The Eurozone, consisting of 20 European Union member states that use the Euro as their official currency, stands as an essential player in the global economy.

- The Eurozone is vital and impactful for major currency pairs, including EURUSD.

- Of 27 EU member countries, seven haven’t adopted the Euro yet.

- The European Central Bank manages inflation within the Eurozone.

What is the Eurozone?

The Eurozone, also known as the euro area, comprises 20 of the 27 European Union member states adopting the Euro as their official currency. Established in 1999, the Eurozone plays a massive role in the global economy. As a monetary union, it facilitates trade and financial transactions among member countries, promoting economic stability and integration.

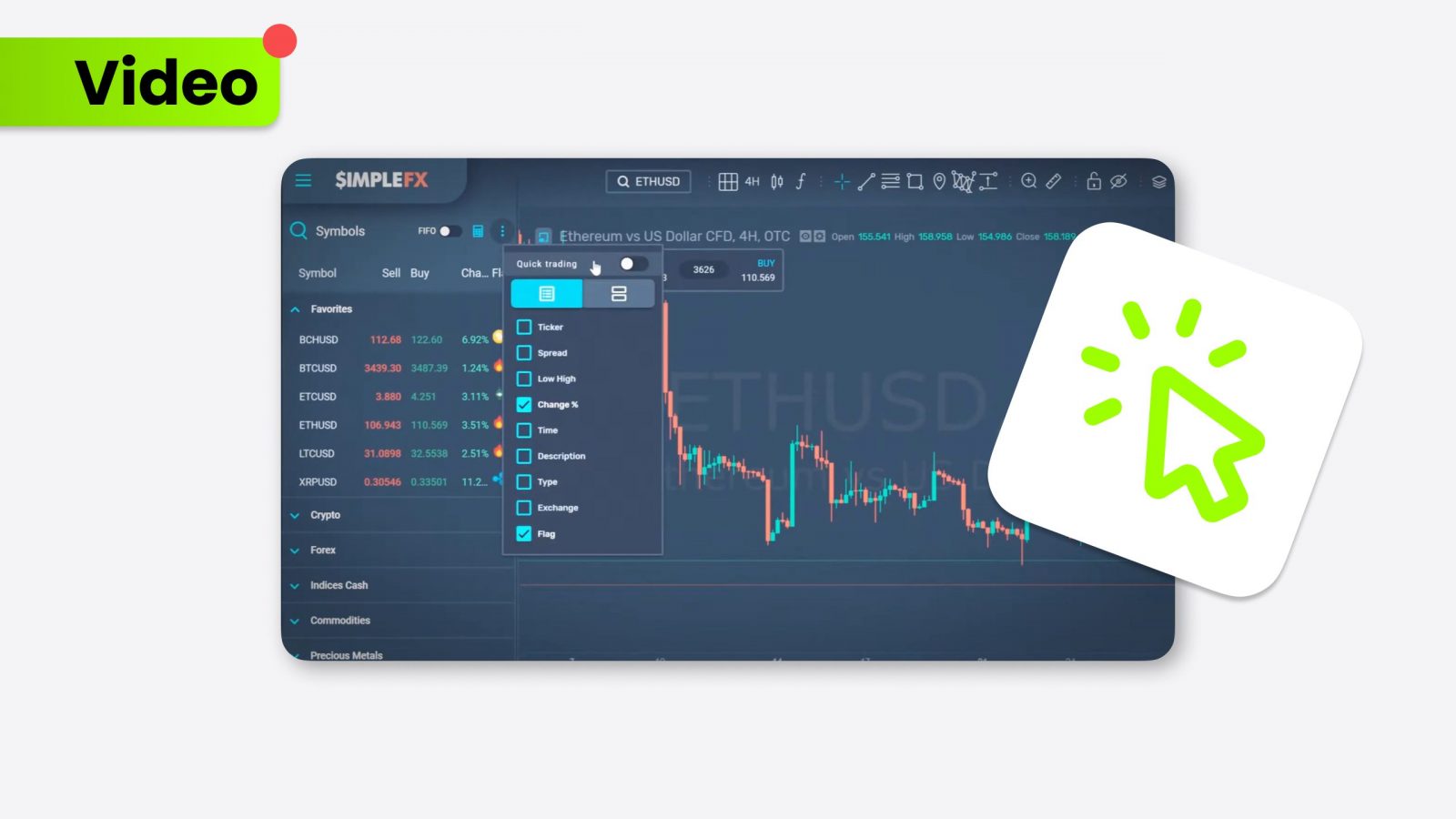

One of the significant aspects of the Eurozone is its influence on major currency pairs, notably the EURUSD. It is the most traded currency pair in the world, reflecting the economic relationship between the Eurozone and the United States. The value of the Euro against the U.S. Dollar is a critical economic indicator, pointing out strength and impacting import and export prices, in addition to investment flows between the two regions.

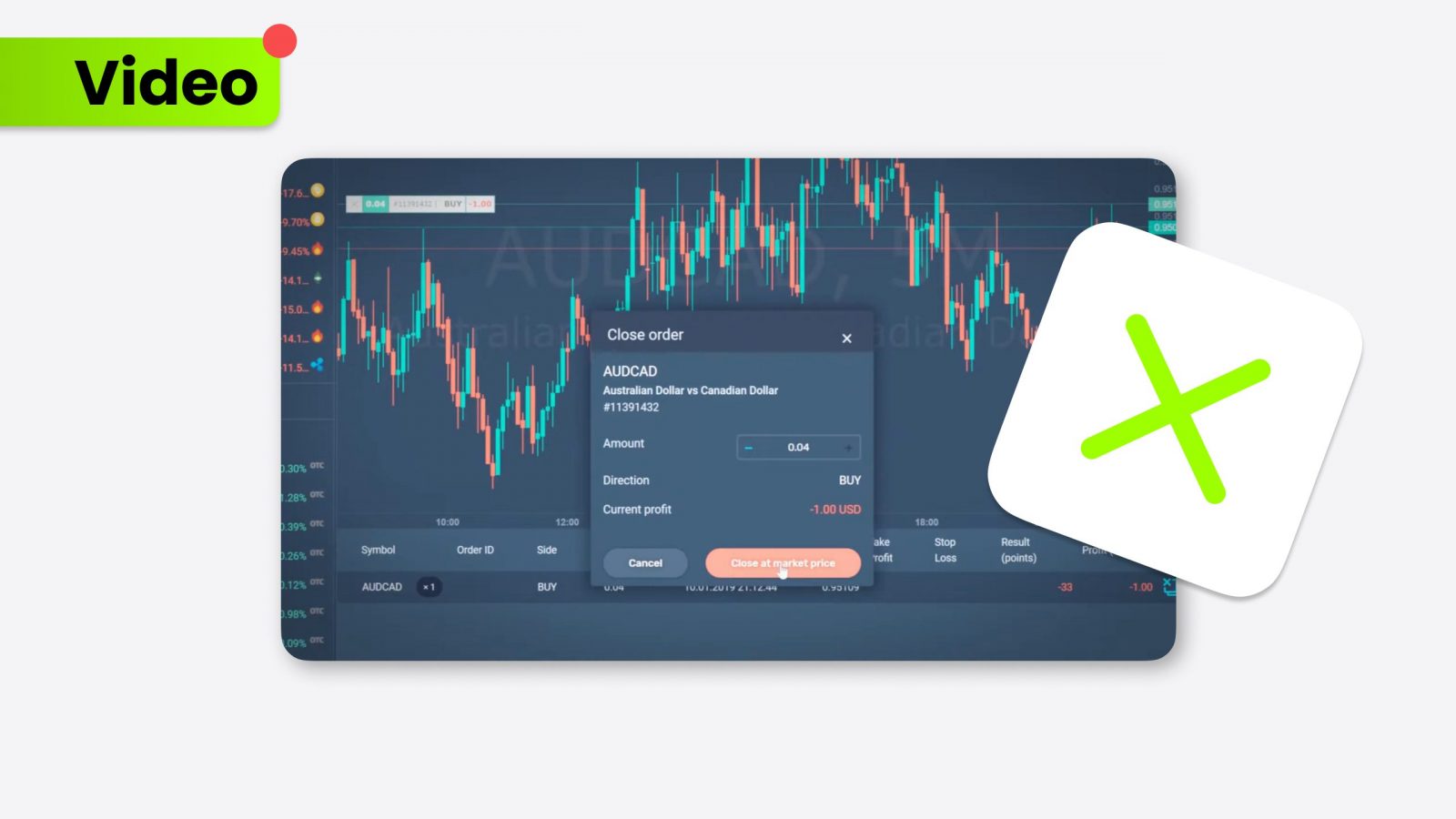

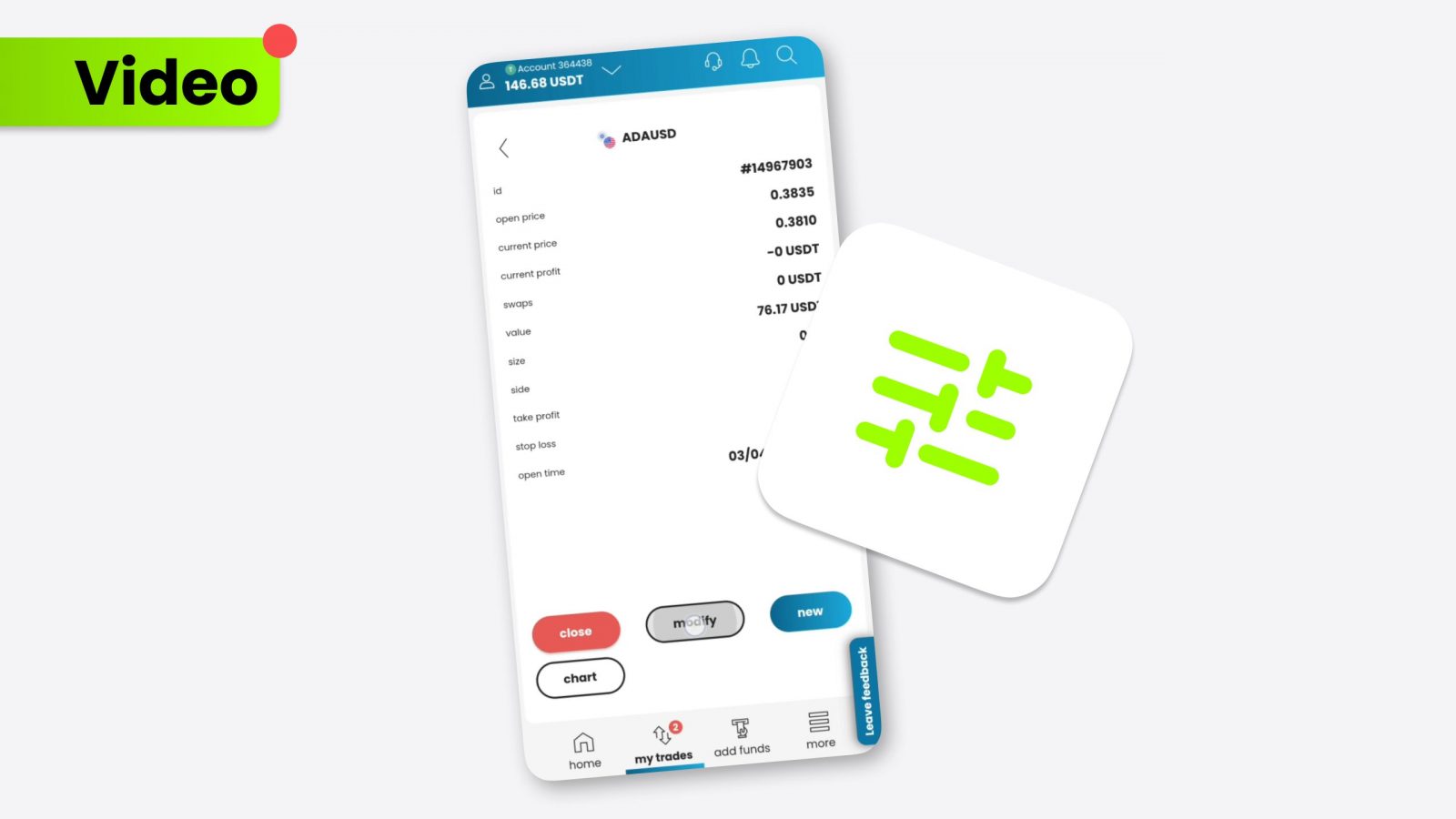

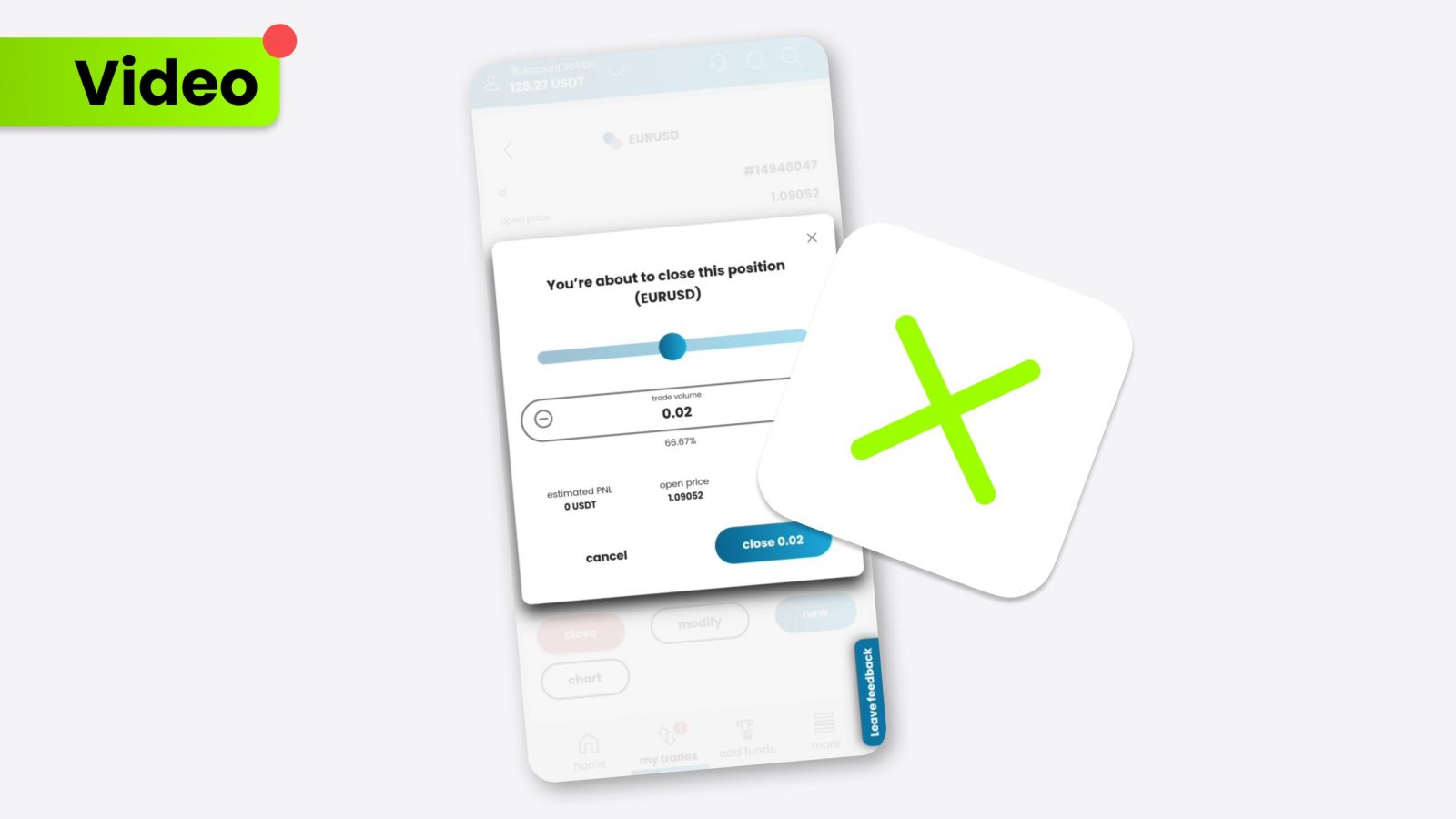

Understanding the dynamics of the Eurozone is essential for those interested in currency trading. It affects the EURUSD pair and has implications for other major currencies. The connection between economic policies, political events, and market sentiment in the Eurozone creates a dynamic trading environment. Keeping an eye on developments within the Eurozone can provide valuable insights for making informed trading decisions.

Eurozone countries

The Eurozone consists of 20 countries that have adopted the Euro as their official currency. These Eurozone countries include Austria, Belgium, Croatia, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia, and Spain.

Germany and France stand out as the most influential countries in the Eurozone due to their substantial economic power. With its robust industrial base and leading stock index, the DAX40, Germany plays a pivotal role in shaping Eurozone economic policies. France, represented by the CAC40 index, also contributes significantly to the EU’s economic dynamics, particularly in sectors like luxury goods, aviation, and energy.

Not all European Union members have adopted the Euro for various reasons. Denmark has an opt-out clause from the Maastricht Treaty, allowing it to retain its currency, the Danish Krone. Sweden also stayed with its Swedish Krona, but their postponement came from public opposition and the need for more favorable economic conditions. Poland and other newer EU members are gradually working towards fulfilling the economic criteria required for Eurozone membership, but political considerations and economic readiness continue to influence their timelines.

Eurozone: Inflation in the Union

Eurozone inflation is a critical economic indicator that reflects the price stability within the 20-member bloc. Managing this is a complex tax. The European Central Bank (ECB) is responsible for setting monetary policy to maintain price stability, targeting an inflation rate of close to, but below, 2% over the medium term.

The ECB uses interest rates as a primary tool to control Eurozone inflation. By adjusting these rates, the ECB can influence borrowing costs, consumer spending, and investment across the member states. For example, lowering interest rates typically stimulates economic activity and can help raise inflation when it’s too low. Traders and investors eager to engage in the forex market closely monitor these policy decisions, as they directly impact currency values.

Eurozone inflation is shaped by several factors and managed through the coordinated efforts of the ECB and member states’ governments. The ECB’s monetary policy, particularly its manipulation of interest rates, plays a vital role in maintaining price stability across the region.

Eurozone: Conclusion

The Eurozone is a cornerstone of the European Union, promoting economic integration and stability among its members. Its influence on global markets, particularly through currency exchange rates and inflation control, is pivotal for successful trading and investment strategies.