The U.S. Dollar has established itself as a cornerstone of global finance, acting as the primary reserve currency worldwide. Its role impacts every aspect of the international economy.

- The U.S. Dollar serves as a global reserve currency, crucial for international trade, investments, and monetary stability.

- Key initiatives have historically cemented the USD’s role as the foremost reserve currency.

- The USD significantly impacts forex, metals, commodities, and the emerging crypto markets.

What is a reserve currency?

A reserve currency is a foreign currency held in significant quantities by governments and institutions as part of their foreign exchange reserves. This type of currency plays a pivotal role not only in national monetary policy but also in stabilizing global markets. Reserve currencies are used for international transactions, investments, and all aspects of the global economy. That includes goods and services, financial transactions, and a reliable store of value.

The importance of a reserve currency stems from its widespread acceptance and trustworthiness. It enables more straightforward trade between countries with different domestic currencies and provides a financial safe haven. Over the years, the U.S. Dollar has become the vital reserve currency, dominating global transactions.

This dominance is linked closely to the robustness of the U.S. economy and its significant influence over global monetary policy.

The history of USD as a reserve currency

The story of the U.S. dollar as a global reserve currency has to begin with the history of the USD. Its substantial status started to solidify after World War II, as the USD emerged as the most reliable and stable currency worldwide. It has since been a cornerstone in international finance, facilitating global trade and investments. The trust and reliability that the USD offers have made it a preferred choice for maintaining the value of national reserves.

Vital initiatives

Throughout the 19th and 20th centuries, several critical initiatives have shaped the economic landscape of the United States. Establishing the gold standard under the Coinage Act in the late 18th century provided a stable basis for USD value. Later, the Bretton Woods Agreement in 1944 further cemented the USD’s dominance by linking international currencies to the dollar instead of gold. These initiatives, among other economic indicators, have been instrumental in defining the economic power and the reliability of the USD on the world stage.

World reserve currency

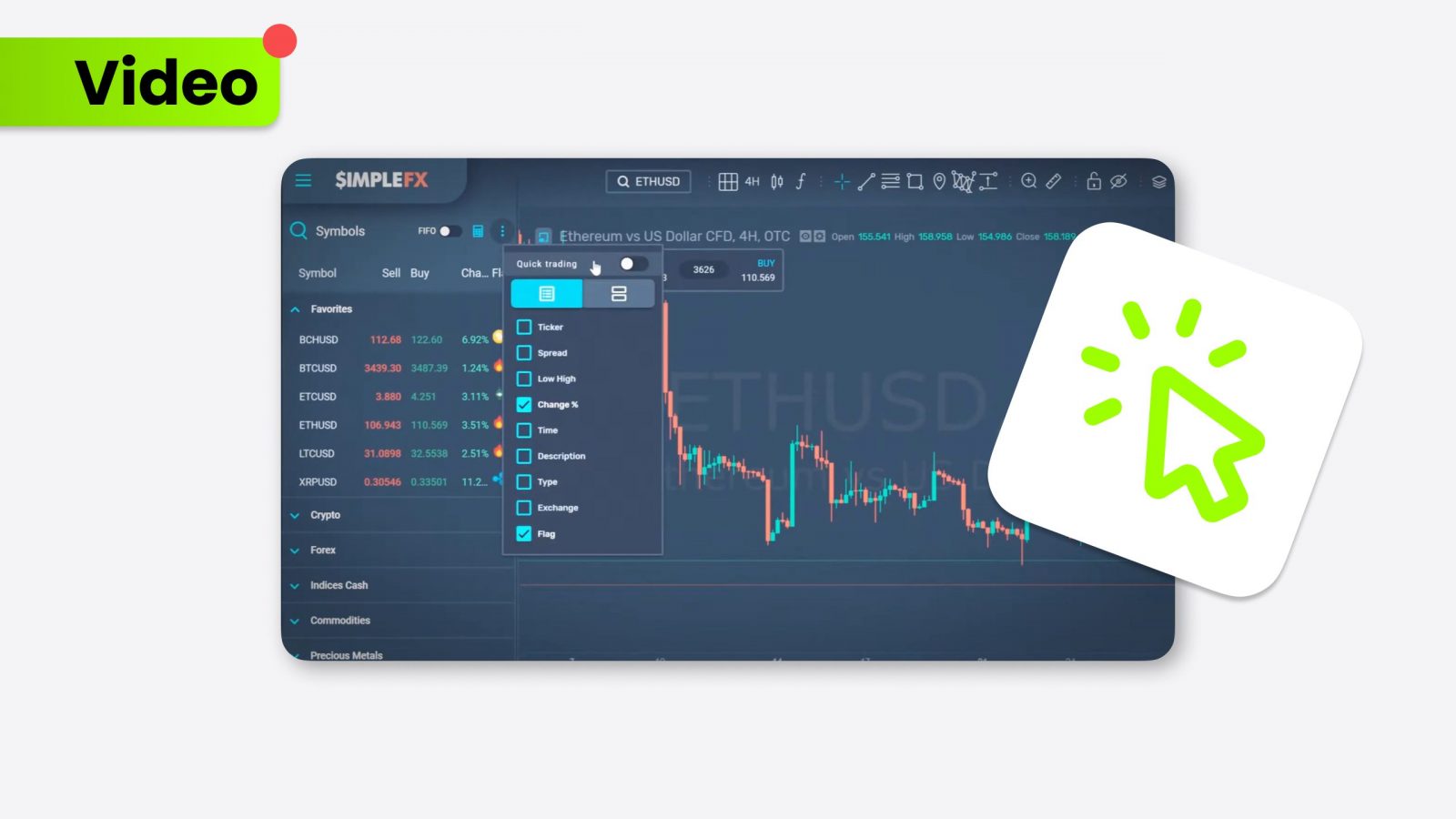

The world reserve currency, predominantly the USD, has been around for several decades and continues to influence various global markets significantly.

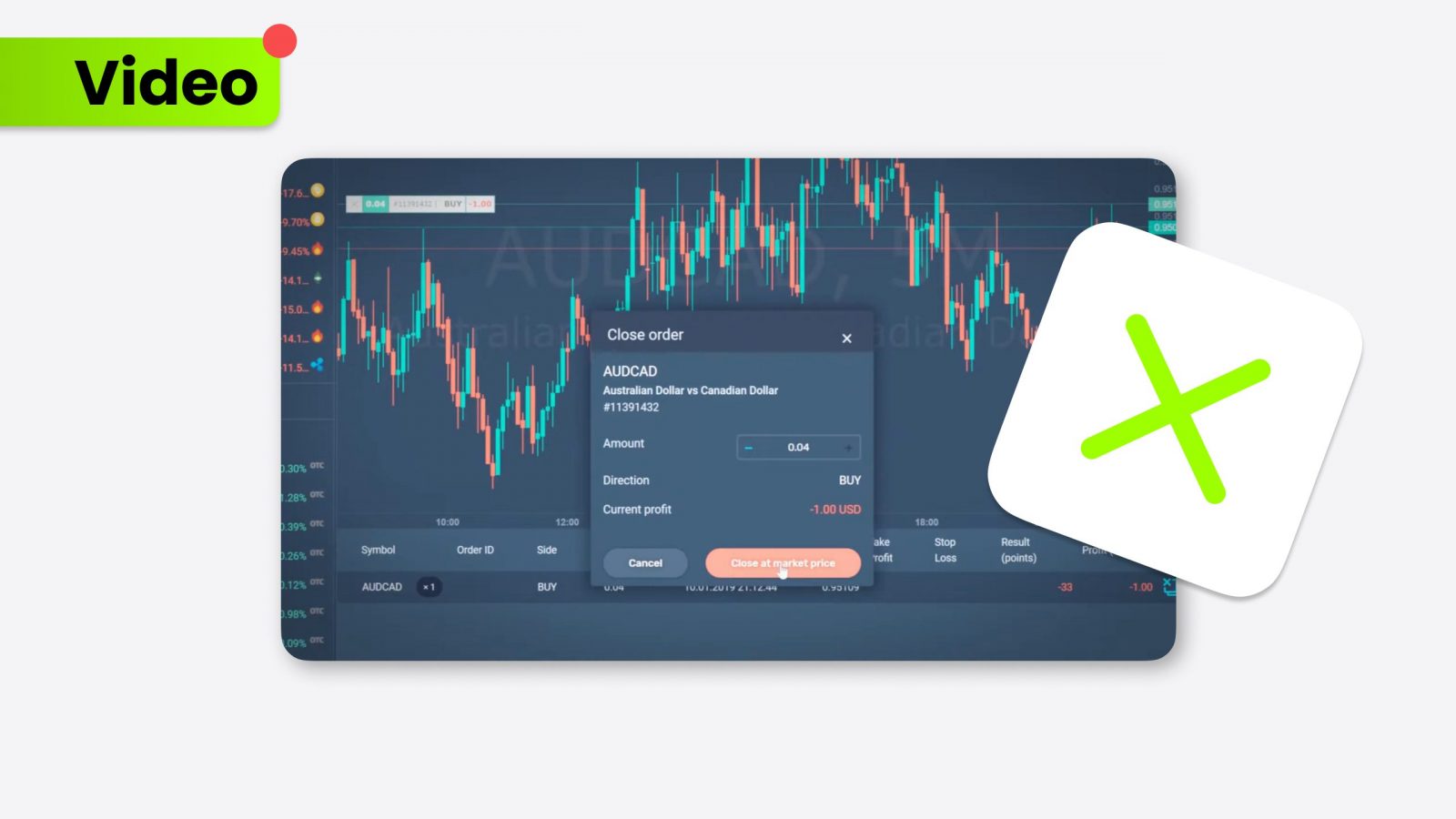

Forex

The USD’s development as the world reserve currency eventually contributed to the forex market, including major pairs like the Euro and the Dollar. The Federal Reserve and the International Monetary Fund recognize the USD’s pivotal role in maintaining economic balance, further highlighting its significance in USD forex dynamics.

Metals and commodities

For decades, the world reserve currency has linked the USD with the metals and commodities markets. The value of assets like gold, silver, and oil is usually denominated in USD, reflecting its substantial influence. This linkage stabilizes and drives the pricing structures within these markets. This process showcases the profound impact of the USD’s status.

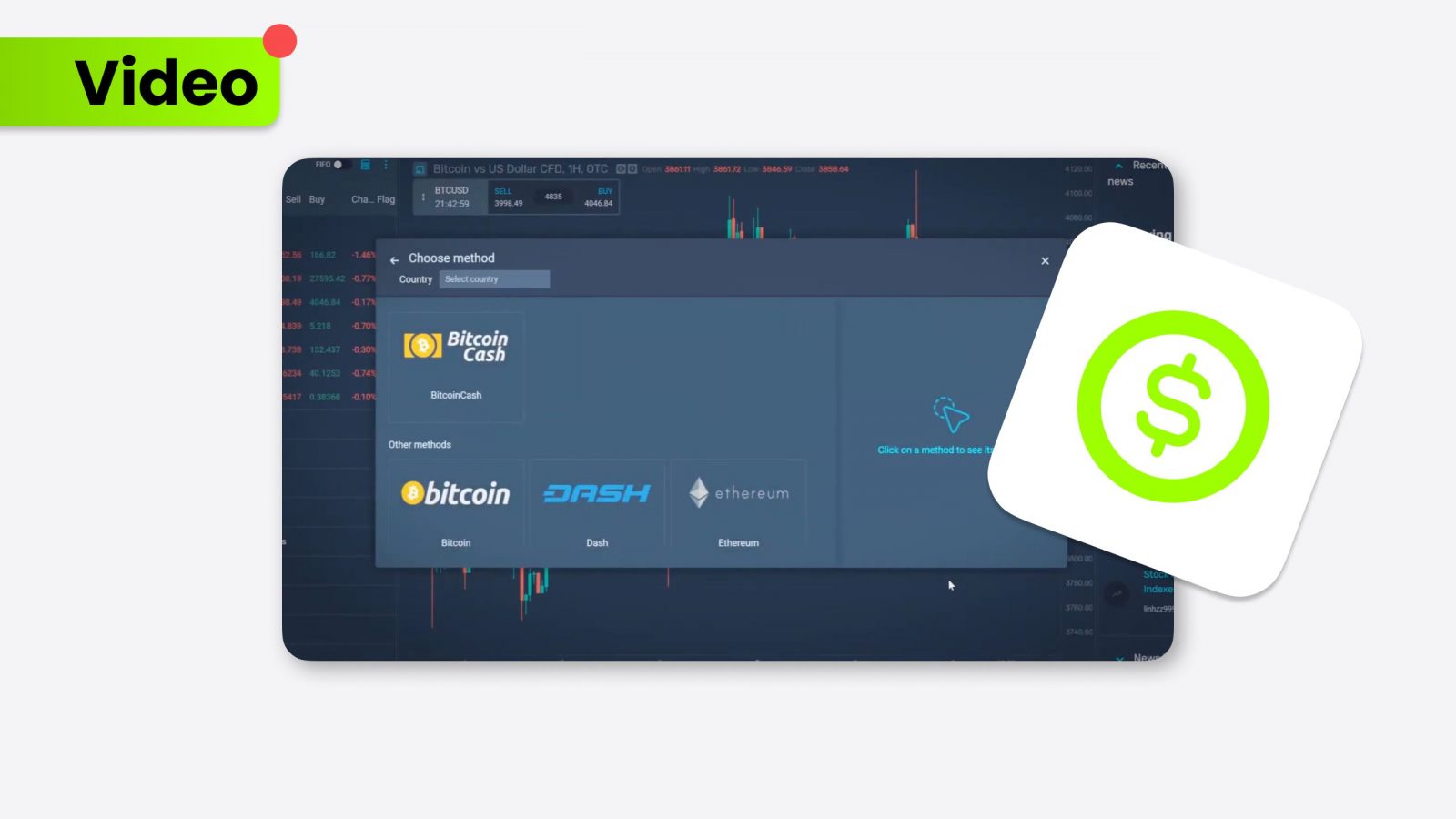

Crypto

The strength of the U.S. economy, underpinned by its national currency, has significantly contributed to the crypto market in the USA and worldwide. Traders can experience innovations such as stablecoins – with USDT at the forefront, which anchors crypto to the USD.

Reserve currency: Conclusion

The U.S. Dollar’s journey as the world’s leading reserve currency underscores its impact across various economic sectors. It controls international trade, stabilizes global financial markets, and serves as a benchmark for commodities and cryptocurrencies. The USD’s dominance, driven by the strength of the U.S. economy and strategic economic policies, continues to shape the financial landscape globally.