A currency pair is essential to forex trading, representing the quotation of one currency against another. It allows traders to speculate on the strength of currencies relative to each other in a 24/5 market. This dynamic setup is crucial for assessing international economic conditions and making informed trading decisions.

- Identify the key factors that influence currency pair fluctuations

- Understand the role of economic data releases like NFP and CPI in forex trading

What is a currency pair?

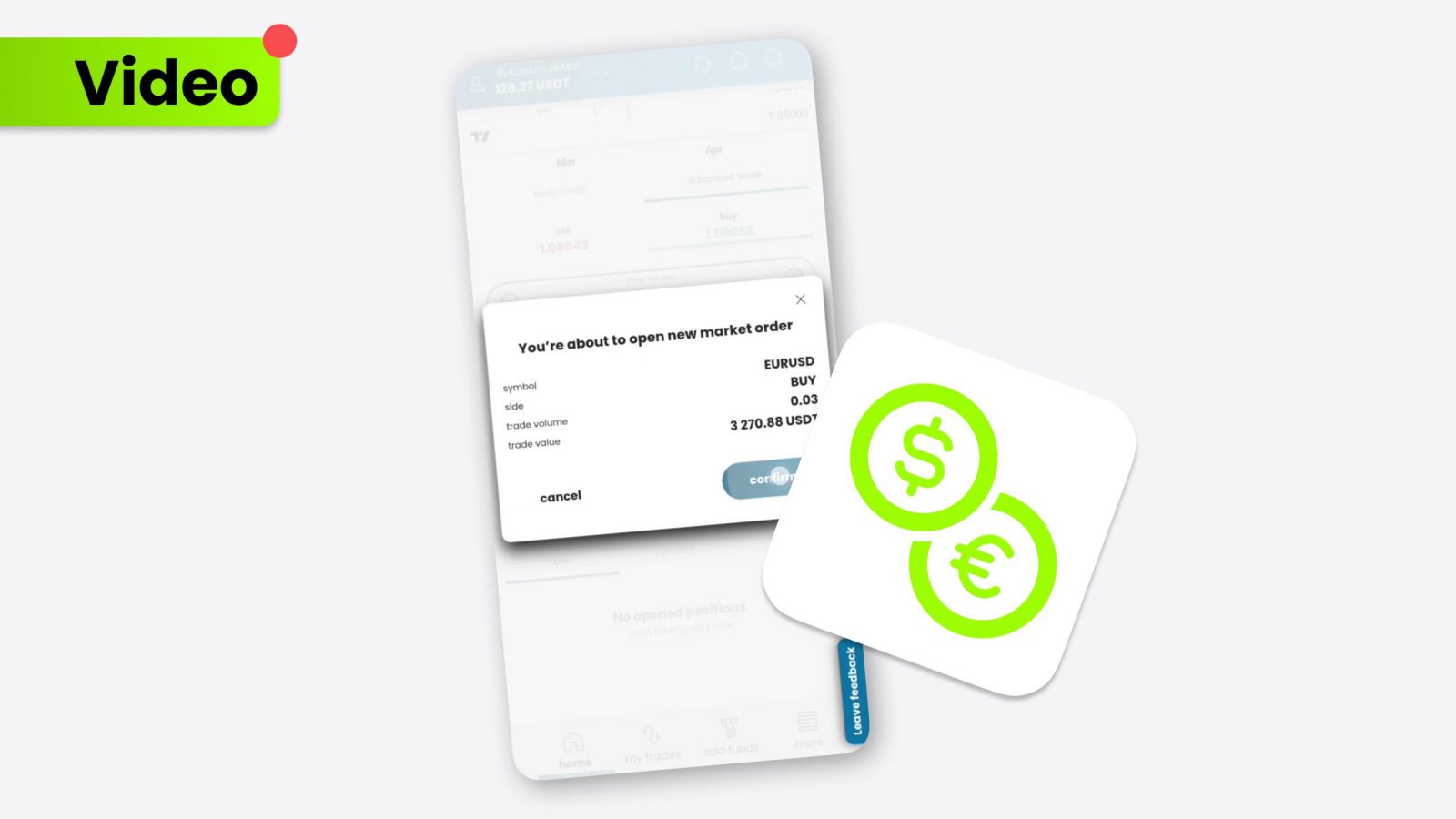

A currency pair is a quotation involving two different currencies, where one currency’s value is quoted against another’s value. The first listed currency of a currency pair is the base currency, and the second is the quote currency. For instance, in the Euro to Dollar (EURUSD) currency pair, the Euro is the base currency, and the Dollar acts as the quote currency.

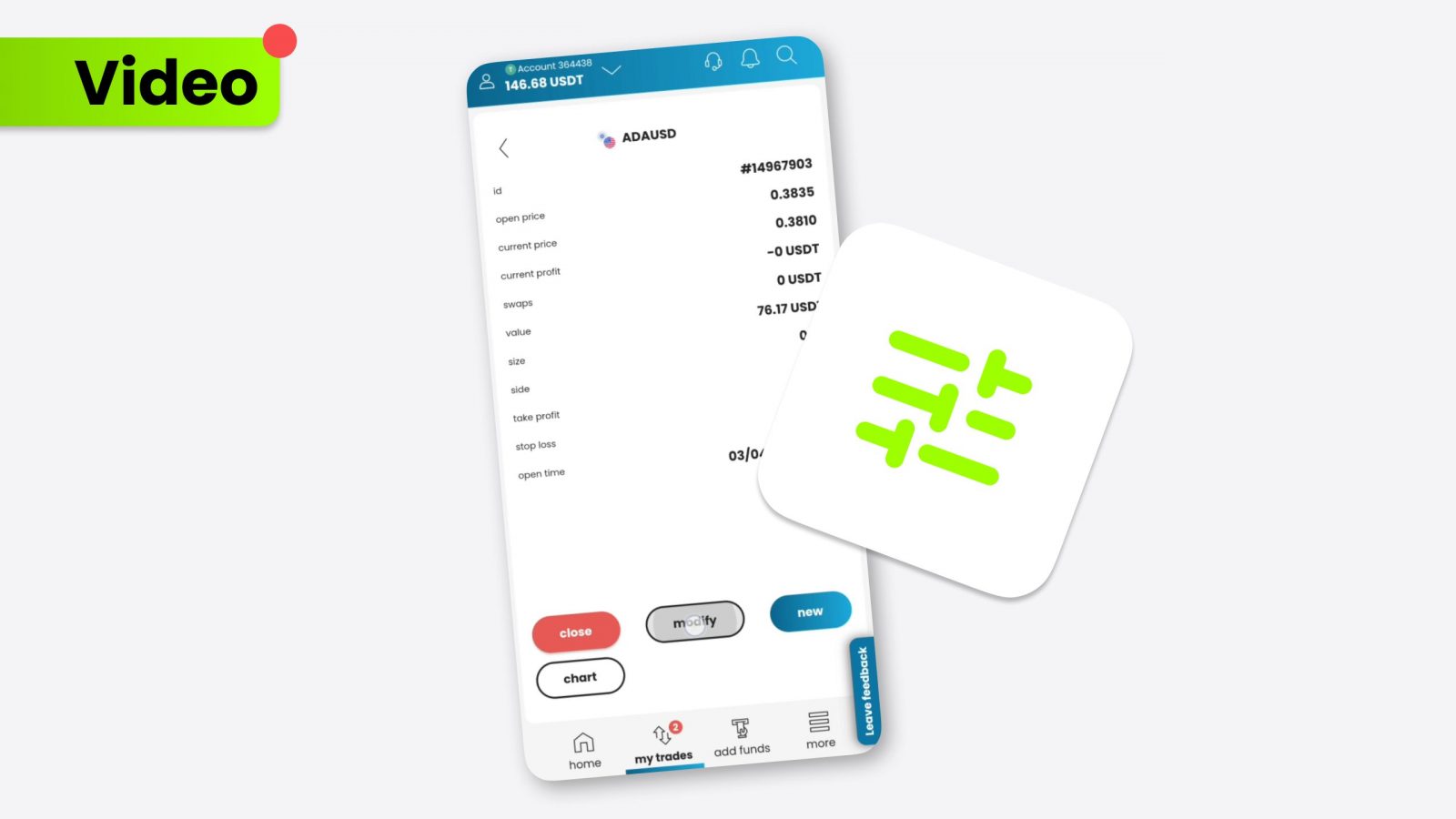

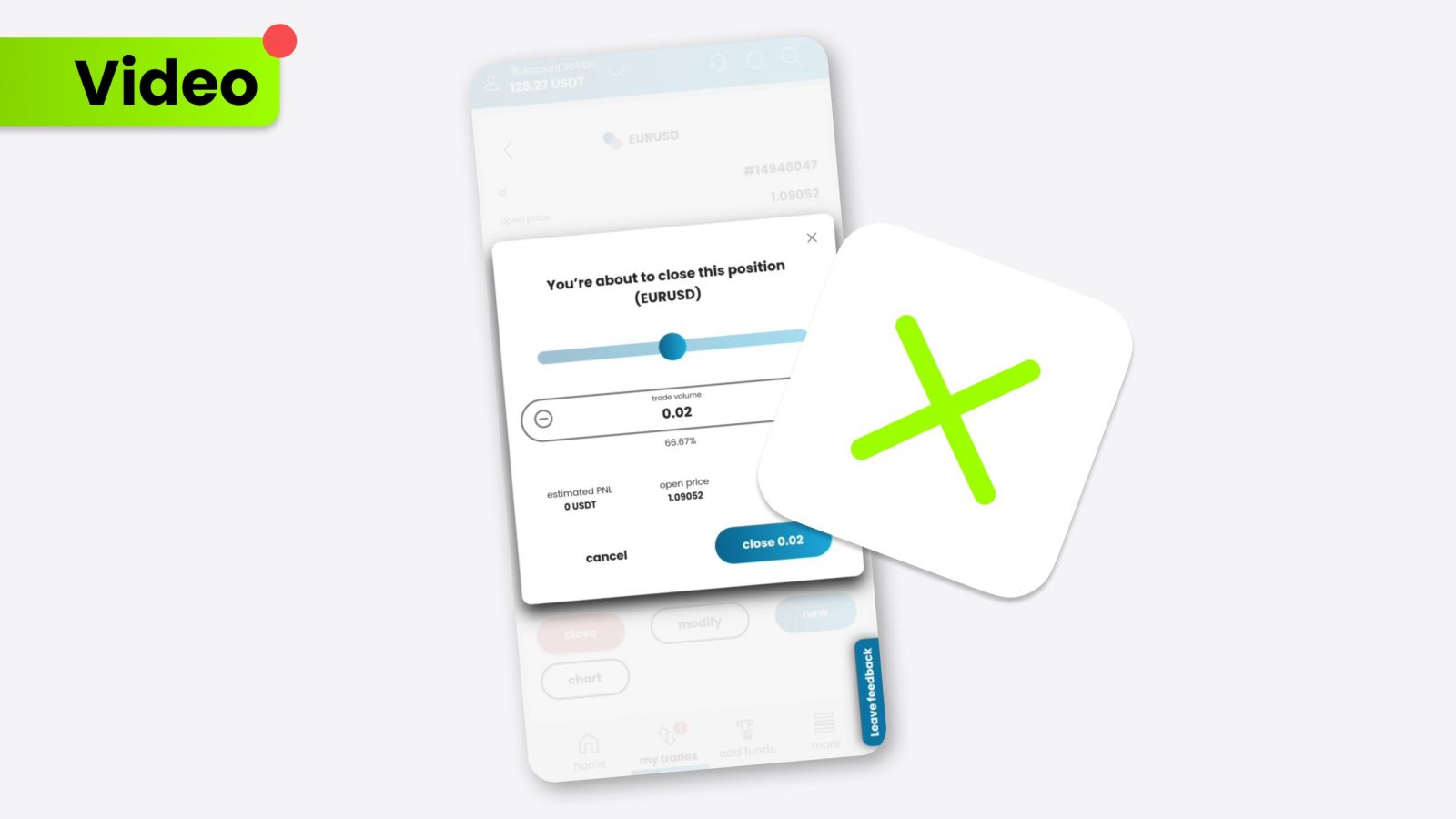

Forex traders engage with these pairs by buying or selling based on their predictions of movements in these currencies. They anticipate whether the base currency will strengthen or the quote currency will weaken, which forms the essence of forex trading strategies. This concept is a fundamental aspect of forex basics, serving as the foundation for all transactions and strategies within the forex market. Such pairs facilitate international trade and finance by setting the exchange rates used globally, making understanding them crucial for anyone involved in economic activities that span different currencies.

Currency pair trading

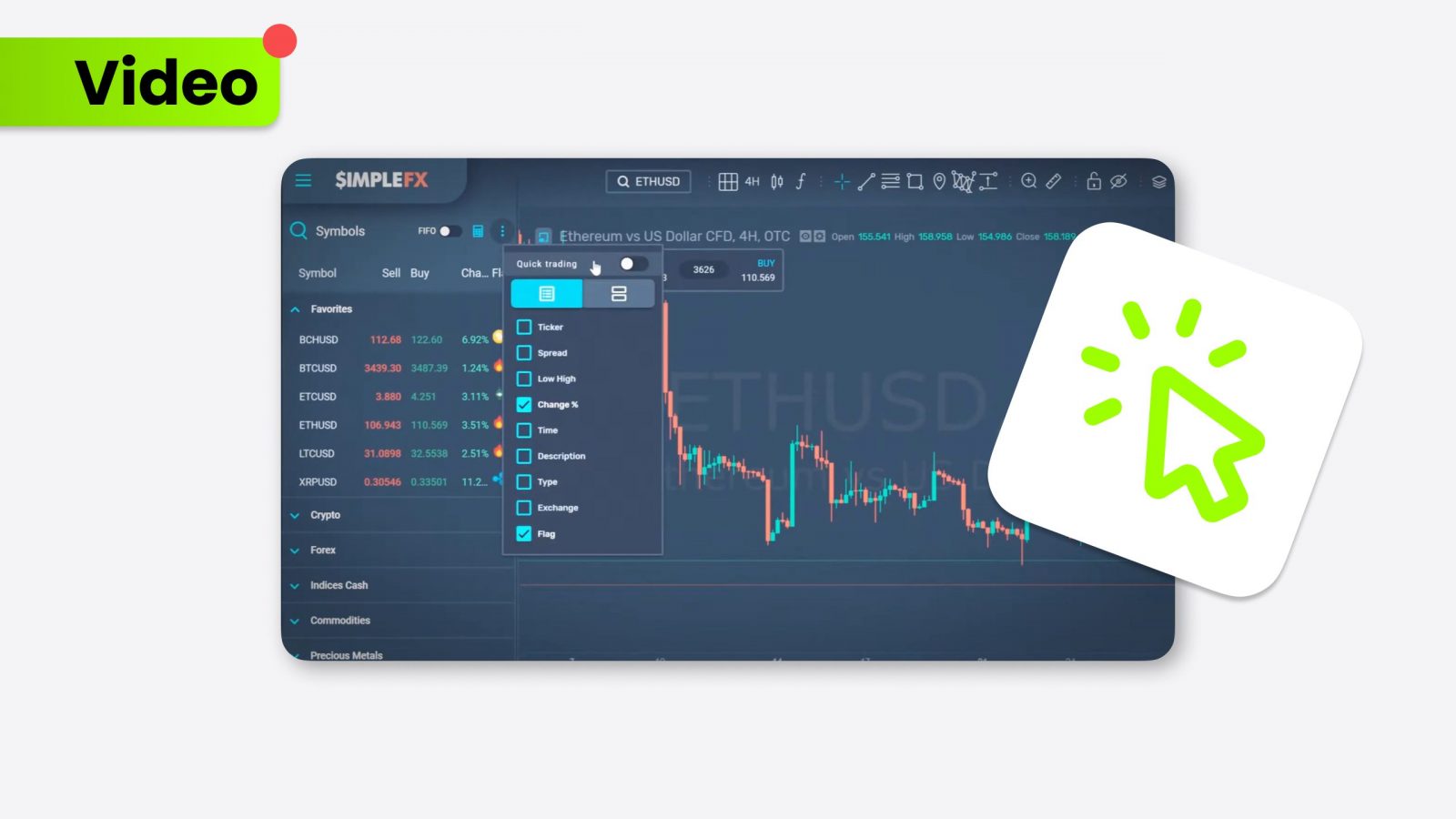

Trading currency pairs involves speculating the exchange rate movement between the two currencies. Factors such as forex rates, economic indicators, and monetary policy significantly determine the movement. Traders must keep abreast of global economic news, including changes in interest rates, political events, and economic data releases like the NFP and CPI, which can drastically affect currency pairs.

Major currency pairs

Major currency pairs are the most traded in the world, characterized by high liquidity and low spreads. They typically involve the U.S. Dollar paired with one of the major currencies like the Euro, British Pound, or Canadian Dollar. These pairs are closely tied to changes in global economic conditions, making them particularly sensitive to U.S. economic announcements and monetary policies.

Exotic Currency Pairs

Exotic currency pairs involve a major currency linked to one from a smaller or emerging economy, such as the USD to South African Rand (USDZAR) or Euro to Turkish Lira (EURTRY). These pairs are characterized by lower liquidity and greater volatility compared to major currency pairs, often influenced by changes in commodities markets, which can drive the economies of the lesser-known currency’s country. While trading exotic pairs offers the potential for substantial profits, the risks are also higher due to their unpredictable price fluctuations in the forex market. This makes the exotic pairs market similar to crypto in terms of volatility and sometimes liquidity.

Conclusion

Currency pairs provide a dynamic component to forex trading, reflecting the economic interactions between countries. Understanding how pairs like Euro to Dollar respond to global economic events, U.S. monetary policy, and forex basics can help traders make informed decisions. As the global economy evolves, so does the forex market, offering continuous opportunities for traders who closely monitor economic trends and policy changes.