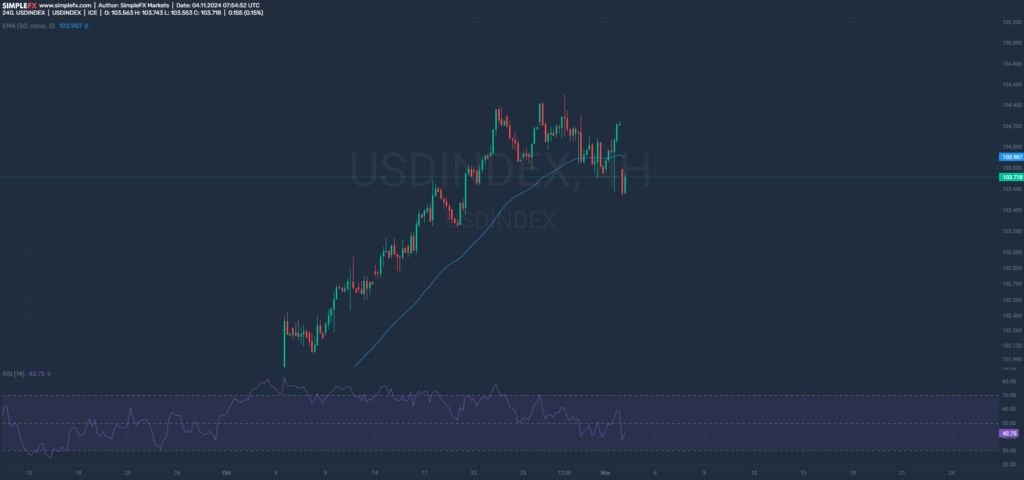

Initial market reactions have been notably cautious, with significant movements in major assets like EURUSD, US500, and precious metals. A few days after poor data from the labor market, declines affect virtually all markets. EURUSD remains the rising pair because, as seen in the chart, the dollar is falling significantly. It can be expected that the sell-off results from expectations for continued easing of monetary policy by the Fed, especially in the light of the weakening labor market. However, indices, precious metals, and cryptocurrencies are also falling – as if the economy was expected to enter a recession.

This month’s NFP figures suggest a potentially shifting economic environment. It should be emphasized, however, that tomorrow, Americans will vote for the person who will hold the position of president of this superpower. This is usually a period of significantly increased volatility, which all investors should pay attention to.

Stay informed and ready to adapt to these developments as they unfold. This month’s NFP data may just be the beginning of a new economic narrative.

The information provided on this website does not, and is not intended to, constitute investment advice; instead, all information, content, and materials available on this site are for general informational purposes only.