One month after Donald Trump’s victory in the U.S. presidential election, the Republican Party has secured a red sweep, gaining control of the presidency, Senate, and House of Representatives. This unified government gives Trump a clear path to implement his ambitious policies. For investors, the spotlight now turns to the key figures Trump is assembling to lead his administration. These appointments will shape the economic, financial, and regulatory landscape for years to come.

Treasury Secretary: Scott Bessent

Donald Trump has chosen Scott Bessent, a hedge fund manager and founder of Key Square Capital Management, to serve as Treasury Secretary. Bessent is set to play a pivotal role in enacting Trump’s economic agenda, which emphasizes cutting taxes and imposing tariffs.

Widely recognized as one of the world’s foremost international investors and strategists, Bessent has been tapped to help usher in what Trump has described as a “new Golden Age” for the U.S. economy. His responsibilities will include reinvigorating the private sector and curbing federal debt, a pressing concern for many investors. The financial community eagerly awaited the Treasury pick, signaling Trump’s commitment to reshaping global trade and continuing tax policies from his first term.

Commerce Secretary: Howard Lutnick

Howard Lutnick, CEO of Cantor Fitzgerald, has been named Commerce Secretary. Known for his outspoken advocacy for Trump’s policies, Lutnick will spearhead the administration’s trade and tariff agenda. His appointment is particularly significant as the Commerce Department plays a vital role in areas where national security and business interests intersect, such as technology exports and tariffs.

Lutnick has been a controversial figure on Wall Street, especially for his vocal support of wide-ranging tariffs and the elimination of income tax. He also seeks to deepen ties between Cantor Fitzgerald and Tether Holdings Ltd., the company behind the largest stablecoin. Talks reportedly include plans for a multibillion-dollar program to lend dollars to clients using Bitcoin as collateral. Lutnick’s efforts aim to bolster domestic manufacturing and strengthen U.S. companies, aligning closely with Trump’s “America First” economic philosophy.

SEC Chairman: Gary Gensler steps down

Current SEC Chairman Gary Gensler has announced his resignation, effective January 20, as Donald Trump’s administration takes over. Gensler, nominated by President Biden in 2021, has been a divisive figure, particularly in the crypto industry. His tenure saw aggressive enforcement actions against major players like Coinbase, Kraken, and Binance under the banner of Operation Chokepoint 2.0, which targeted unregistered crypto activities.

While courts have largely upheld Gensler’s positions, his confrontational approach drew criticism from Wall Street and both sides of Congress. With Gensler stepping down, the Trump administration will appoint a new SEC chair, potentially signaling a more crypto-friendly regulatory environment. This change could significantly impact the trajectory of the digital asset market.

Crypto’s cyclicality

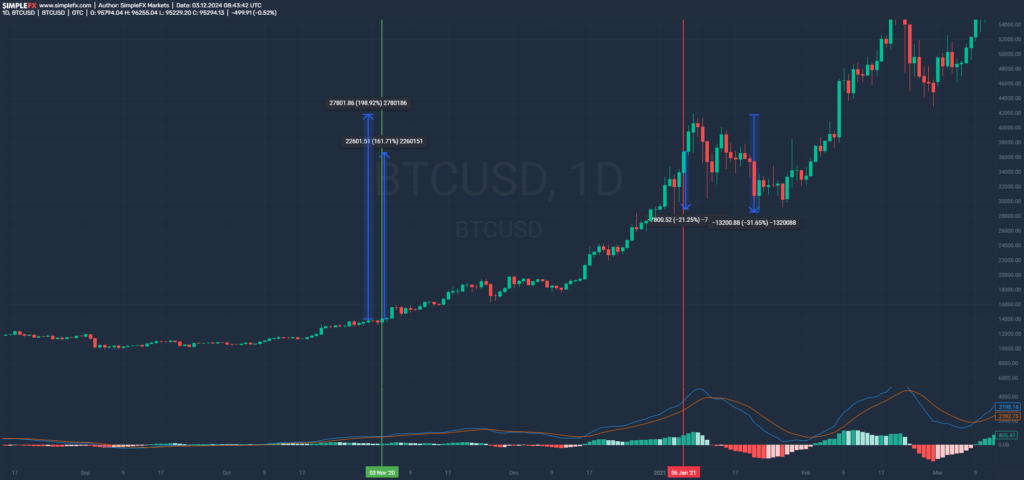

The crypto market has long exhibited a cyclical pattern tied to significant events, and presidential elections are no exception. Historically, Bitcoin has experienced a strong upward trend from the election in the halving year to January next year. What happened this month? Let’s take a look at the charts.

Q4 2016: The golden pocket for crypto.

As you can see in the chart, between Trump’s first victory (elections on November 8, 2016) and January 6, 2017, the BTCUSD price increased by up to 64% and then drastically corrected by 36% in a week. What date is January 6? It wasn’t just a bearish MACD crossover.

Members of the U.S. House of Representatives and the U.S. Senate convened in a joint session of Congress on Friday, January 6, 2017, to count and certify the electoral college’s votes for the next President of the United States. The joint session is the final step in counting and validating the Electoral College votes in a presidential election.

Q4 2020: The second golden pocket.

History does not repeat itself but rhymes. From the time of the elections on November 3, 2020 (green line), to January 6, 2021 (red line), BTC increased by 162%, and to the local peak 2 days later by as much as 200%! From January 6, it corrected by 21% in two weeks, and from January 8 by as much as 32%, after which the increases continued.

Q4: 2024: The third golden pocket?

2024 and November 5, Donald Trump wins again. As you can see, BTC is currently up 38% since then. The cyclicality seems to be maintained at the moment, although you should watch out for the MACD crossing on the 1D interval.

Will the increases last until January? Nobody knows this. The only thing we have is historical data, which does not provide any certainty. Be careful!

Conclusion

Donald Trump’s presidency and a Republican-controlled Congress set the stage for significant shifts in U.S. economic and regulatory policies. Key appointments like Scott Bessent as Treasury Secretary and the yet-to-be-announced SEC chairman will shape the financial landscape from traditional markets to crypto. The next few months will be crucial for investors as markets respond to policy announcements and structural changes in the U.S. government. Whether in stocks, currencies, or crypto, opportunities abound as we move into this transformative period.

The information provided on this website does not, and is not intended to, constitute investment advice; all information, content, and materials available on this site are for general informational purposes only.