The U.S. dollar’s performance is closely monitored by traders from all over the world. Its strength impacts several markets – from forex and indices to commodities and even crypto. That’s the reason why investors must remember indicators influencing USD performance.

- Economic indicators, such as the CPI and other measures like GDP growth and unemployment rates, influence the USD’s value.

- Decisions by the Federal Reserve, especially those made by the Federal Open Market Committee (FOMC), directly affect the USD’s strength.

- The USD performance has a significant impact across various markets, including forex, crypto, indices, and commodities.

Is the U.S. Dollar getting stronger or weaker?

The USD performance doesn’t hinge on a single factor; it’s the culmination of various internal and external elements. Below, we explore crucial indicators that help analyze whether the dollar is on an uptrend or downtrend.

Inflation rates

Inflation rates are a vital indicator of the USD’s internal value, directly affecting its purchasing power. The Consumer Price Index is often spotlighted when inflation rates are in conversation.

CPI reflects the average price change that consumers pay for a basket of goods and services over time.

A rising Consumer Price Index signals increasing prices, potentially weakening the dollar as it buys less over time. Conversely, low inflation rates can strengthen the dollar by preserving its purchasing power, making it more attractive to investors.

Economic indicators

Economic health indicators like GDP growth, unemployment rates, and manufacturing output offer insights into the economy’s vitality. A robust economy signaled by high GDP growth and low unemployment typically strengthens the USD. Those indicators not only reflect economic strength but also influence investor sentiment toward the dollar.

Monetary policy decisions

The Federal Reserve’s interest rate and monetary policy decisions, steered by the Federal Open Market Committee (FOMC), directly impact the USD’s value. An interest rate hike can bolster the dollar by attracting yield-seeking capital. In contrast, expansionary policies can pressure the dollar downwards.

The U.S. Dollar value and NFP

The Non-Farm Payroll (NFP) report, detailing monthly changes in employment numbers excluding agricultural jobs, is a critical economic indicator for the U.S. dollar value.

Significant job additions suggest economic health, potentially leading to interest rate hikes by the Fed, thus strengthening the dollar. On the other hand, weak NFP results can hint at economic slowdowns, pressuring the Fed to adopt a dovish stance and potentially weakening the USD.

USD value: Impact on various markets

The USD’s stature as the world’s primary reserve currency means its performance determines all major asset classes, influencing market dynamics globally.

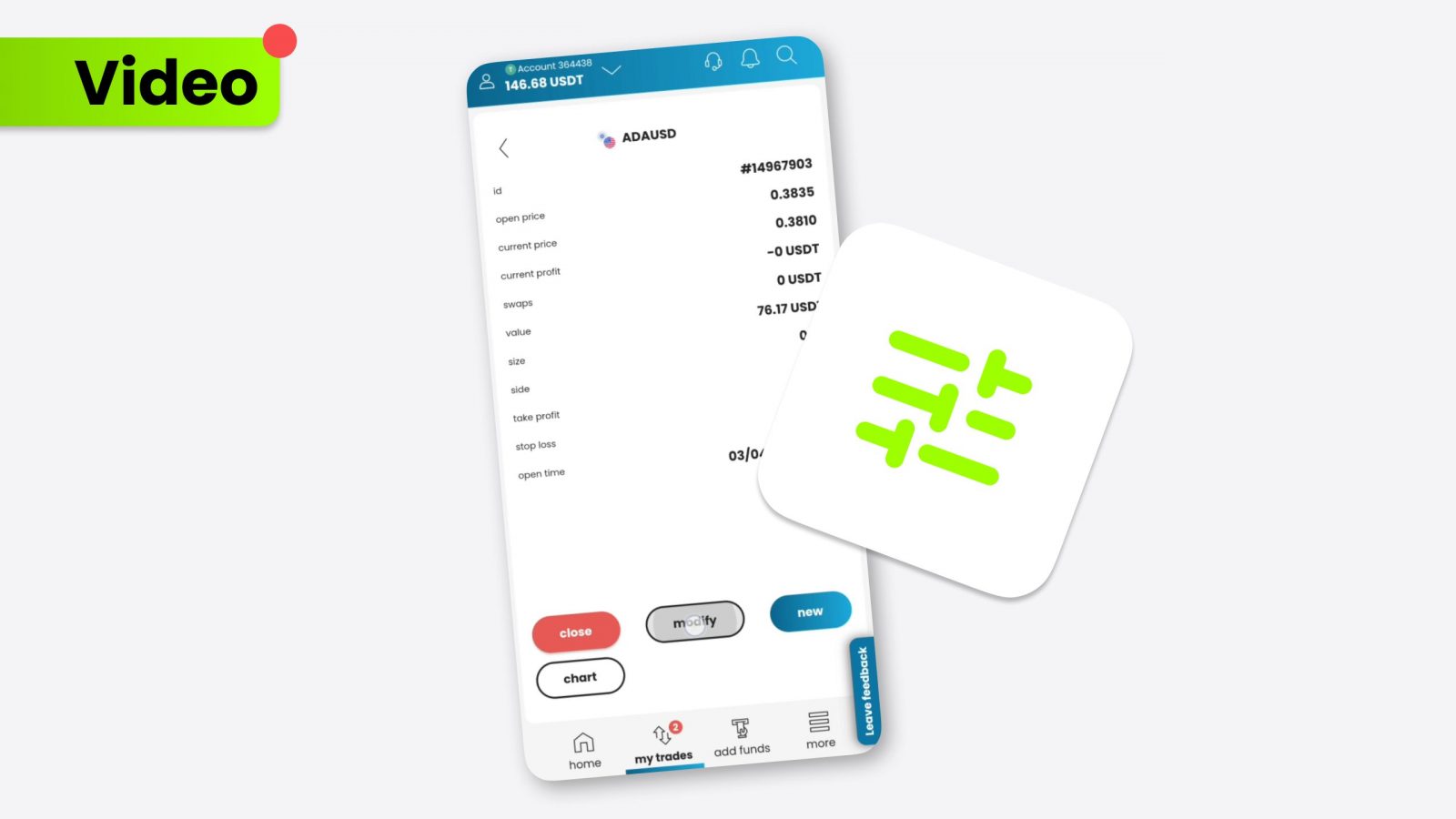

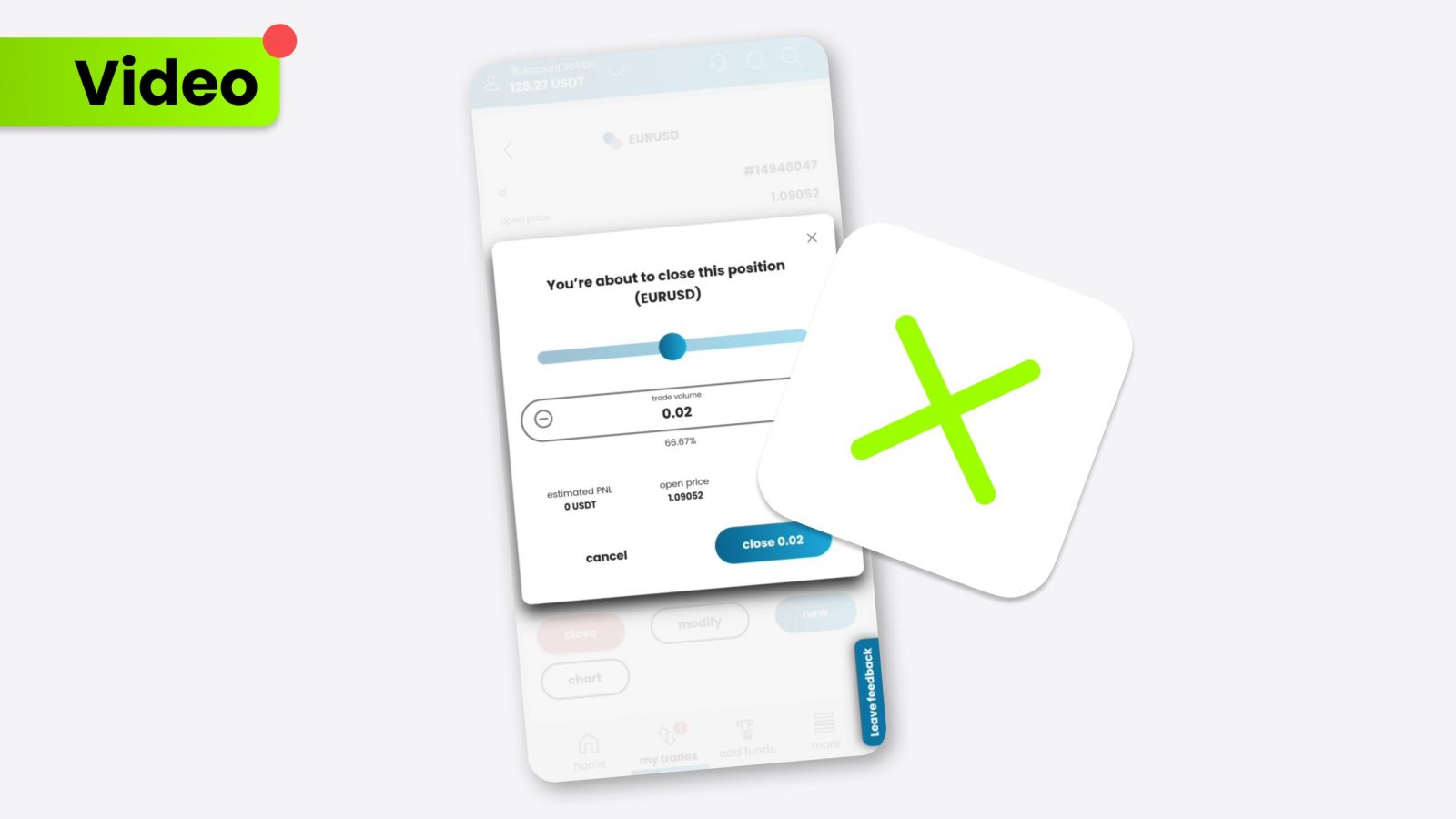

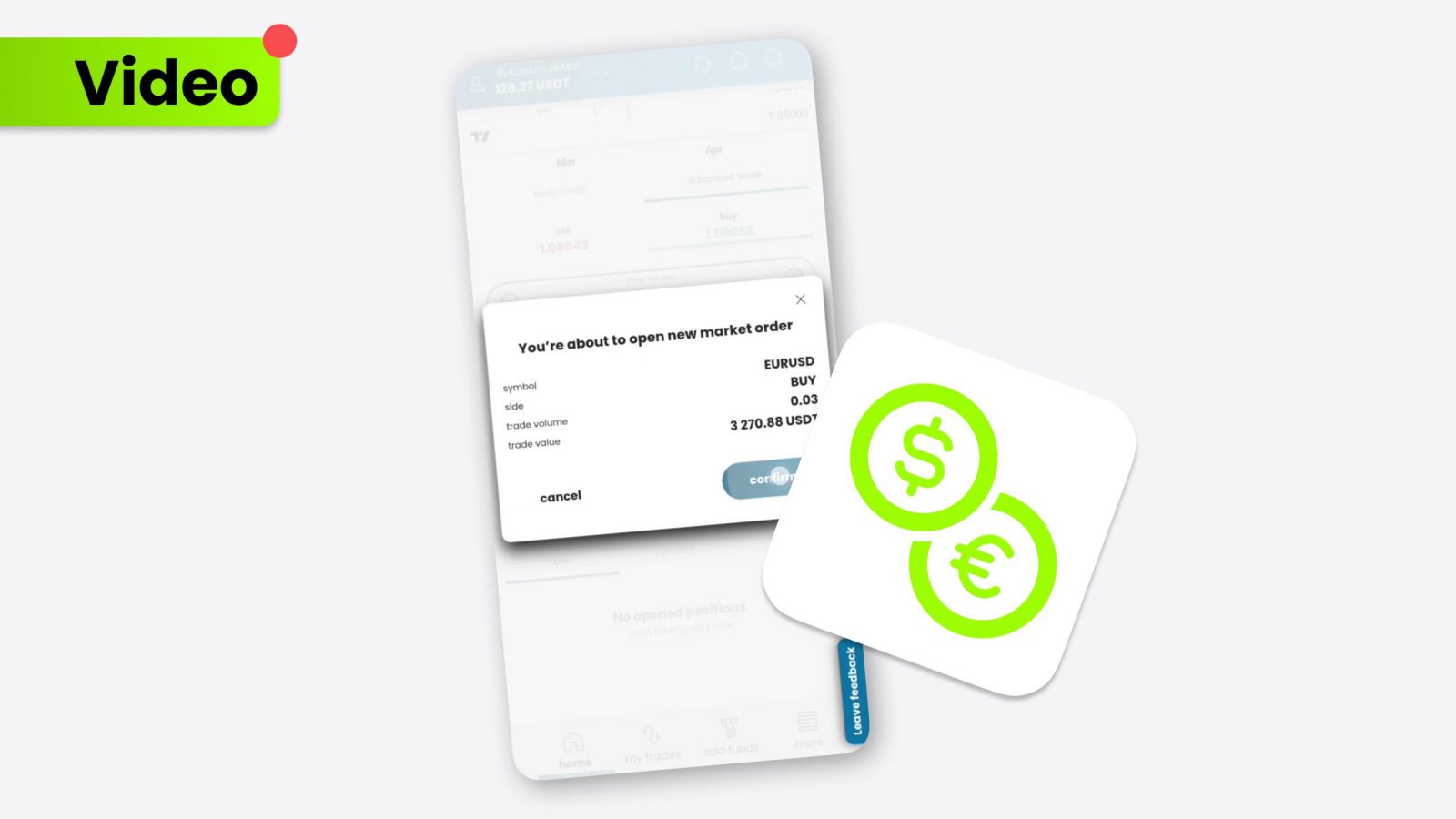

Forex

In the forex market, a strong USD results in a lower value for currency pairs where the USD is the quoted currency, such as EURUSD, because buying one unit of foreign currency takes fewer dollars. Conversely, a weak USD can lead to a higher value for these pairs.

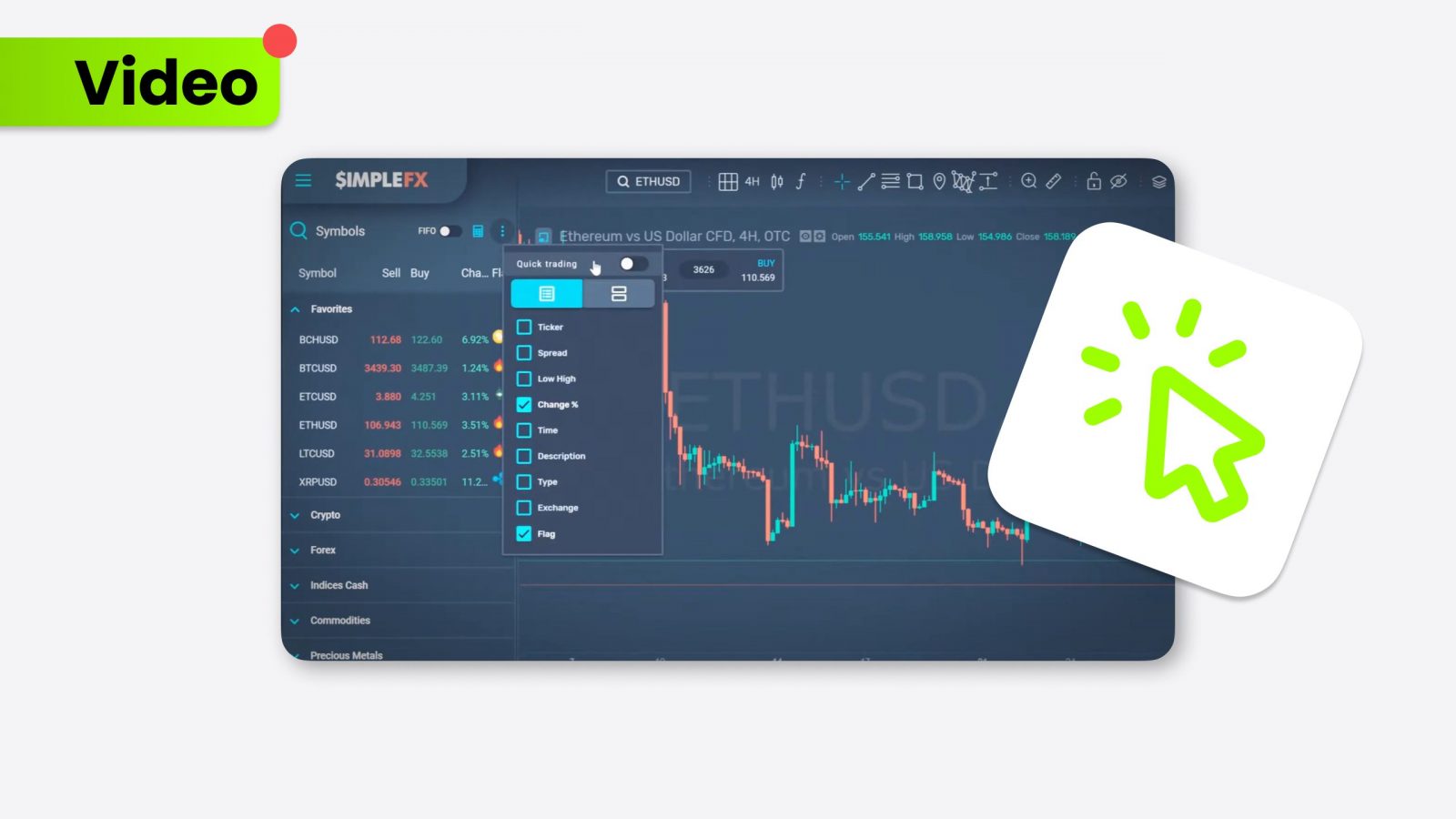

Crypto

The cryptocurrency market, including Bitcoin and altcoins, often sees an inverse relationship with the USD. A stronger dollar can lead to lower crypto prices as investors seek refuge in the stability of fiat. In comparison, a weaker dollar can boost crypto investments as an alternative asset class.

Indices

U.S. stock indices like the S&P500 may react negatively to a strong USD, as multinational companies face headwinds from unfavorable currency conversion rates. A weaker dollar can boost these indices by making U.S. stocks more attractive to foreign investors.

Commodities

Commodities priced in USD, such as oil and gold, typically move inversely to the dollar. A stronger dollar makes these commodities more expensive in other currencies, potentially reducing demand, while a weaker dollar does the opposite.

Conclusion

The performance of the USD is a complex interplay of various indicators, from inflation rates and economic health to monetary policy decisions. Understanding these factors is crucial for traders who navigate the nuances of the forex, crypto, indices, and commodities markets.