European indices offer a window into Europe’s vibrant and diverse economic landscape. They reflect the complex landscape of the continent’s economy.

- European indices differ from American ones due to diverse economic policies across European countries.

- Traders must remember that indices such as STOXX50 focus on the European Union and consist of companies from various EU countries.

- STOXX50 highlights companies from various countries and sectors.

What are European stock indices?

European stock indices are aggregate measures of the selected stocks from various European sectors. These indices present market trends and the economic health of the European region.

Most European stock indices focus on a single country, but some of them blend results from multiple nations and reflect the interconnected nature of the European economy.

When comparing them to American indices, a few distinctions stand out. Primarily, European indexes might encompass a broader variety of countries, each with its economic policies and conditions, introducing a unique blend of volatility. In contrast, American indices such as Dow Jones or the S&P500 reflect the economic climate within the United States, even if they focus on a specific set of equities.

EU stock index and national indices

EU stock indices play a significant role in representing the economic performance of the European Union and countries that are not its members.

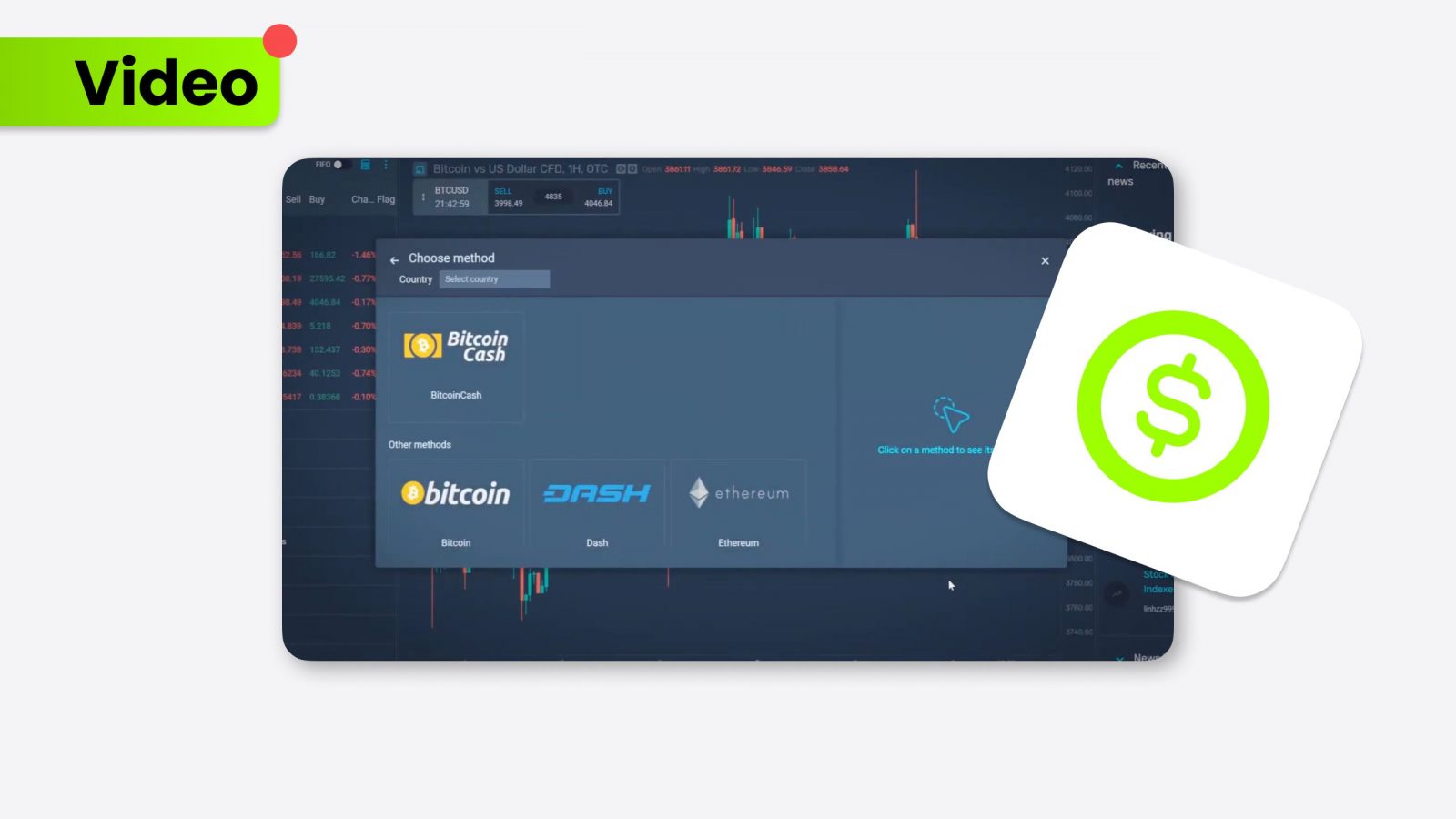

Traders should remember that indices and future indices present the same financial assets.

The well-known STOXX50 is a benchmark index that comprises 50 of the most extensive and most liquid stocks across the EU. It offers investors a complex view of the market’s health and trends, including significant financial assets like the Euro to Dollar.

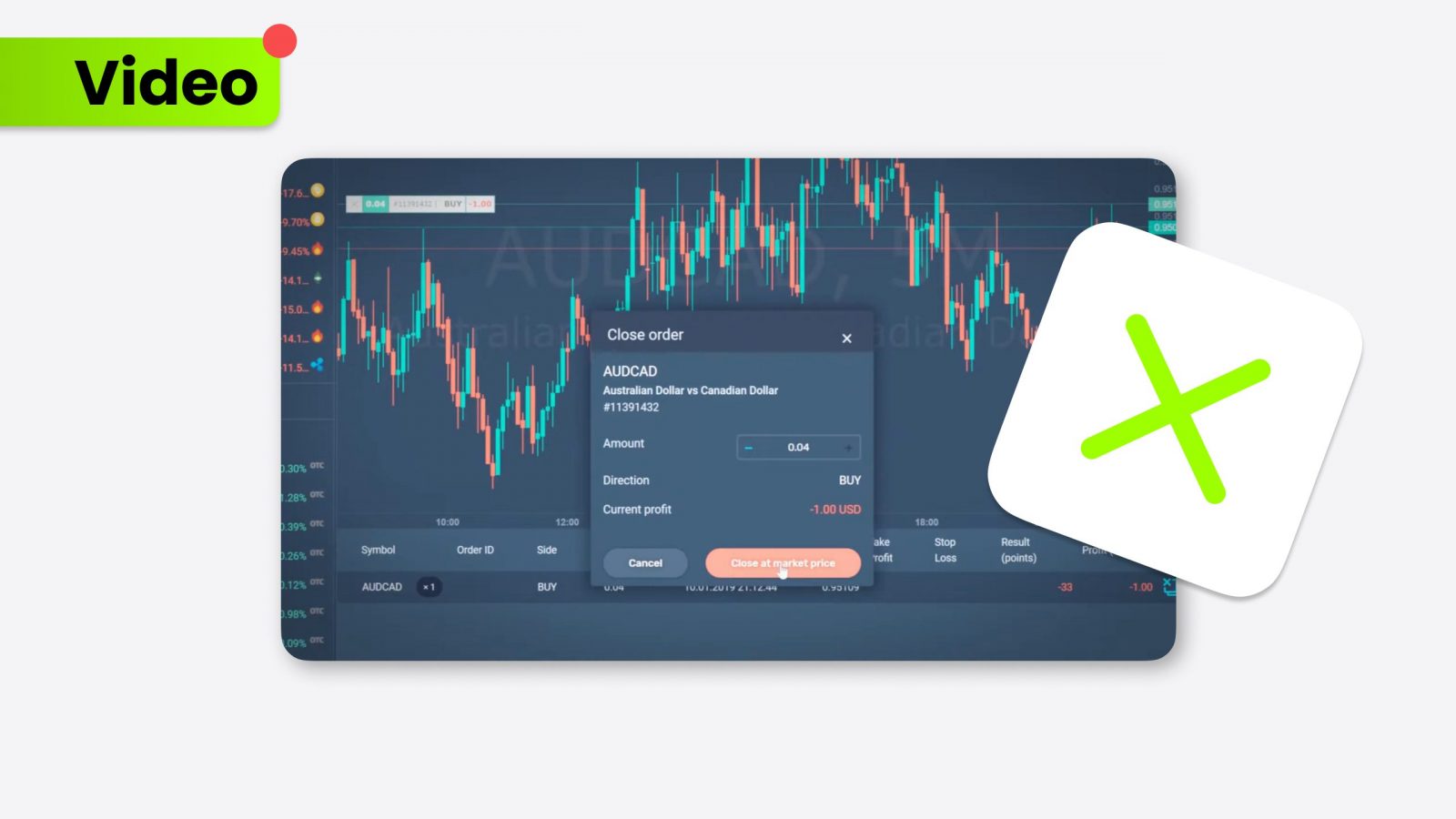

The DAX40, another major index, specifically tracks the performance of 40 major companies listed on the Frankfurt Stock Exchange in Germany. It is often used as a barometer for the overall health of the German economy, the largest in Europe. Similarly, the CAC40 includes the top 40 equities listed on the Paris Bourse in France. It is indicative of the French market’s current condition.

Even though the UK hasn’t been an EU member for a couple of years, the FTSE100 still plays an essential role in the European economic landscape. The index comprises 100 of the largest companies by market cap listed on the London Stock Exchange. It is crucial for investors interested in assets such as EURGBP and the relation of GBP to USD.

Towards the south, the IBEX35 serves as the benchmark stock market index of the Bolsa de Madrid in Spain. It includes 35 of the most liquid Spanish stocks and is a vital indicator of the Spanish economic climate. Another noteworthy index, the SMI20, tracks the top 20 stocks in Switzerland, providing insights into Swiss market dynamics.

Europe stock market indexes: Most popular equities

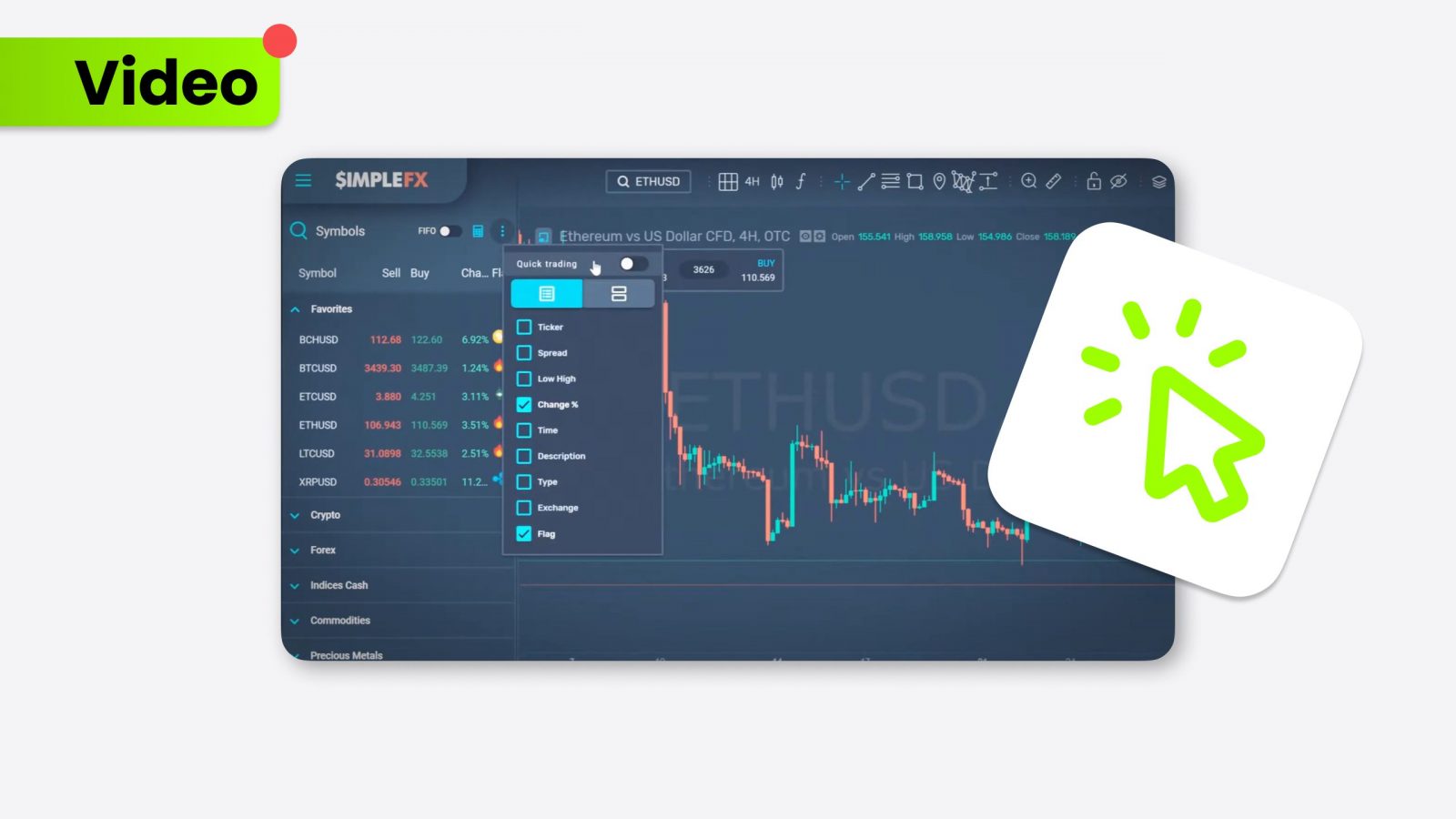

Europe stock market indexes, particularly STOXX50, showcase many industries that drive the European economy. Among these, specific sectors stand out due to the popularity and performance of their leading companies.

Within the STOXX50, luxury goods, banking, and insurance are prominent sectors that attract substantial investment. Companies like Louis Vuitton showcase the luxury goods sector within Europe and globally, reflecting consumer demand and a strong market presence. LV’s consistent performance and iconic brand identity make it a staple within this index.

In the banking sector, BNP Paribas stands as a powerhouse. As one of Europe’s largest banks, BNP Paribas represents a significant component of the financial landscape, demonstrating the strength and stability of European banking.

Giants like Allianz similarly represent the insurance sector. Known for its comprehensive range of insurance and financial services, Allianz is a crucial player in the European market, highlighting the reliability and growth of the insurance industry within the continent.

European indices: Conclusion

European indices serve as a critical barometer for assessing both the unified and individual economic health across Europe. From the comprehensive reach of the STOXX50 to the specific insights provided by national indices like the DAX40 and FTSE100, these indices equip investors with the necessary tools to navigate the complexities of the European market.