The world of equities may be the most diverse throughout all financial assets’ categories. Traders can enter this market to diversify their portfolios with unique companies.

- Equities are financial assets representing companies in the market

- Even though they are similar, equities and stocks are not the same

- Nowadays, most traders keep their eyes on AI, hi-tech, and energy equities in the market

- Equities can also be divided into world regions of their origin.

What are equities?

Equities represent company ownership interests, providing shareholders with a stake in the company’s assets and earnings. These financial instruments are traded on the equities market, where investors buy and sell shares based on their perception of a company’s current and future value.

Indices, such as the Dow Jones Industrial Average and NASDAQ Composite, act as barometers, measuring the market’s overall health and performance. For example, the NASDAQ-100 index includes major global companies like PayPal and Netflix. The inclusion of these firms shows their significance within the equities market, and their performance directly impacts the movement of this index.

Market participants often compare equities’ movements with the indices to measure relative performance. Additionally, factors like economic indicators such as NFP, investor sentiment, and forex rates can affect equities’ pricing, making it crucial for investors to understand how these external elements connect with equities rates.

Key differences between equities and stocks

The terms “equities” and “stocks” are often used interchangeably, but they carry distinct meanings in the financial world. Understanding the nuances between equities vs. stocks is crucial for investors.

Equities refer to ownership interests in companies containing all forms of ownership. It includes common and preferred stocks, as well as other types of equity ownership like private equity or shares in unlisted firms. On the other hand, stocks denote publicly traded companies’ shares listed on an exchange. These shares come in two main forms: common and public.

To illustrate, traders can consider Adobe. As a publicly traded company, Adobe’s shares are listed on the NASDAQ exchange, allowing investors to own a portion of its business. These shares fall under the definition of stocks. However, Adobe equities would also include other potential forms of ownership, such as unlisted shares or private equity stakes.

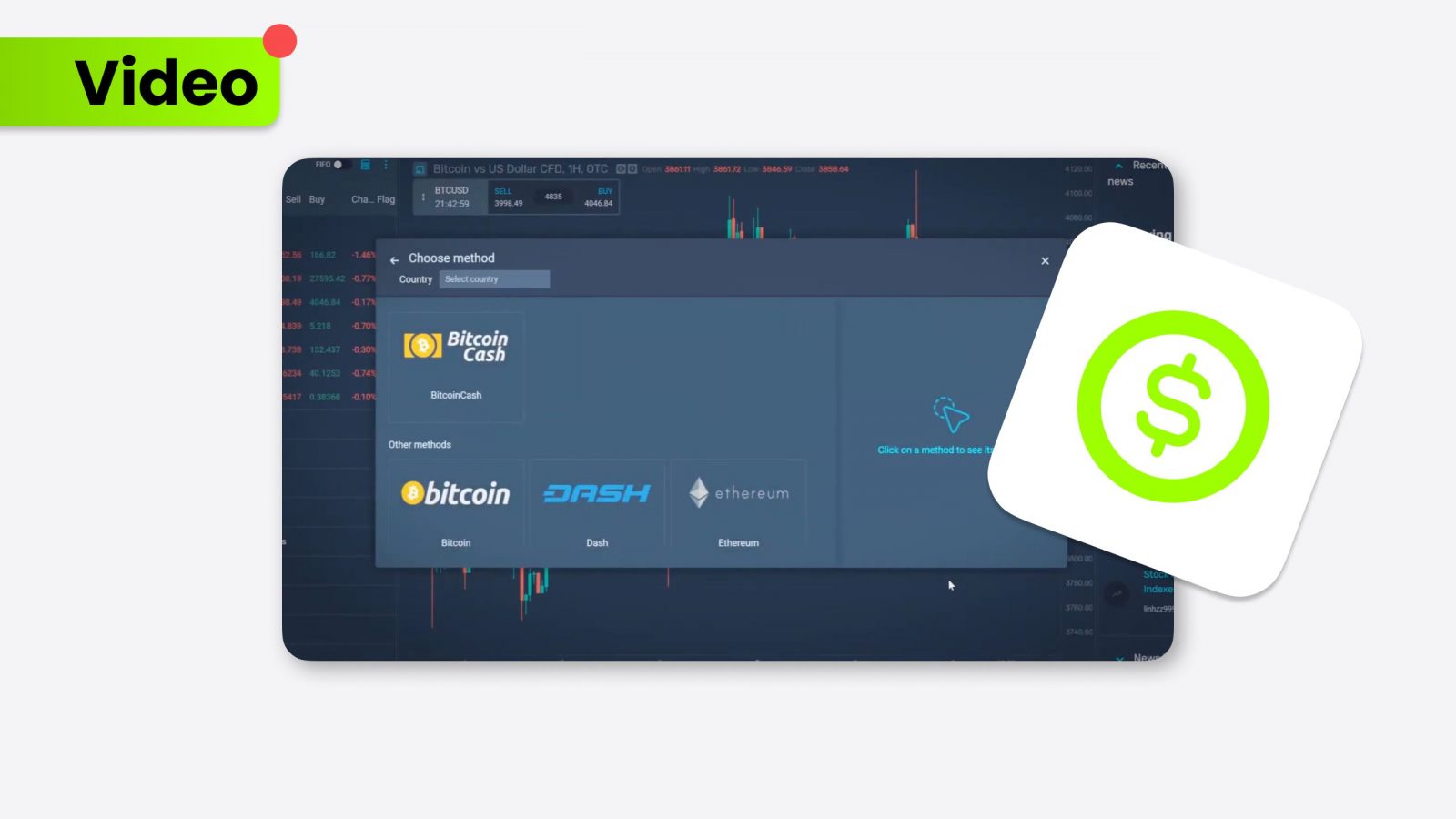

Investors should also remember the growing interest in alternative investments, such as cryptocurrencies, when comparing equities vs. stocks. Diversification between various assets is essential in creating a trader’s portfolio.

Most popular types of equities

There are various types of equities, each representing a different sector and offering unique potential for investors.

AI

Artificial Intelligence (AI) equities represent companies that develop AI technologies or consolidate them into their business models. These equities are gaining significant traction in the market as AI increasingly shapes various industries. NVIDIA, a leader in AI computing, stands at the forefront of this trend with its GPU technologies. MicroStrategy, another notable player, integrates AI into its analytics while also holding substantial investments in Bitcoin. AI equities are becoming pivotal as technology rapidly evolves.

Hi-tech

Hi-tech equities include companies at the forefront of technological advancement, such as Apple and Uber. These firms leverage groundbreaking technologies like blockchain, which plays a vital role in securely managing data and transactions. Hi-tech equities attract investors seeking to participate in the technological shifts transforming global markets, promising returns linked to rapid growth and adoption rates.

Pharmaceutical

Pharmaceutical equities encompass firms that research, develop, and manufacture medicines. The COVID-19 pandemic profoundly impacted this sector, significantly raising the profile of companies like Pfizer or European Bayer. Their role in developing vaccines not only affected the U.S. Dollar but also underscored the sector’s critical importance in public health.

Energy

Energy equities are categorized into two primary groups: those related to fossil fuels and those focusing on clean energy. Companies like Shell and ExxonMobil represent the traditional fossil fuels sector, which is highly important in terms of commodities. Clean energy equities, such as Tesla, concentrate on developing sustainable energy solutions, often with a robust use of renewables.

Magnificent Seven: Need to know

In the equities market, the Magnificent Seven refers to a group of leading technology companies that have substantially impacted global stock exchanges due to their market dominance and consistent growth. This group consists of Apple, Microsoft, Amazon, Alphabet, Meta, NVIDIA, and Tesla. These companies are all based in the United States.

These firms are primarily involved in the AI and hi-tech sectors, shaping global trends and redefining how businesses operate and people live. Their influence extends from AI computing and cloud services to social media, e-commerce, and electric vehicles. Their dominance within their respective sectors makes them critical components of global investment strategies, as their actions often set the trend of the entire market.

The Magnificent Seven equities are substantial to the major U.S. indices, such as the S&P500 and the NASDAQ-100, which reflects their influence on the equities market. Given their enormous market capitalizations, their collective performance often dictates the overall market sentiment and direction.

Equities markets from all over the world

Equities markets are global, with nearly every country having its own exchanges and unique set of influential companies. Each region reflects distinct economic, cultural, and regulatory influences.

American

American equities are globally recognized for their technological innovation and dominance. Companies like ARM Holdings, Disney, and Mastercard highlight the diversity of sectors that make up the U.S. market. The tech sector, in particular, drives much of the market’s growth, with firms pushing the boundaries of AI, fintech, and digital transformation.

European

European equities have a rich mix of traditional industries and innovative companies. Volvo leads in automotive engineering, Louis Vuitton embodies luxury fashion, and countless others span diverse sectors. European firms often balance innovation with tradition. The cultural heritage of the region influences product development and corporate strategies. The EURUSD or USDCHF rates often impact European equities through the forex market.

Japanese

Japanese equities reflect the country’s longstanding commitment to manufacturing excellence and technological innovation. Shiseido and Sony illustrate companies that have a global impact and are leading in beauty and consumer electronics. Japan remains a vital hub for investors seeking exposure to the Asia-Pacific region with Japanese equities or USDJPY.

South American

The South American equities market is characterized by a rich diversity of natural resources and growing industries. The Brazilian market is particularly influential, with Petrobras – a state-owned oil company – as a major energy player.