Precious metals have long been considered a cornerstone of financial security and investment strategy. These metals hold intrinsic value and play a critical role in various industries, from jewelry to technology.

- Explore the enduring allure and utility of precious metals in today’s economy.

- Understand how precious metals can diversify and stabilize investment portfolios.

Precious metals: Overview and significance

Precious metals like gold, silver, palladium, and platinum are highly valued for their economic, industrial, and artistic worth. These metals are essential for manufacturing and technology and are also fundamental components of metals trading.

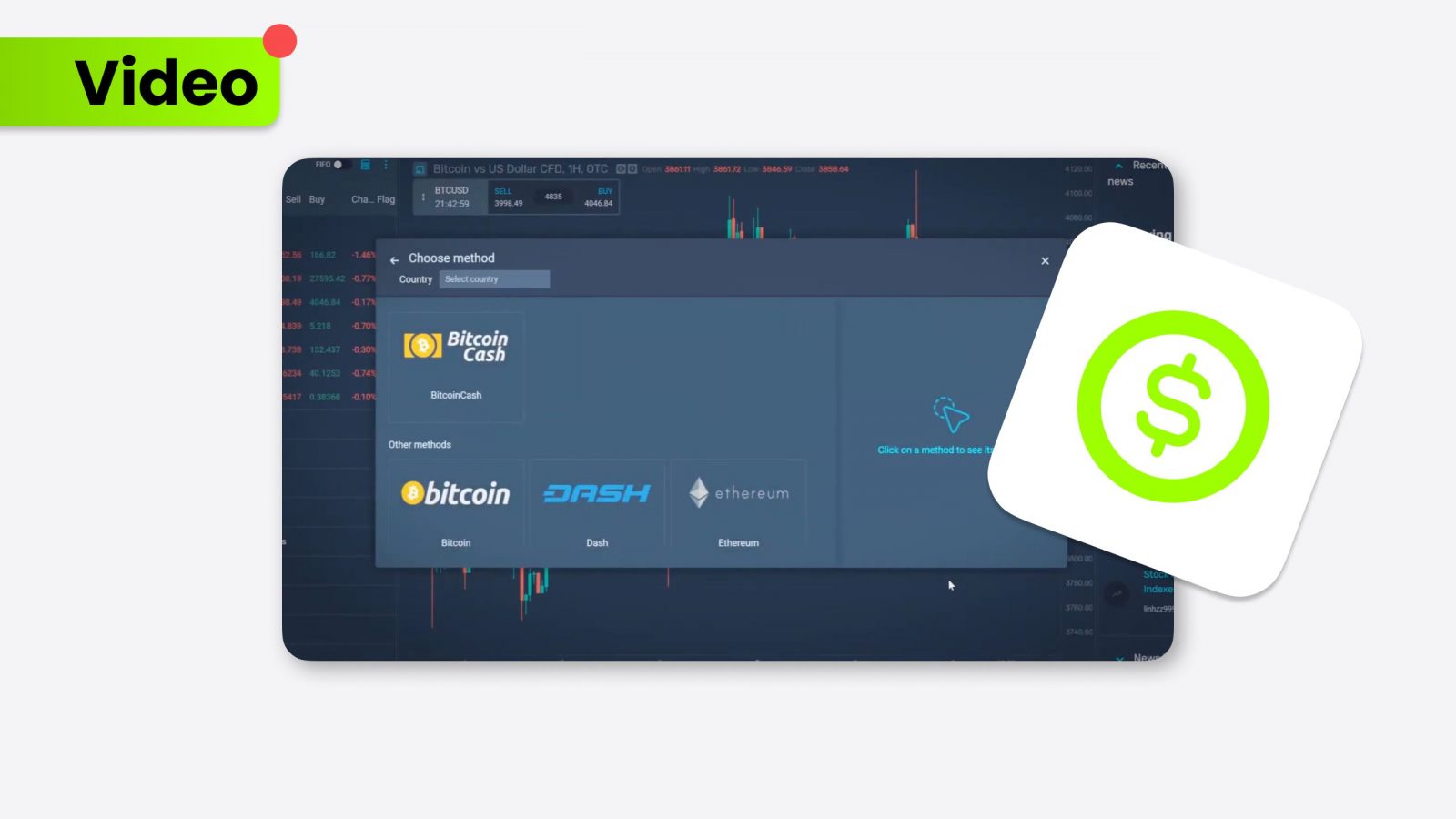

Investing in precious metals through ETFs (Exchange-Traded Funds) offers a way to gain exposure to their value without physically owning the metal.

Precious metals values: Factors influencing prices

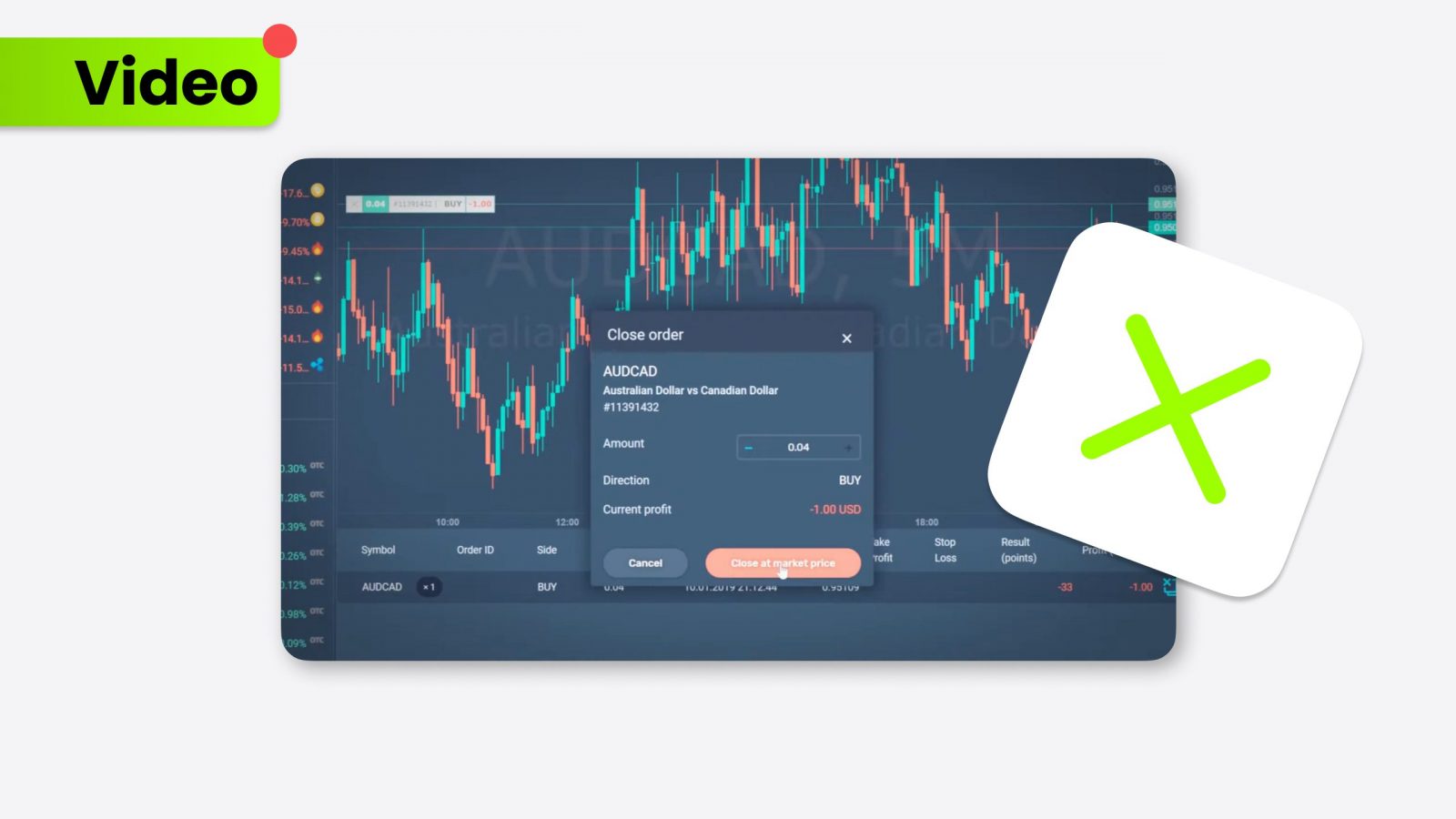

Various factors, including market demand, mining supply, and macroeconomic indicators, influence the precious metals values. For example, gold is often seen as a safe haven during times of economic uncertainty, while industrial demand significantly impacts the prices of palladium and platinum. Understanding these dynamics is crucial for anyone involved in the trading of metals.

Most expensive precious metals

Among metals, rhodium, palladium, and platinum often top the list of the most expensive precious metals due to their rarity and extensive use in catalytic converters and other industrial applications. The prices of these metals can be tracked through commodities markets and are often included in diversified precious metals ETFs, providing a gauge for their market value.

Precious metals ETF: Investment potential

Precious metals ETFs provide a convenient way for investors to engage with the metals market through financial instruments rather than physical holdings. These ETFs encompass a variety of precious metals, such as palladium and platinum, enabling investors to diversify their portfolios and manage risks effectively. This versatility makes precious metals ETFs a favored option for those involved in broader financial markets, including those who participate in forex trading to hedge against currency fluctuations and economic volatility.

Conclusion

Investing in precious metals, whether through physical ownership or ETFs, remains a popular strategy for portfolio diversification and risk management. As global economic landscapes evolve, the role of precious metals and their ETFs in investment strategies continues to be redefined, offering both challenges and opportunities for savvy investors. Understanding the complex dynamics of this market is essential for capitalizing on the potential benefits that precious metals can offer.