Welcome to an electrifying exploration of Decentralized Finance (DeFi), a seismic shift reinventing the very essence of traditional finance. Prepare to have your understanding of finance expanded, challenged, and transformed as we navigate the cutting-edge, dynamic universe of DeFi together.

- Introduction to decentralized finance: This text introduces the revolutionary concept of Decentralized Finance (DeFi), explaining its shift from traditional financial systems to transparent, open networks that allow direct peer-to-peer transactions.

- Key features and benefits of DeFi: Highlights how DeFi utilizes blockchain technology to enable a range of financial services.

- The impact and future of DeFi: Discusses the transformative potential of DeFi across various industries, its current challenges, and future developments.

Introduction to decentralized finance (DeFi)

Decentralized Finance, or DeFi, represents a radical shift from traditional, centralized financial systems to open, transparent, and accessible networks. DeFi leverages blockchain technology, including Layer 1 platforms like Ethereum (ETH), to eliminate intermediaries in financial transactions, offering a peer-to-peer model where users transact directly. Notably, DeFi projects are not limited to Ethereum; other blockchains like Bitcoin (BTC), Solana (SOL), Cardano (ADA), and Avalanche (AVAX) are also exploring DeFi applications, broadening the ecosystem and increasing opportunities for innovation and accessibility. This innovative approach democratizes access to financial services, from lending and borrowing to trading and insurance, all without the need for traditional financial institutions, making it a pivotal development in the world of finance.

What is DeFi?

Decentralized Finance, or DeFi, represents a radical shift from traditional, centralized financial systems to open, transparent, and accessible networks. DeFi leverages blockchain technology to eliminate intermediaries in financial transactions, offering a peer-to-peer model where users transact directly. This innovative approach democratizes access to financial services, from lending and borrowing to trading and insurance, all without the need for traditional financial institutions.

The pillars of decentralized finance

Decentralized finance, often referred to as DeFi stands on the foundational principles of openness, interoperability, and user sovereignty. It leverages blockchain technology to create financial services that are open to all, bypassing traditional gateways and intermediaries.

The heartbeat of DeFi: smart contracts and blockchain

Imagine a world where agreements don’t just sit on paper but live and breathe in the digital realm, executing themselves automatically. This is the reality in DeFi – smart contracts. These are not just any contracts but agreements coded into the blockchain, like Ethereum, acting as the backbone for a transparent, unchangeable, and secure transaction environment. It’s like having an impartial digital mediator who ensures everyone plays by the rules without a central authority. This groundbreaking technology paves the way for decentralized applications (dApps) (including the development of GameFi) to flourish, offering financial services accessible to anyone, anywhere, without traditional banking gateways.

The role of dApps and protocols: Empowering everyday users

Consider the case of Sarah, a freelance designer in Argentina, who wants to lend her extra earnings to earn interest. Through DeFi platforms, she can directly lend her digital assets to someone on the other side of the world, say, Mike in Australia, who’s looking to borrow funds for his startup. All without going through a bank. Decentralized applications (dApps) transform traditional financial services like lending, borrowing, trading, and insurance, making them accessible to anyone with an internet connection. By tapping into open-source protocols, developers are crafting financial tools that are not only innovative but also inclusive, breaking down the barriers erected by conventional financial institutions.

How DeFi works

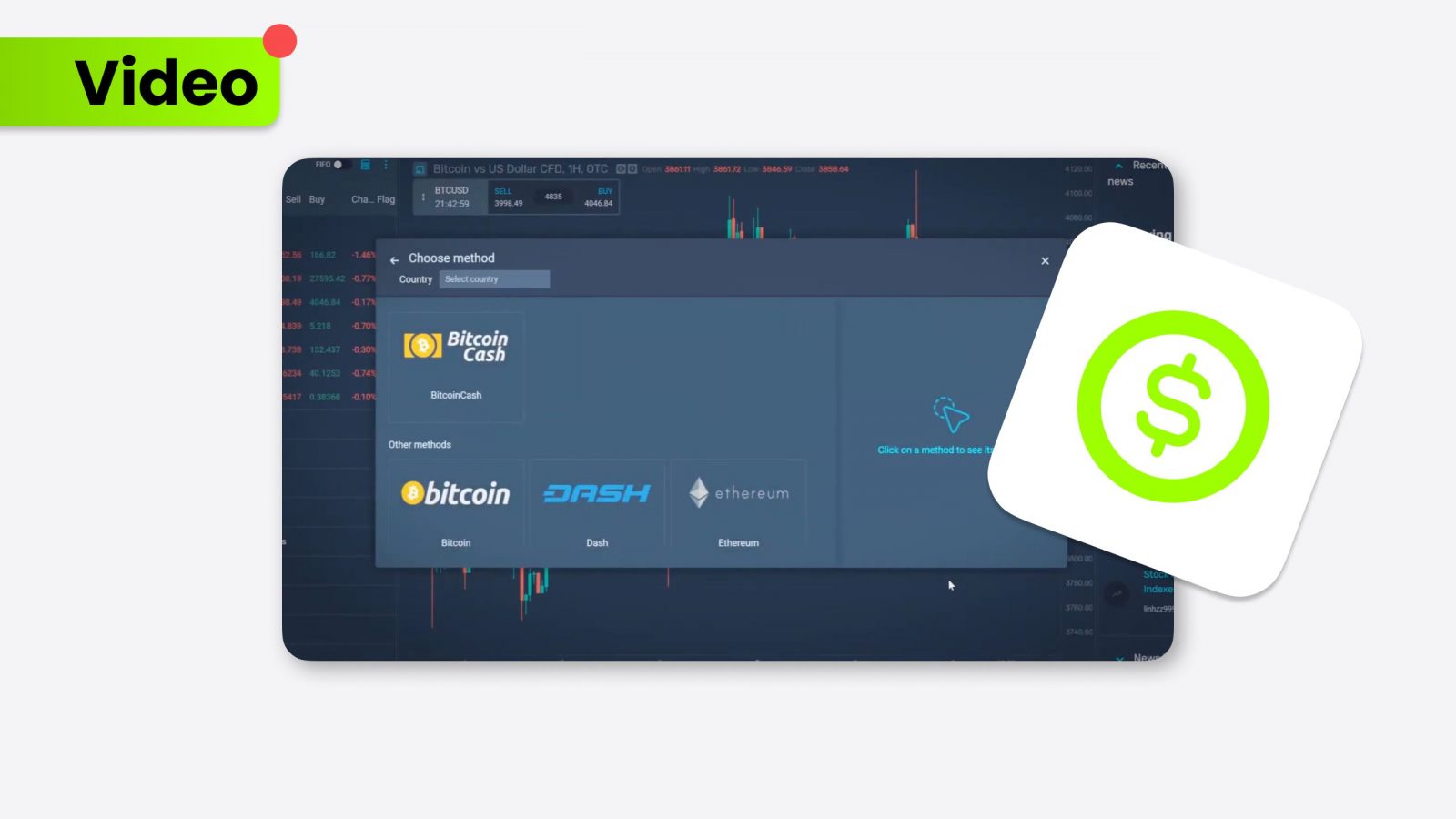

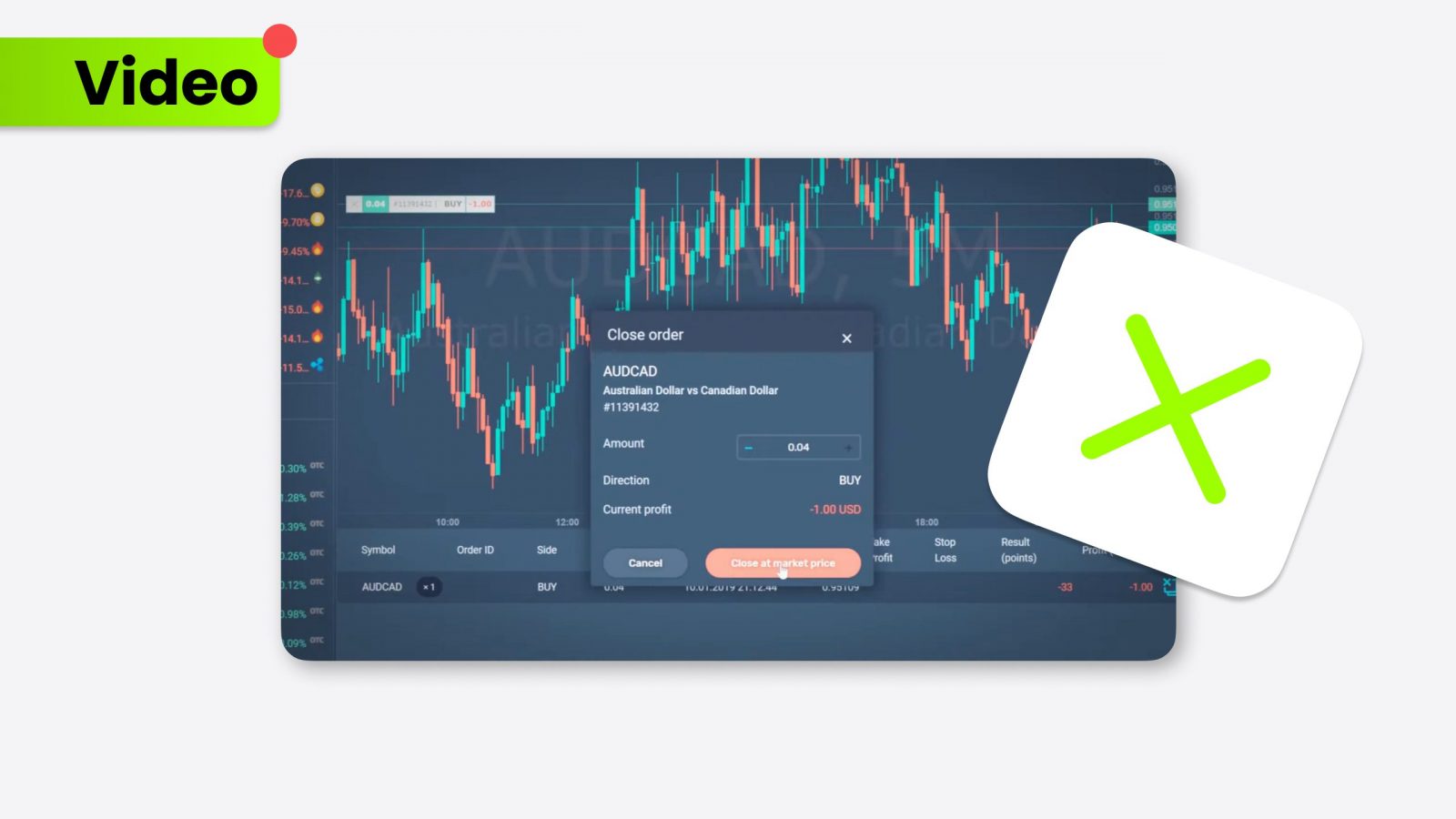

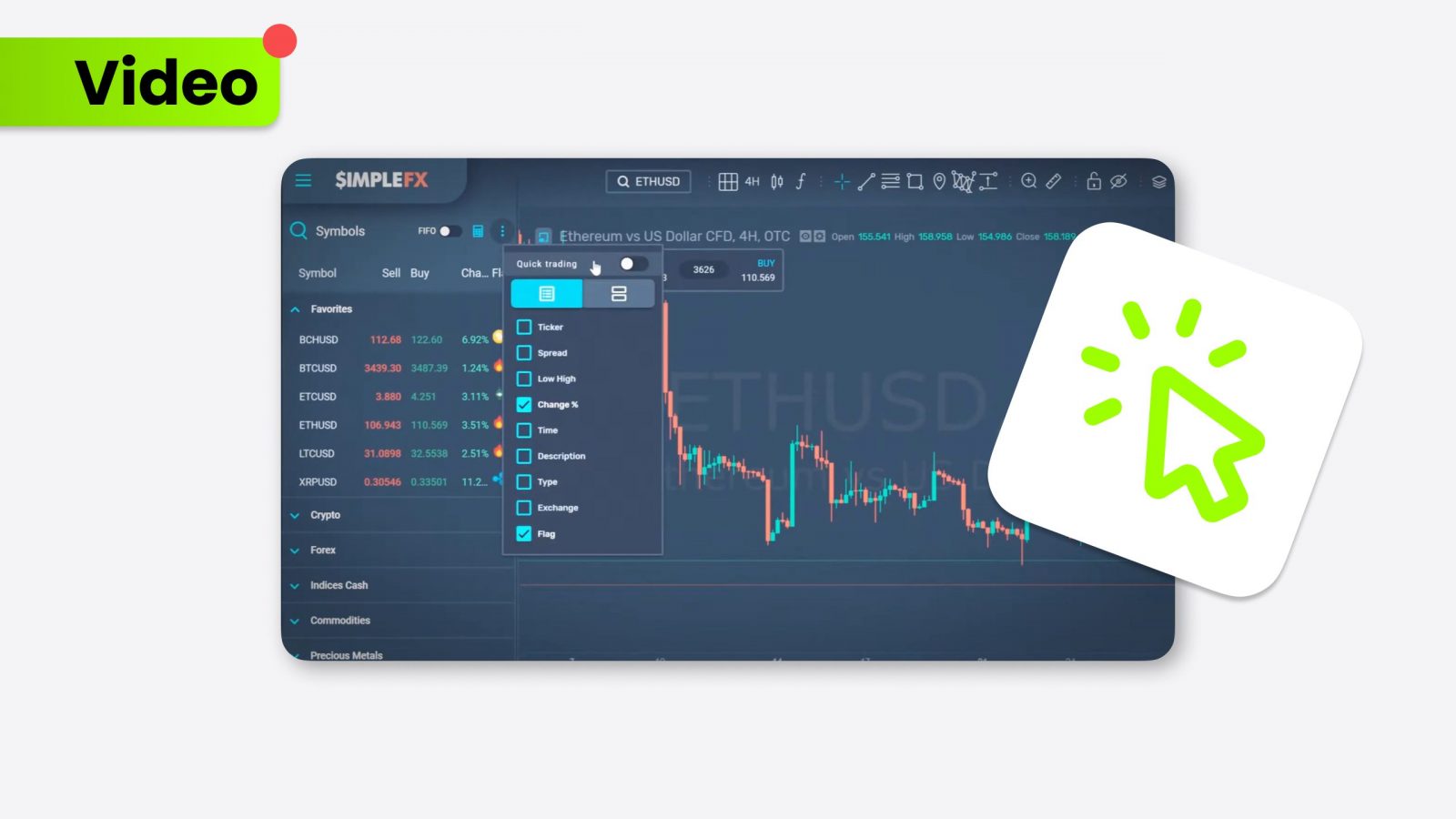

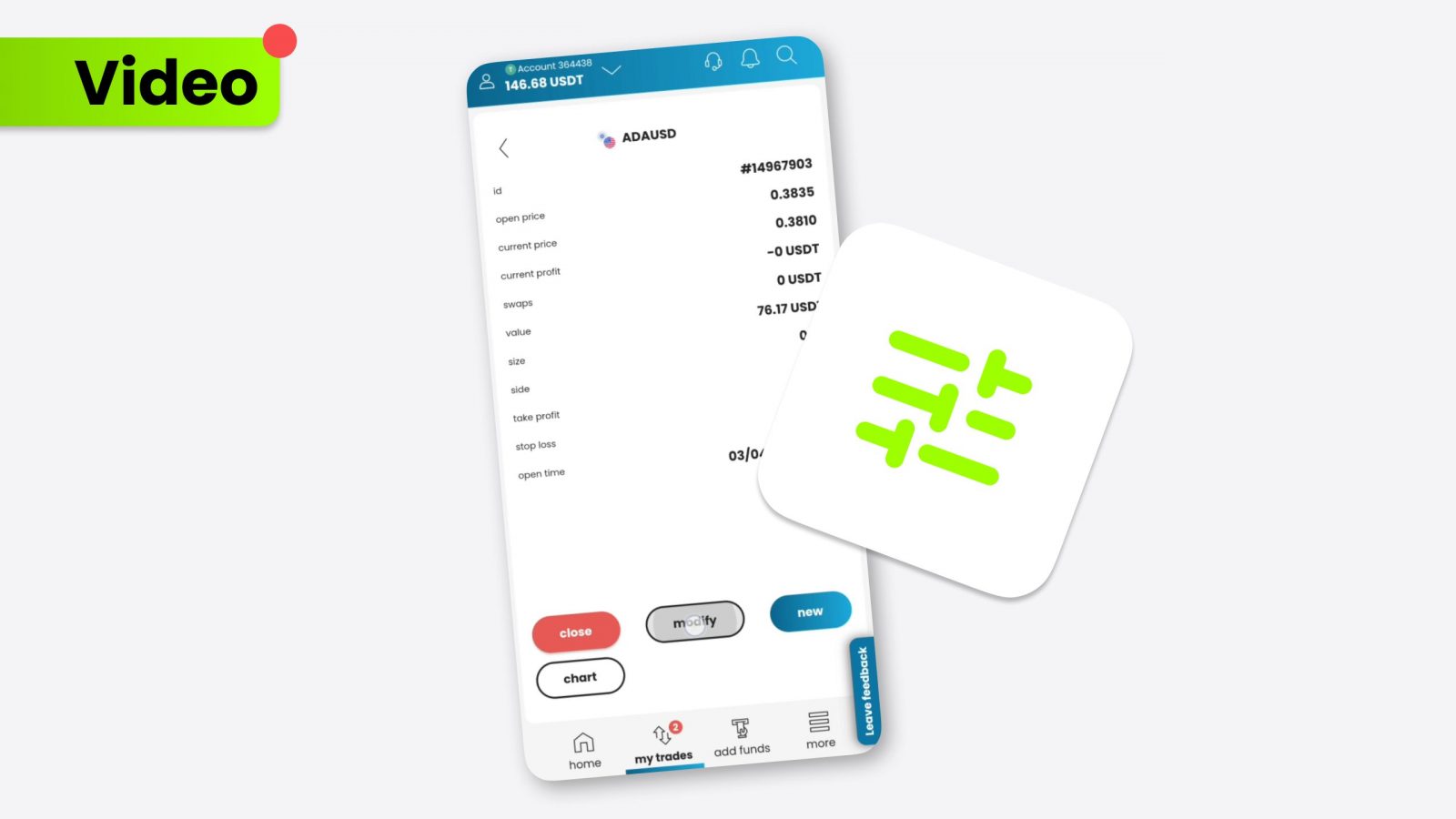

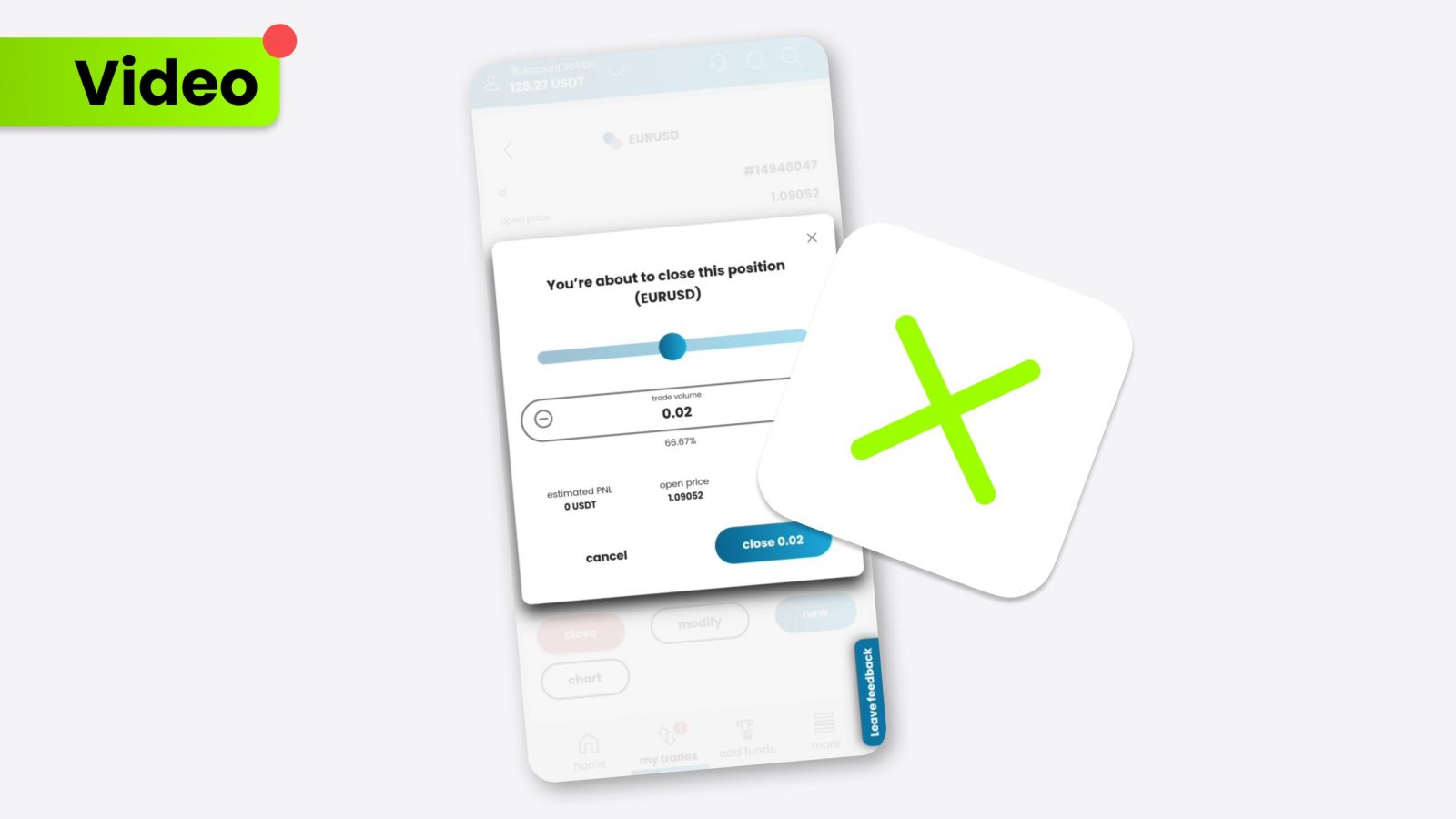

DeFi utilizes blockchain technology to operate financial services without central authorities, making transactions, lending, and borrowing more accessible and transparent. By employing smart contracts and Web3 wallets, DeFi platforms automate and secure financial transactions, ensuring trust and efficiency without intermediaries.

From transactions to governance

DeFi transforms every aspect of traditional finance. Users can engage in financial activities directly from their digital wallets, including earning interest on savings-like products, obtaining loans without credit checks, and exchanging assets through decentralized exchanges (DEXs). Furthermore, DeFi extends to governance, where token holders can vote on decisions affecting the future direction of DeFi protocols, embodying the principles of decentralization and democratic control.

Liquidity pools and yield farming

Liquidity pools are foundational to DeFi, enabling trading and lending by pooling assets for users to borrow or exchange. Yield farming or liquidity mining, has emerged as a popular way to earn rewards by providing liquidity to these pools, incentivizing participation, and ensuring the smooth operation of DeFi services.

The impact of decentralized financing

Decentralized financing is reshaping the financial sector’s fabric by introducing mechanisms that operate on principles of transparency, autonomy, and direct peer-to-peer interactions. This movement towards decentralized financing not only challenges centralized financing but also sets the stage for a more equitable distribution of financial services worldwide.

A paradigm shift in finance

DeFi challenges the status quo, offering a more inclusive, efficient, and transparent financial system. It reduces barriers to entry, allowing anyone with an internet connection to access financial services previously reserved for a privileged few. This open financial system has the potential to foster economic innovation, freedom, and equality on a global scale.

Challenges and considerations

Despite its potential, DeFi faces challenges, including regulatory uncertainty, security vulnerabilities, and the complexity of understanding and interacting with DeFi platforms. The developing nature of the technology means that risks, such as intelligent contract exploits and market volatility, are significant considerations for participants.

Conclusion: The future of DeFi

As DeFi continues to evolve, it promises to introduce more sophisticated financial instruments, enhance security, and improve usability, making decentralized financial services more accessible to a broader audience. The journey of DeFi is just beginning, with the potential to redefine the very fabric of the financial sector.