Bitcoin and Ethereum are foundational pillars of the cryptocurrency world, each with distinct philosophies, technical architectures, and use cases.

- Overview of the core functionalities and objectives of Bitcoin and Ethereum.

- Exploration of the technical differences that separate BTC and ETH.

- Analysis of the market influence and investment prospects of both cryptocurrencies.

Bitcoin vs. Ethereum difference

Bitcoin and Ethereum represent the two most significant innovations in the blockchain space, but they serve markedly different purposes within the ecosystem. While both were created to challenge the conventional financial system, their approaches and underlying technologies cater to diverse user needs and goals.

Functionality and purpose

Bitcoin’s primary function is to act as digital gold, providing a decentralized currency free from governmental oversight. Ethereum, however, serves a dual purpose: it operates both as a digital currency and as a platform for developing applications, significantly broadening its use cases.

While Bitcoin’s scope is primarily confined to transactions, Ethereum’s design as a programmable blockchain allows developers to create diverse, decentralized applications directly on its platform, ranging from games and marketplaces to large-scale financial contracts and decentralized exchanges.

Bitcoin vs. Ethereum overview

Bitcoin and Ethereum are the two most prominent players in cryptocurrency, each spearheading unique innovations and approaches to digital blockchain technology. While both aim to disrupt traditional financial systems, they do so with distinct visions and technical frameworks that cater to different aspects of the digital economy.

Foundational differences

Bitcoin, created by an unknown entity under the pseudonym Satoshi Nakamoto, was designed as a digital alternative to traditional currencies—a decentralized medium of exchange and store of value. Ethereum, conceived by Vitalik Buterin, expands upon the basic idea of blockchain to include complex agreements through smart contracts, making it a currency and a platform for decentralized applications.

BTC’s heart is blockchain technology, which aims to enable transparent and secure financial transactions. While also using blockchain, Ethereum incorporates intelligent contracts that execute automatically when conditions are met, supporting a broader range of applications beyond simple transactions.

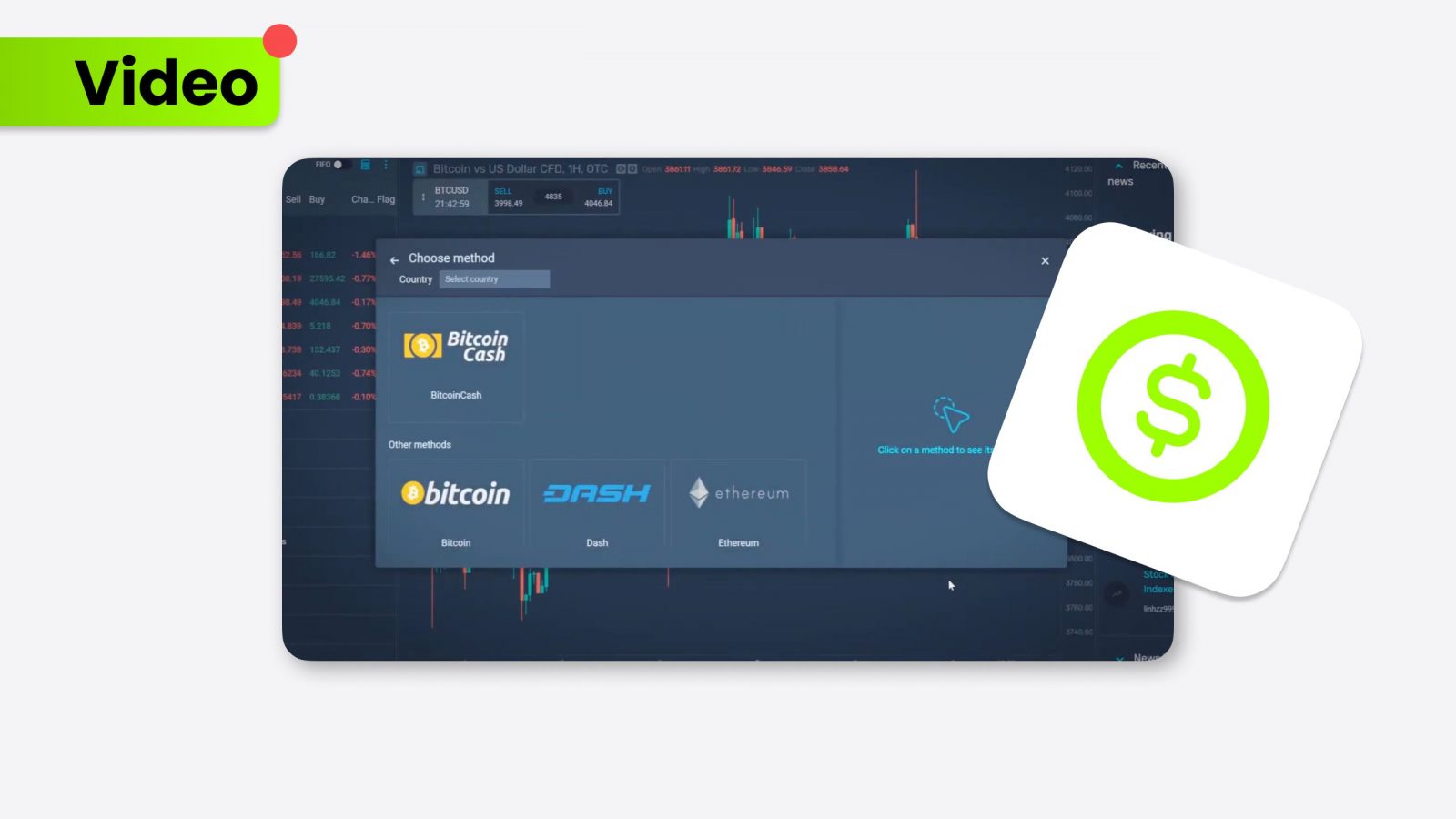

Market dynamics and investment

The cryptocurrency market is volatile, but Bitcoin and Ethereum are two titans with substantial influence over market trends and investment flows. Understanding the financial implications and growth potential of these leading digital currencies is essential for investors navigating the complexities of crypto investments.

Growth potential & financial Implications

Investing in Bitcoin is often seen as investing in the gold standard of digital currency, with its value derived primarily from its first-mover advantage and established network. Ethereum’s value, meanwhile, is tied not only to its function as a currency but also to its extensive utility in hosting applications, which can drive demand for its native token, Ether.

The future growth of BTC and ETH depends on several factors, including technological advancements, regulatory developments, and the evolving needs of the global economy. Bitcoin continues to lead in market capitalization and user base, while Ethereum’s continual development, particularly with the transition to Ethereum 2.0, suggests substantial potential for scalability and efficiency improvements.

Technological evolution and future trends

As blockchain technology evolves, Bitcoin and Ethereum face opportunities and challenges that could reshape their roles within the industry. Bitcoin’s potential adoption as a global reserve currency contrasts with Ethereum’s expanding ecosystem, which can support cutting-edge financial products and services. These future trends will influence their individual growth trajectories and the broader acceptance and integration of cryptocurrencies into the global financial system.

Conclusion

BTC and ETH each play crucial but distinct roles in the cryptocurrency ecosystem. Bitcoin remains the leading digital currency for those seeking a decentralized and secure way to store and grow value. On the other hand, Ethereum provides vast opportunities for innovation in digital contracts and applications, making it indispensable for those involved in the broader scope of blockchain applications. Understanding their differences is critical to navigating the future landscape of digital finance, whether as an investor, developer, or technology user.