Open Finance marks a significant evolution in the financial sector by leveraging blockchain technology to create an inclusive, transparent, and efficient financial environment. This system extends beyond the confines of traditional finance.

- Highlighting the shift from traditional to decentralized financial structures.

- Examining the broadened accessibility and efficiency introduced by Open Finance.

- Discussing the implications of Open Finance on global economic participation.

What is open finance?

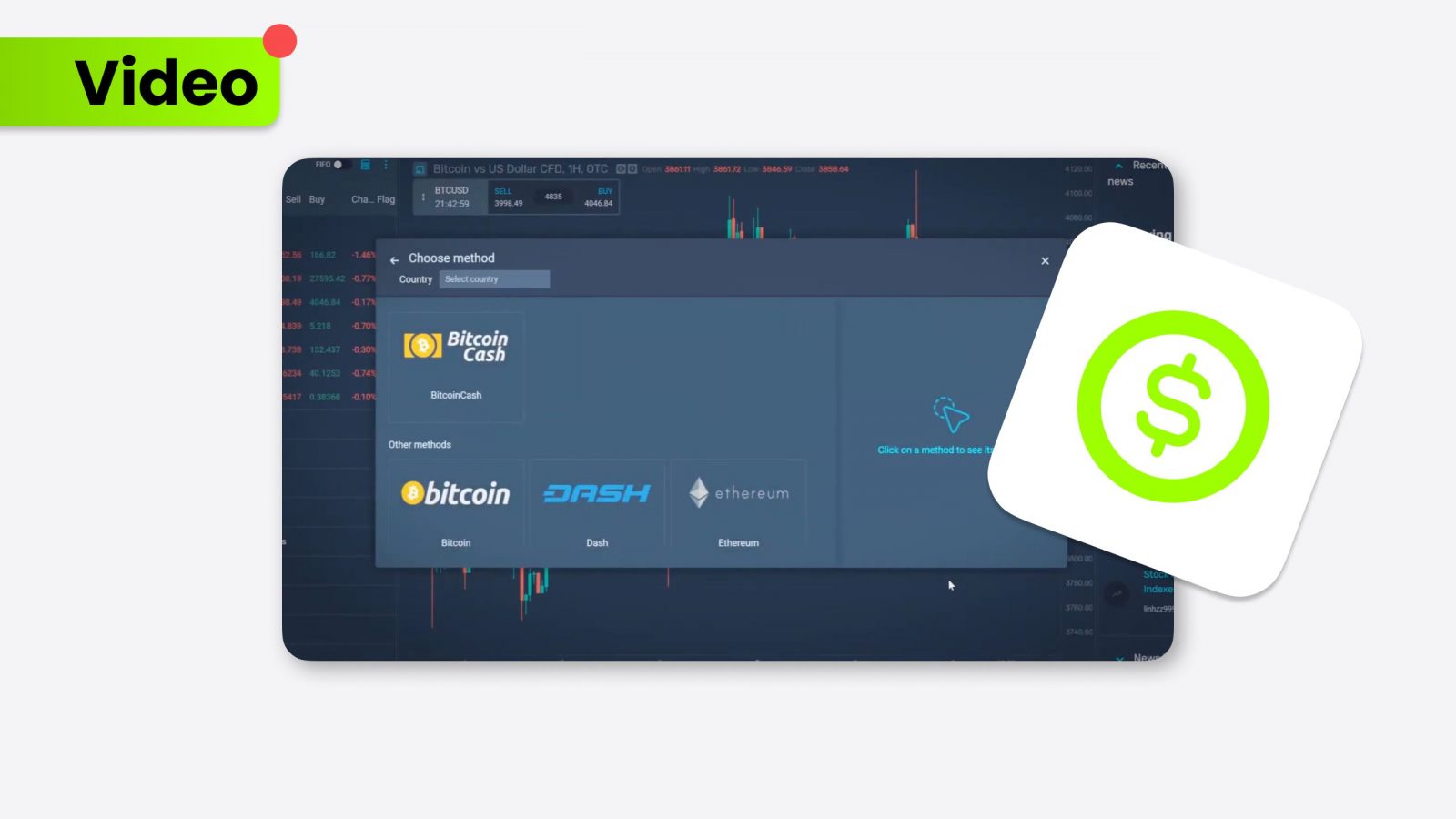

Open finance extends the principles of decentralized finance (DeFi) to offer a wide array of financial services through blockchain technology. This includes everything from basic banking to advanced financial instruments, accessible to anyone with internet access, thereby democratizing financial involvement globally.

Open finance: Pros and cons

Open finance revolutionizes the financial sector by leveraging blockchain technology to create more accessible and transparent financial services. This shift democratizes financial access and introduces a new level of efficiency and security to personal and business finances.

Pros

This system eliminates many traditional barriers (known from centralized finance model) to financial services, offering enhanced accessibility and reducing user costs. It fosters innovation in financial products and services, leading to more personalized and efficient user experiences. Additionally, the inherent transparency of blockchain technology means that transactions are open and traceable, enhancing security and trust among participants.

Cons

Despite its benefits, open finance can be complex and intimidating for newcomers, potentially limiting its adoption. Regulatory challenges also pose significant hurdles as the global financial regulatory landscape struggles to keep pace with the rapid development of blockchain technologies and their applications in finance.

Open finance vs DeFi

Open finance should not be confused with DeFi, although both share common principles. While DeFi focuses exclusively on cryptocurrency and blockchain applications, Open finance integrates these technologies into a broader spectrum of financial services, including traditional banking and investment opportunities. This integration bridges the gap between modern decentralized solutions and conventional financial operations.

The future of DeFi and open finance

The future of open finance and DeFi is poised for significant growth as technological advancements continue to permeate the financial sector. These platforms are expected to transform how we transact and think about money and investments, potentially leading to more robust, efficient, and inclusive financial systems globally.

Conclusion

Open Finance represents a transformative phase in the financial sector, promoting a shift towards more accessible and equitable financial services. As this field evolves, it holds the potential to reshape the financial landscape, making it imperative for consumers, investors, and regulators to stay informed and engaged with the latest developments in open finance and DeFi.