The metals market is a dynamic aspect of the global financial landscape. Understanding its complexities can be the first step in exploring the diverse potential of this market.

- Despite similarities, metals and commodities slightly differ

- Metals can be divided into base and precious, with gold and silver standing at the forefront of the latter one

- Trading times, spreads, and leverage are crucial in the metals market

- To explore this market, traders have to understand factors impacting metals prices.

Introduction to metals market for traders

Metals are naturally occurring elements that typically present a shiny appearance and conduct electricity and heat efficiently. They are essential in various industries, from construction and electronics to jewelry. Unlike broader commodities, which include a vast range of goods such as agricultural products and energy resources, metals specifically refer to elements like gold, silver, copper, and iron.

The metals market is distinct from other commodity markets due to its diverse utility and economic significance. Metals are not only essential for manufacturing and technology but also serve as critical instruments in financial trading and wealth preservation. This market corresponds with other asset classes, particularly with forex.

For example, the relations between metals like gold and forex can be seen on the XAUAUD, which represents the price of gold in terms of the Australian dollar. Understanding forex basics is crucial as it shows how fluctuations in this market impact metal prices. XAUAUD heavily depends on variations in the Australian dollar to U.S. dollar rates.

Different types of metals

Traders can explore various metals in the market, such as those presented below:

Gold

Gold, a symbol of wealth and security, holds a special place among metals due to its value and historical significance. It is often referred to as the gold standard in wealth preservation. The digital world also appreciates its reputation – traders often refer to Bitcoin as the “crypto’s gold.” Usually, gold is presented against the U.S. Dollar as XAUUSD.

Silver

Silver is renowned not just for its appeal but also for its industrial applications, making it a versatile and fundamental asset. Its comparison to Ethereum, often named as “Crypto’s silver,” reflects its potential in both traditional and digital assets.

Precious metals

Beyond gold and silver, traders can explore the world of precious metals thanks to platinum or palladium. These metals are essential in various high-tech applications, from catalytic converters to electronics, enhancing their investment appeal.

Base metals

Base metals such as copper play a vital role in modern infrastructure and technology. Unlike their precious counterparts, base metals are abundant but critical for economic growth and technological advancement. Their widespread use in industries underscores their importance.

Investing in precious metals

Historically, investing in precious metals offered a traditional way of hedging against inflation and currency devaluation. These assets have been coveted for ages for their ability to preserve value over time.

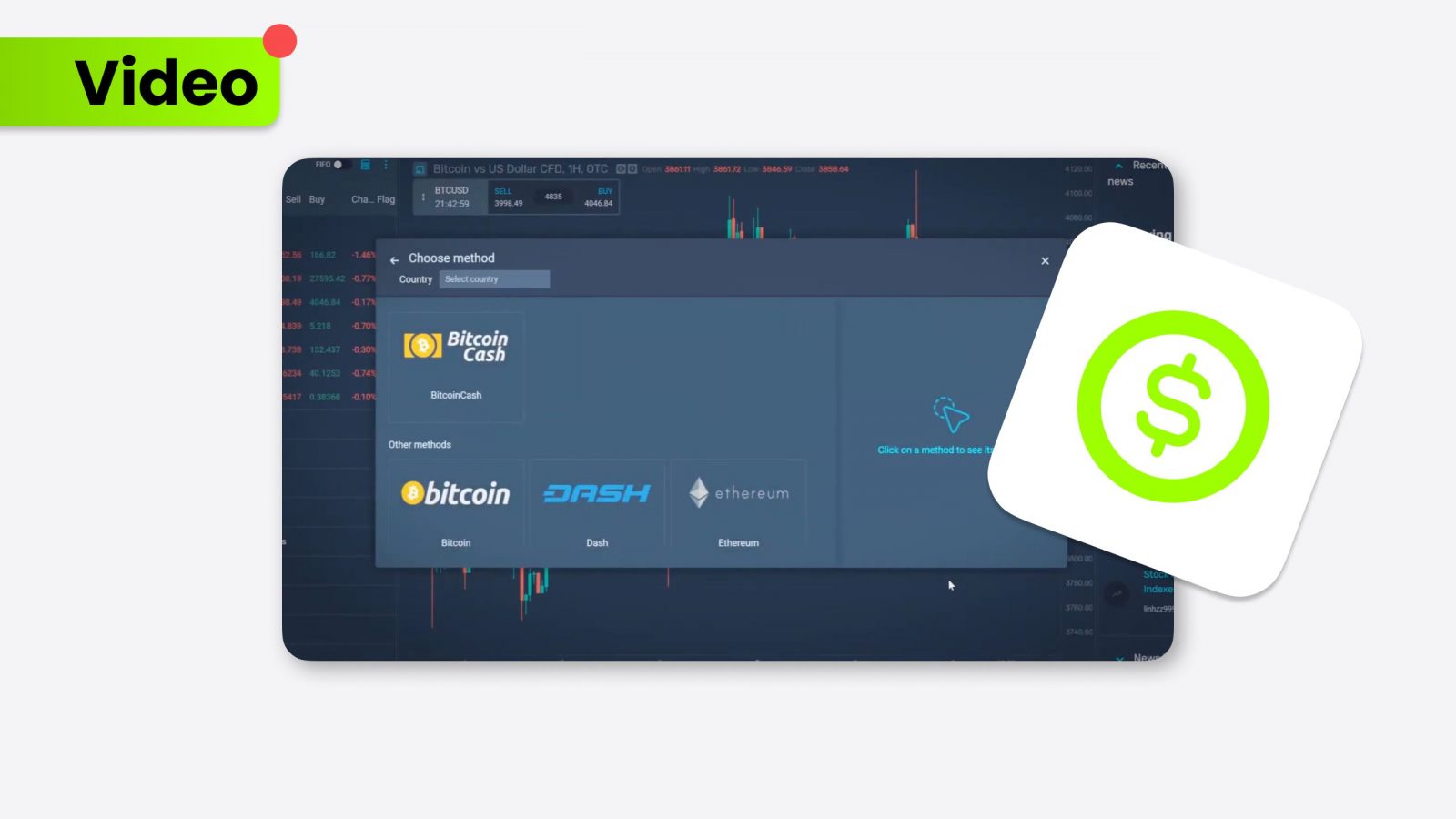

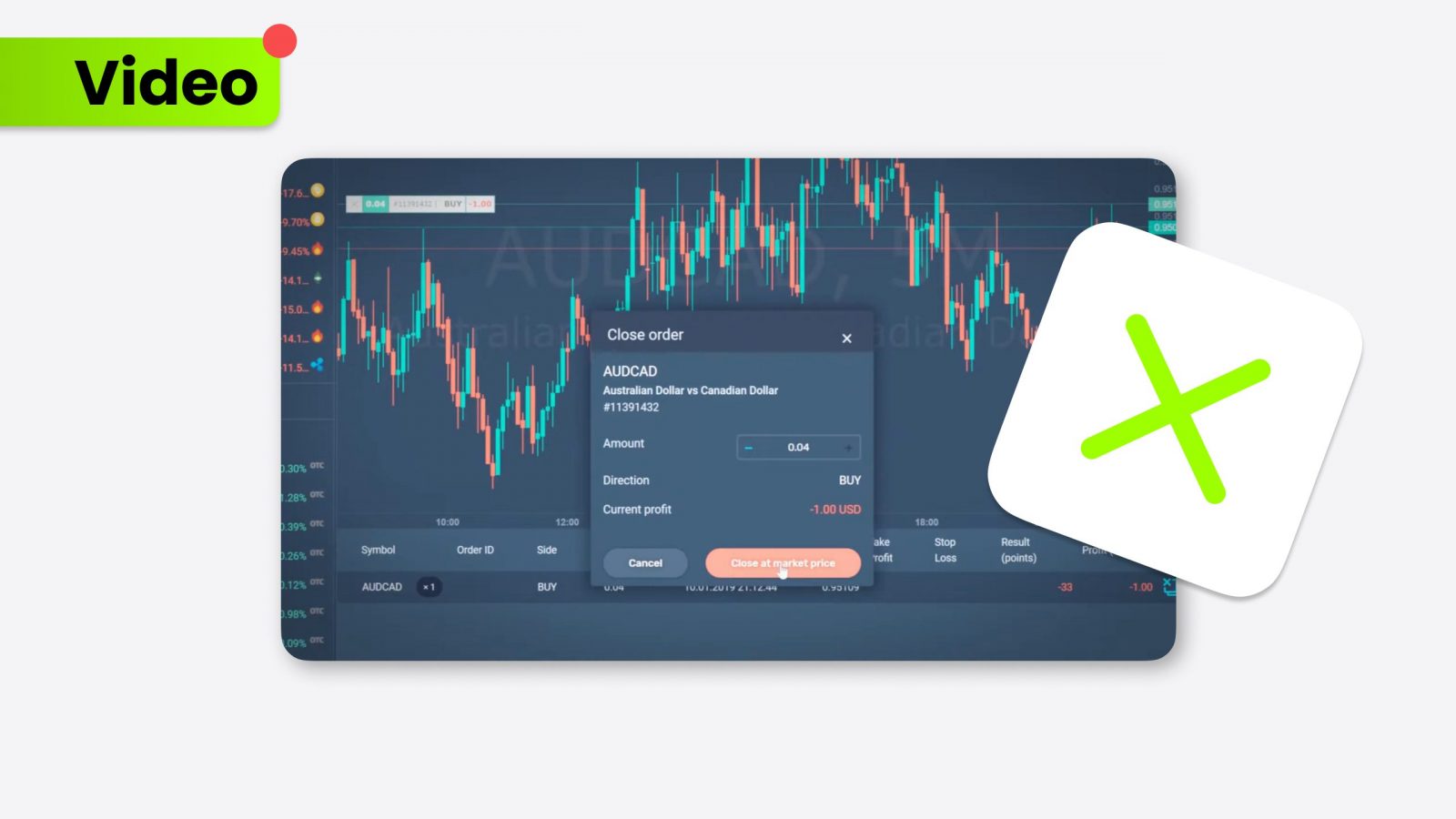

Understanding the basics of trading is crucial before entering the precious metals market. Trading times are paramount. These markets operate almost 24/7, but knowing the peak trading hours can significantly impact potential strategies. The overlap of trading hours between different international markets can increase liquidity and potentially lead to narrower spreads.

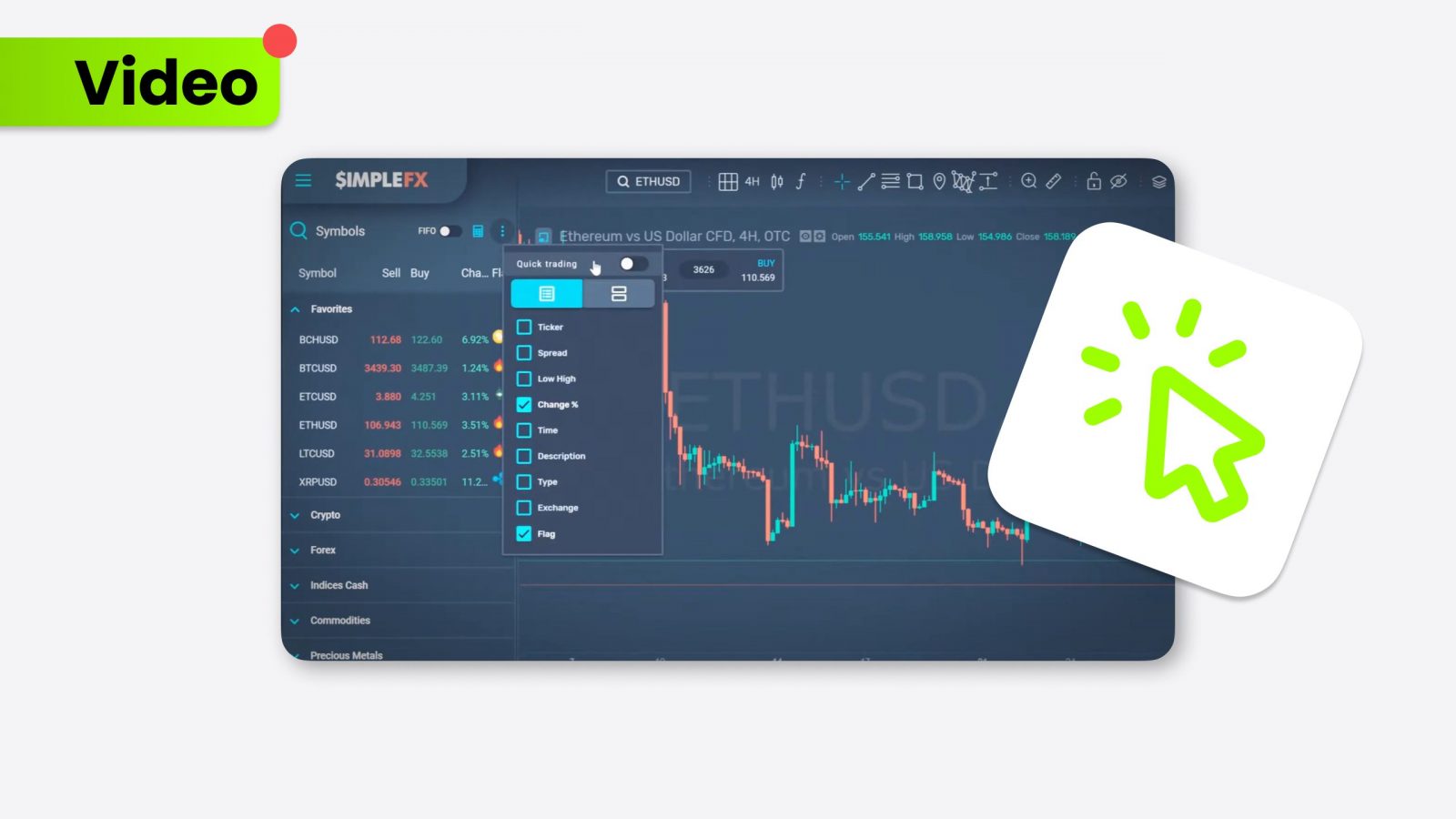

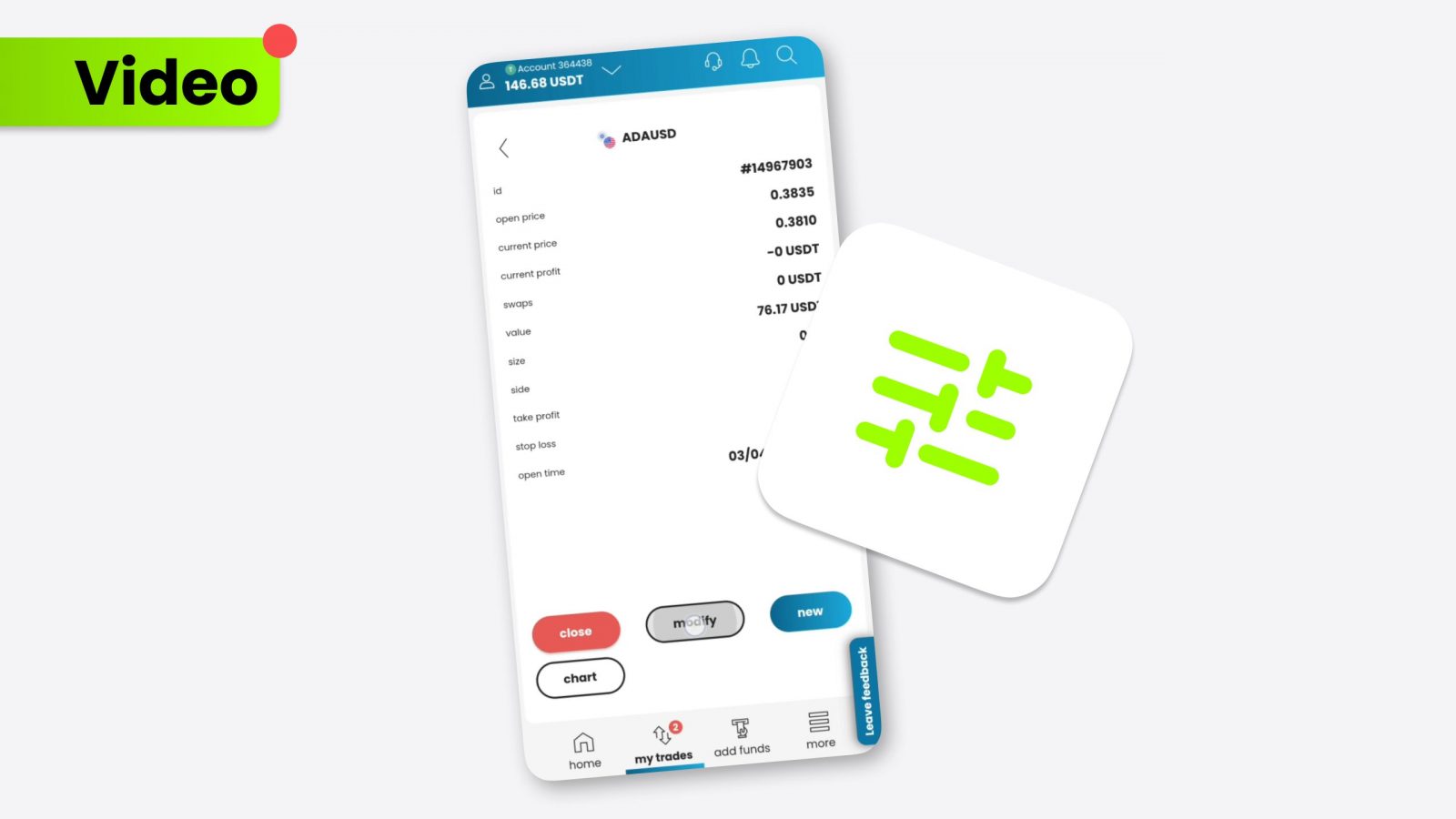

A lower spread generally indicates a more liquid market, which can reduce transaction costs and improve potential profitability. Traders should always be aware of the spreads offered by the SimpleFX platform to manage costs effectively.

Moreover, leverage allows traders to trade larger amounts of metal than they have in capital. Yet, it can increase potential losses. SimpleFX offers varying degrees of leverage, enabling traders to magnify their trading position relative to their actual investment. However, it’s vital to use leverage cautiously, as it amplifies the potential risk of losses.

Factors impacting metals market

The metals market is influenced by a considerable number of factors that play a significant role in shaping prices and trading behaviors.

The U.S. dollar is a vital influence since most metals are priced globally in USD. A strong dollar typically makes metals more expensive in other currencies (such as XAUEUR), reducing demand. On the other hand, a weaker USD can increase demand. Economic indicators like the Non-Farm Payroll (NFP) report can provide insights into the economic health of the United States. As a result, the U.S. Dollar’s performance should be monitored while exploring the metals market.

Political stability or instability can affect the market. Potential tensions in metal-rich regions can disrupt supply chains, leading to fluctuations in metal prices. Conversely, diplomatic agreements can open up markets or stabilize regions, which in turn stabilizes the market. Traders must keep an eye on international developments to understand such shifts.

Traders’ perceptions and reactions to global economic conditions also drive the market. During economic uncertainty, traders tend to turn to historically stable investments like precious metals. Conversely, investors might seek higher returns in more stable or bullish economic times in more volatile markets such as cryptocurrencies. Emerging altcoins like Solana illustrate this trend, offering new potential within the volatile market.

Conclusion

Navigating the metals market requires an understanding of its various components – from the types of available metals to the economic and geopolitical factors that influence their prices. Traders can make more informed decisions by adjusting to market timing and currency fluctuations to explore the constantly evolving metals market.