Spread in trading is the difference between a financial instrument’s bid (buy) and ask (sell) prices.

- Learn how spread impacts trading profitability and transaction costs.

- Understand how spread varies based on market conditions and asset liquidity.

What is spread in forex?

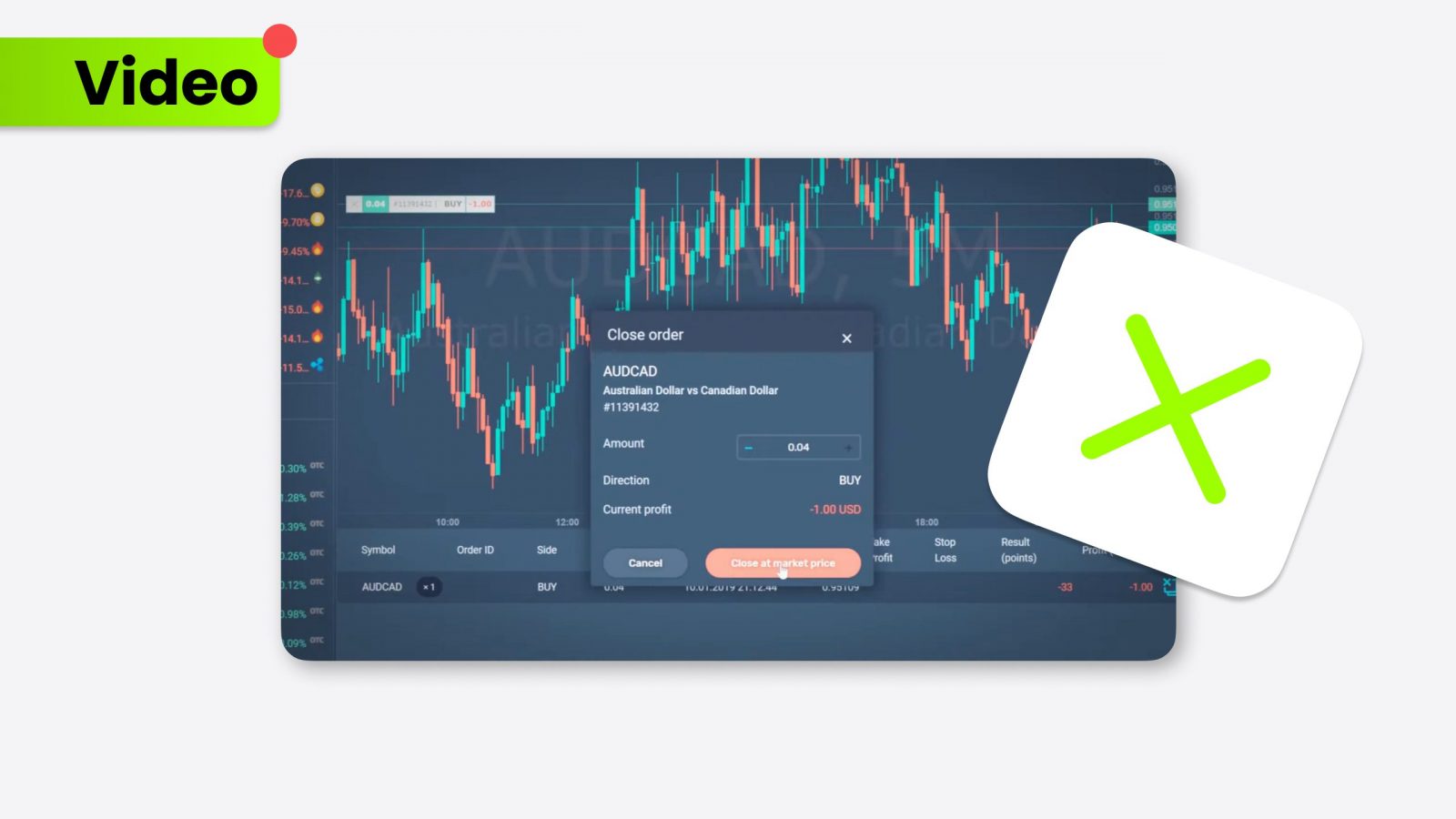

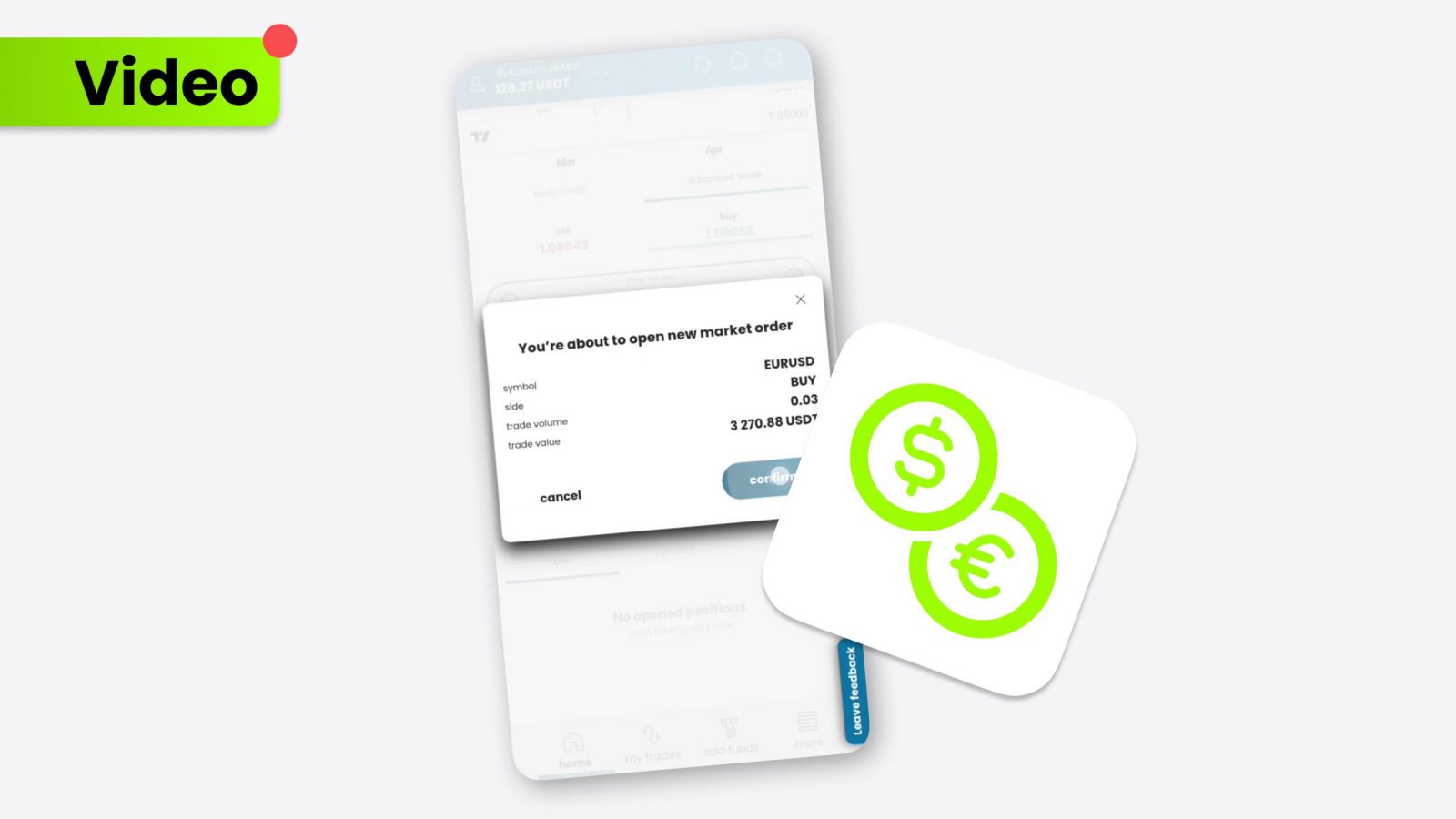

The spread is the difference between the bid and ask prices for currency pairs like Euro to Dollar in forex basics. Brokers typically make money through this difference, so understanding what is spread in forex is crucial for managing transaction costs. For instance, if the EURUSD pair has a bid price of 1.1000 and an asking price of 1.1003, the spread is 3 pips.

What is trading spread?

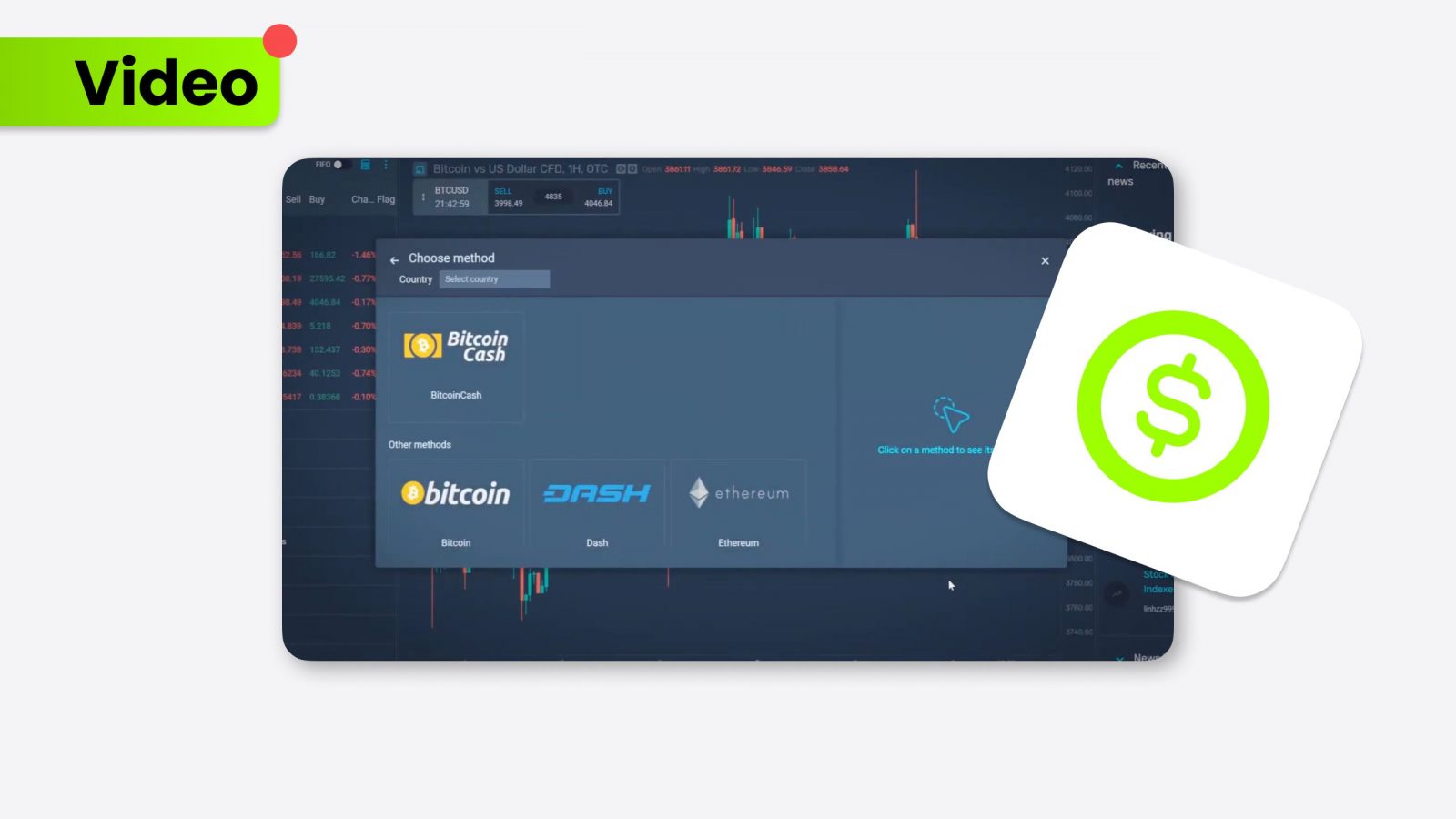

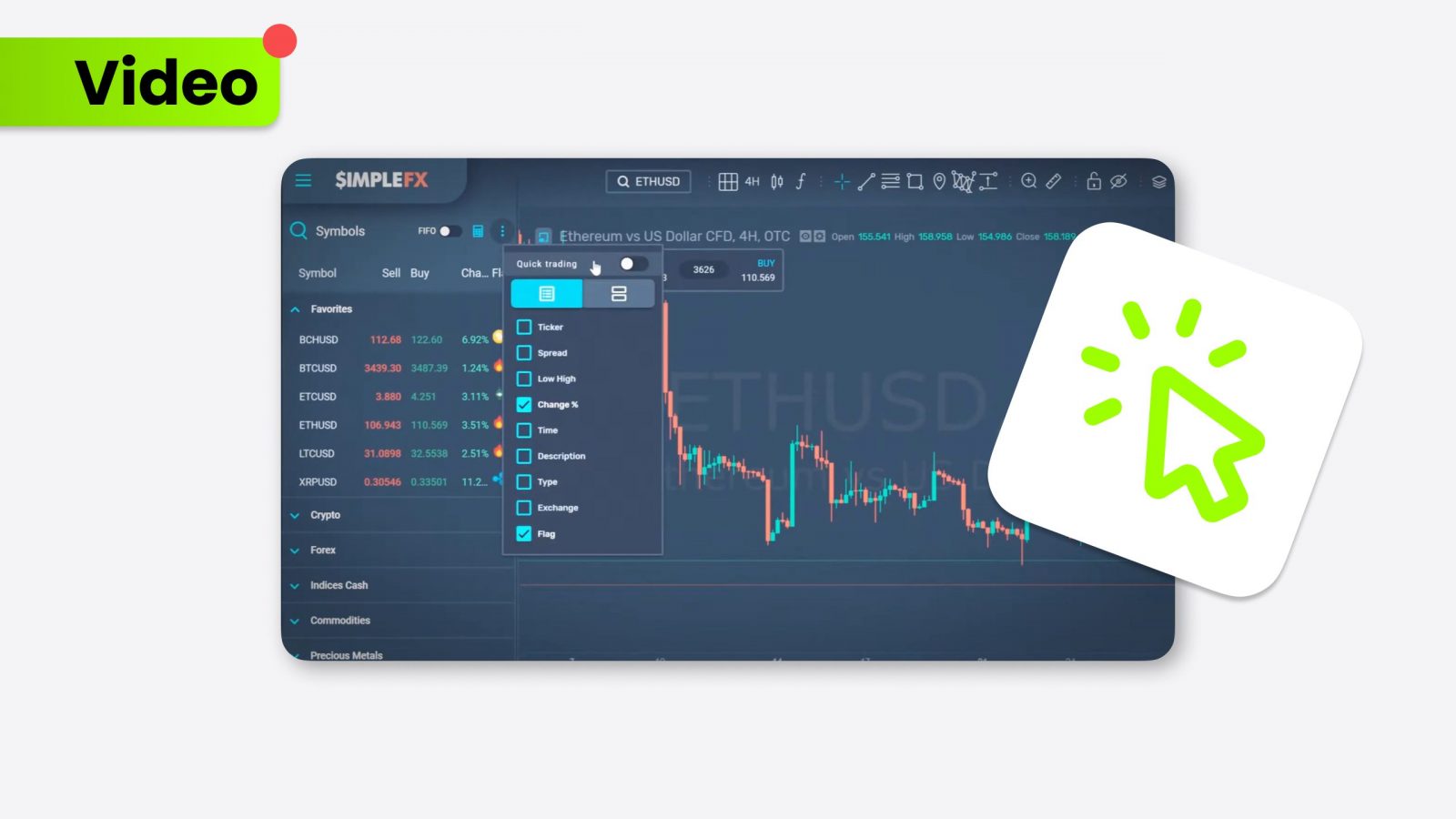

A trading spread generally refers to the difference between the buying (bid) and selling (ask) prices across various financial markets. This difference directly influences trading costs, meaning tighter spreads are often more favorable for traders because they translate to lower costs. Spreads tend to widen during high volatility or market uncertainty, affecting instruments like Bitcoin, U.S. Dollar to Offshore Chinese Yuan, and Ethereum.

Spread trading

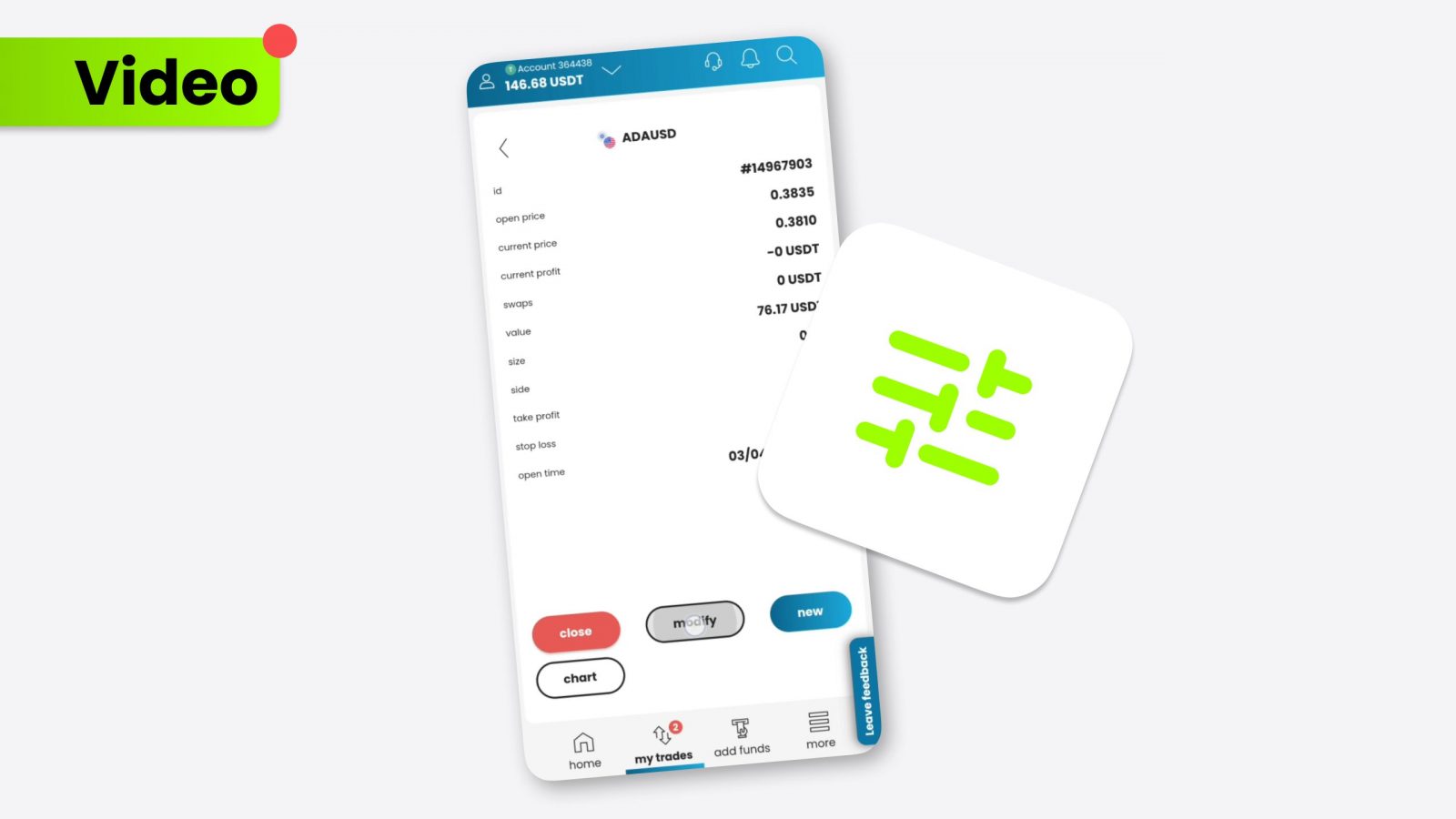

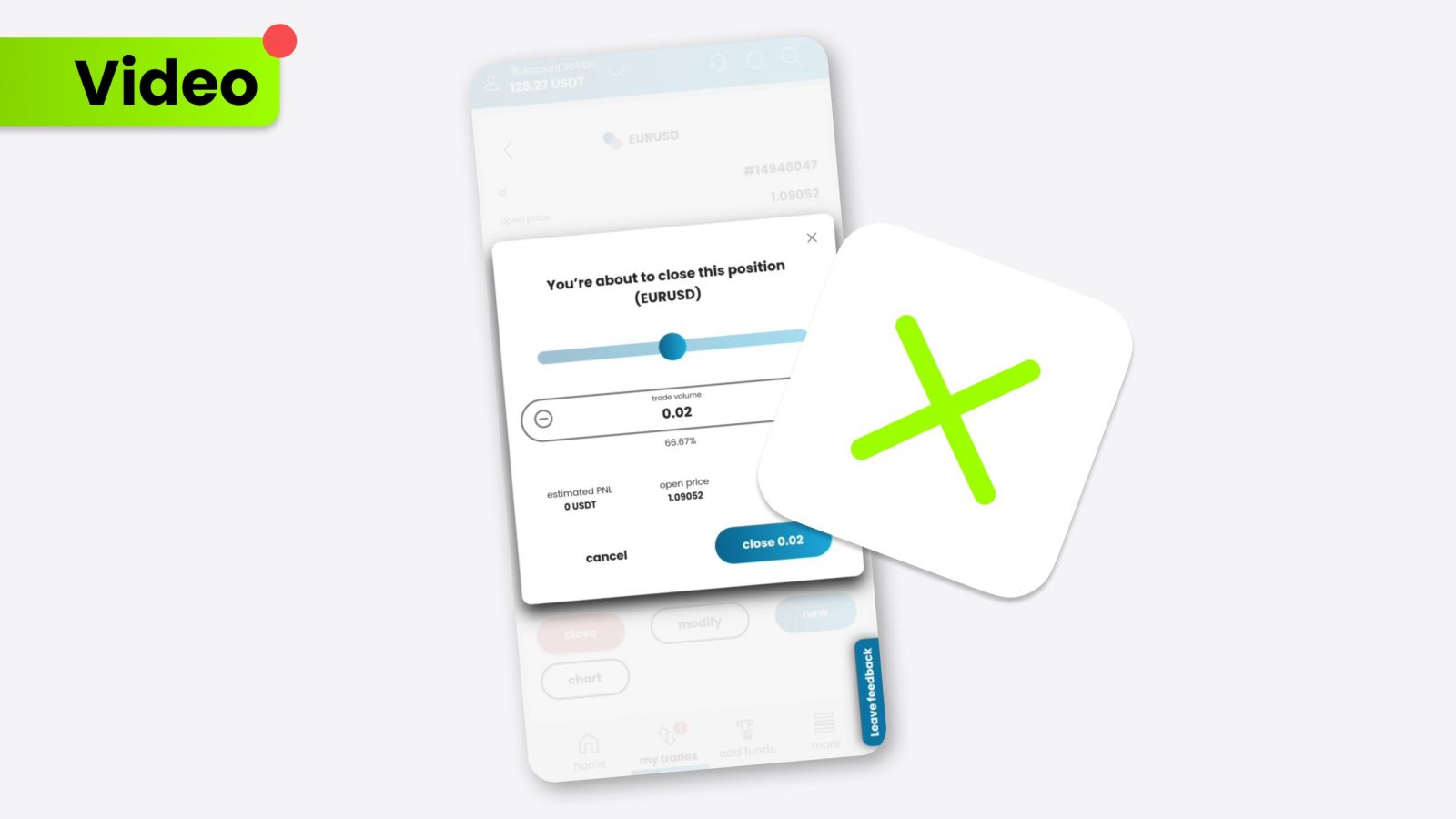

Spread trading involves trading the difference between two related markets. For instance, a trader might take a long position on one asset and simultaneously short a correlated or competing asset, seeking to profit from price differences. This strategy can be used in various asset classes, including forex and cryptocurrencies, to hedge risks or exploit market inefficiencies.

Trading spreads according to markets

Trading spreads vary significantly across markets based on liquidity and market conditions. Forex spreads tend to be tighter due to the high liquidity of currency pairs, while crypto spreads can be wider due to higher volatility. In forex, spreads can also differ between CNY and CNH, which represent the onshore and offshore Chinese yuan, respectively. Understanding how spreads impact different markets, from forex pairs like EURUSD and USDCNH to cryptos like BTCUSD, is crucial for developing effective trading strategies.

Conclusion

Understanding spread in trading is essential for anyone looking to navigate markets successfully. Grasping what is trading spread, mainly what is spread in forex, can help traders assess transaction costs and profitability more accurately. By knowing how spread trading works and the factors influencing trading spreads, traders can optimize their strategies across various assets, whether it’s forex, cryptocurrencies, or other markets.