Leverage trading is a strategy that allows traders to increase their market exposure using borrowed funds. This approach amplifies potential profits but also increases risks.

- Learn how leverage trading can boost both profit potential and risk.

- Explore the role of leverage in forex and crypto markets.

What is leverage trading?

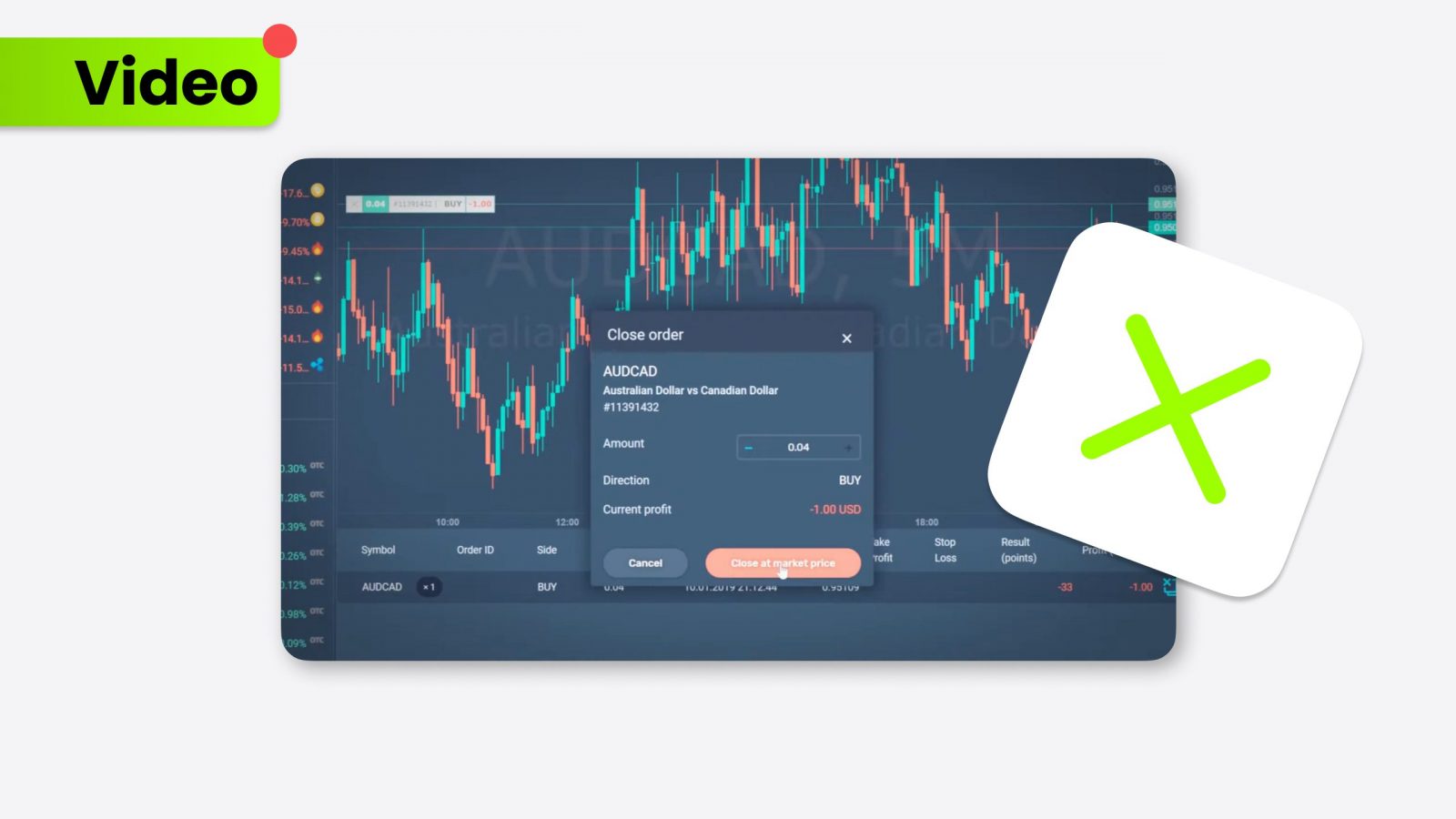

Leverage trading is using borrowed capital to increase the potential return on investment. In this process, a trader borrows money from a broker to control a more prominent position than their initial deposit. For example, if a trader uses 10:1 leverage, they can control a position worth $10,000 with just $1,000 of their funds. This practice can lead to potential multiplication of losses.

Leverage trading in the forex market introduces significant risks as it amplifies both potential gains and losses. Investors should exercise caution, as the use of leverage can result in rapid financial losses if the market moves against their position. It is crucial for traders to understand the volatility of the forex market and to utilize risk management strategies to protect their investments.

What is leverage in forex?

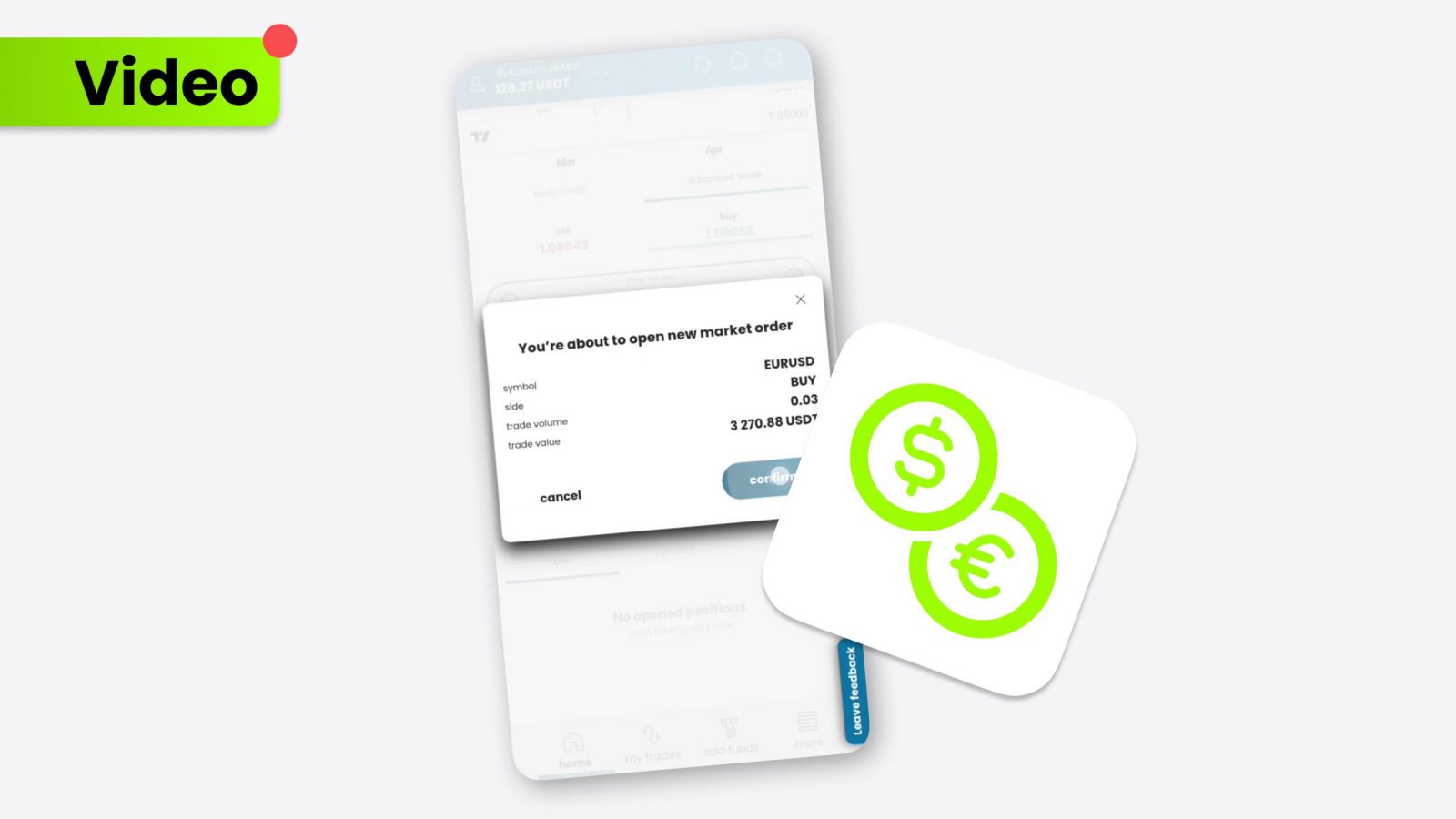

In the forex market, leverage is commonly used because currency pairs like Euro to Dollar, U.S. Dollar to Canadian Dollar, or U.S. Dollar to Australian Dollar typically move in smaller increments. Trading leverage allows traders to control more prominent positions with a smaller deposit, enabling them to capitalize on slight price movements. For instance, a trader who uses 50:1 leverage can control $50,000 worth of a currency pair with only $1,000 of their funds.

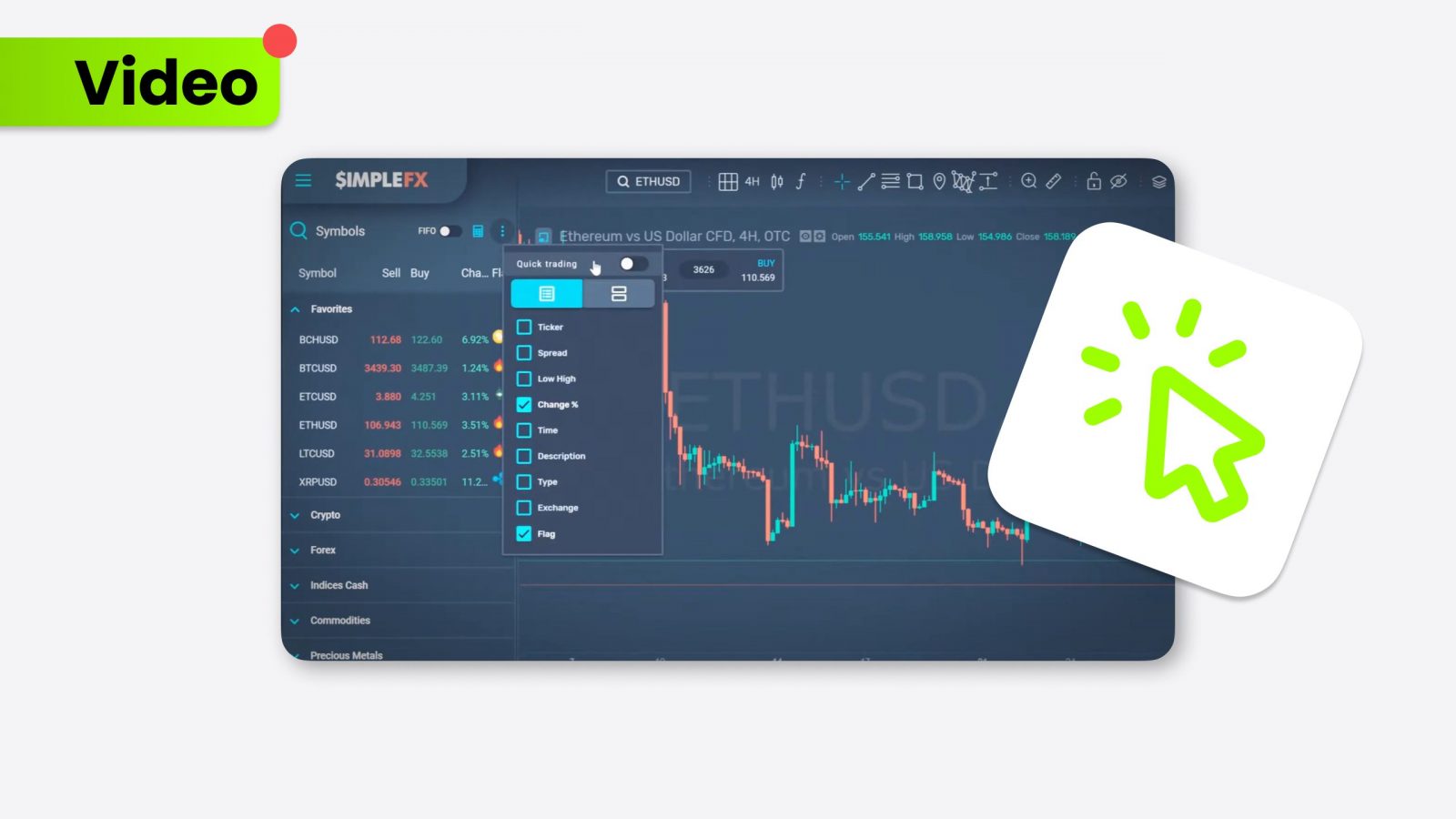

Leverage trading crypto

Leverage trading crypto enables traders to maximize their exposure to cryptocurrencies using borrowed capital. However, the volatility of the crypto market can amplify risks. For example, trading altcoins like Ethereum or other digital currencies with leverage can lead to substantial gains and significant losses due to rapid price fluctuations. Proper risk management is critical when applying leverage in the crypto market.

Trading leverage: Risk management

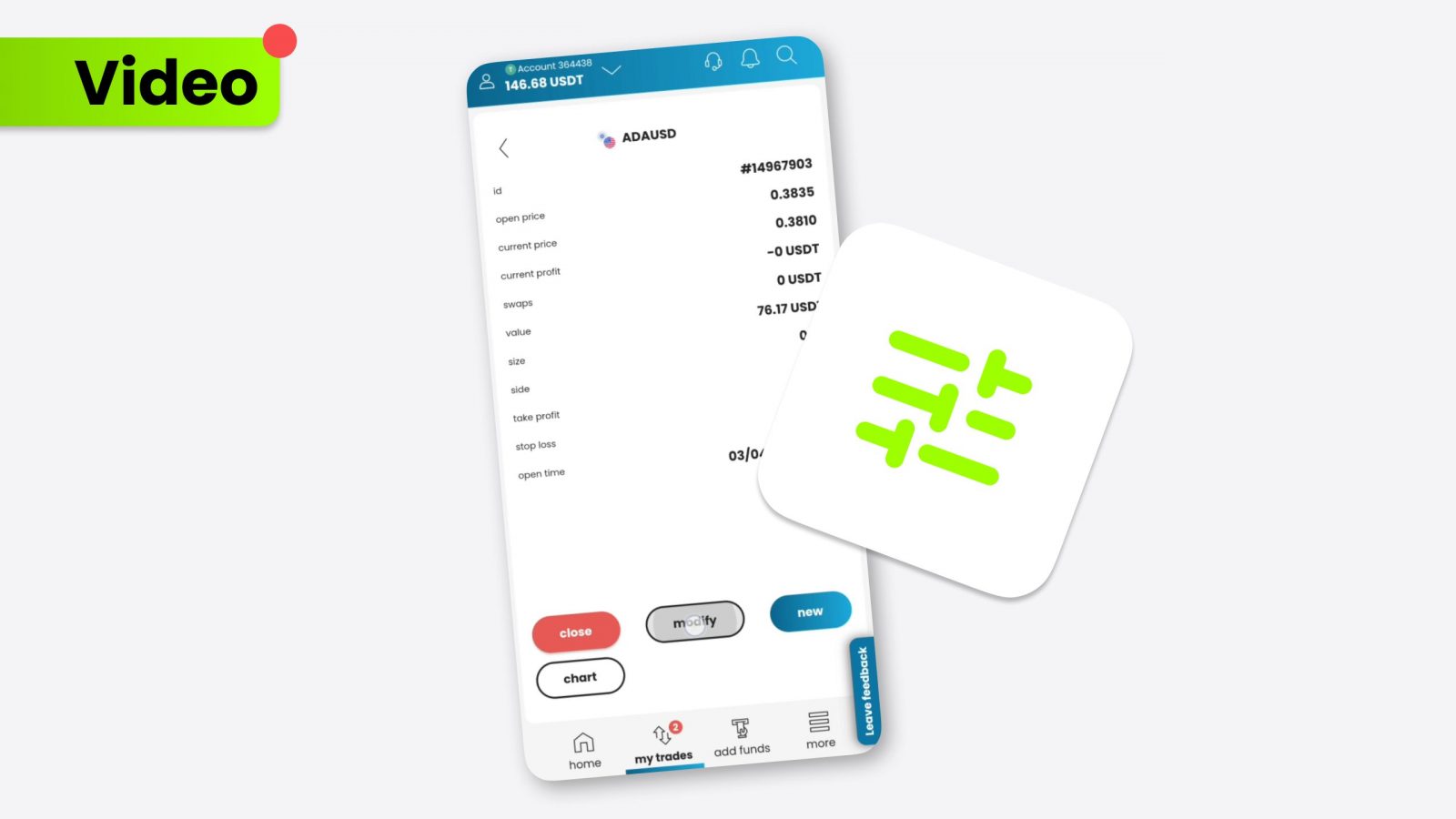

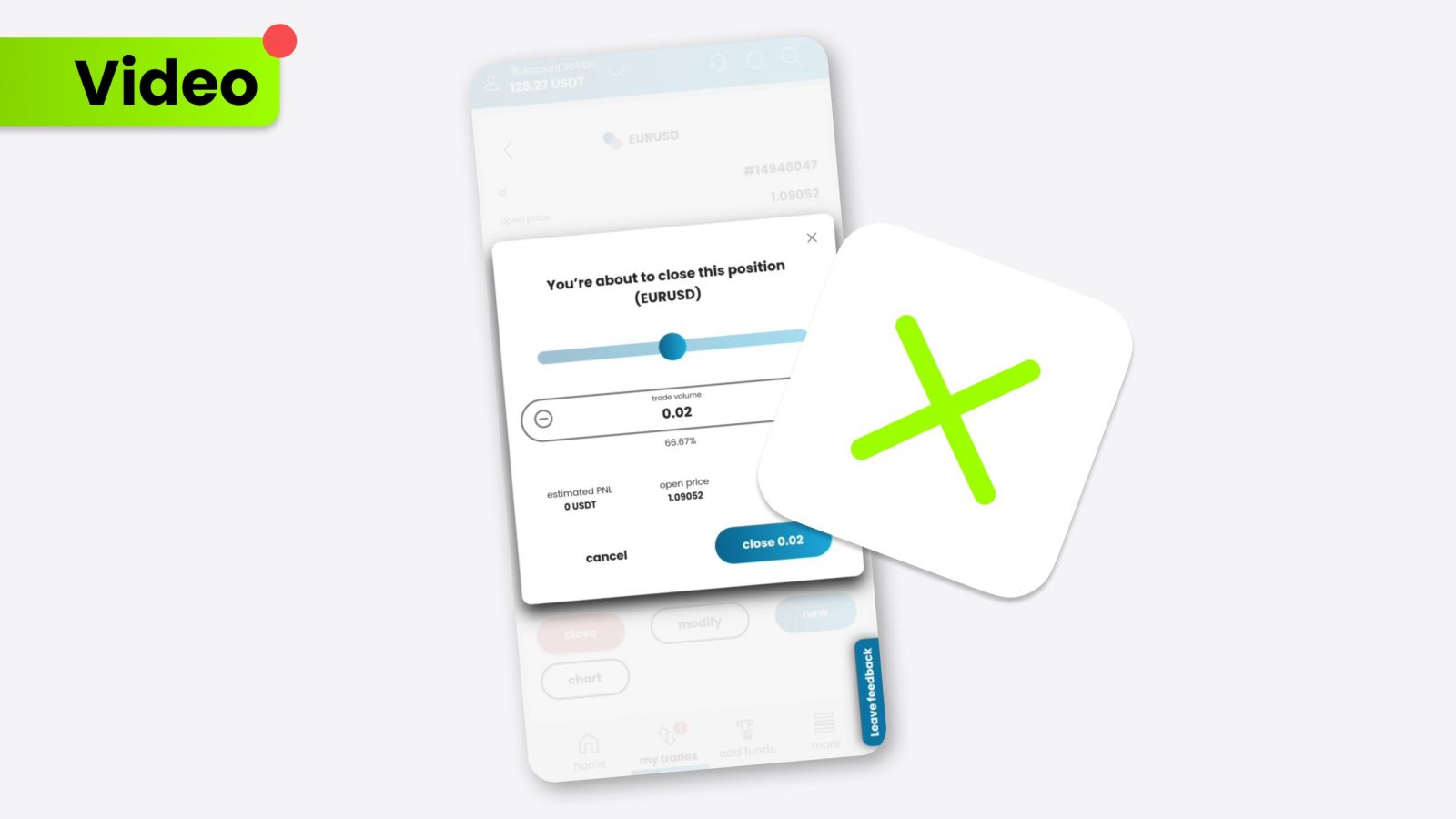

Using trading leverage can enhance both profit potential and risk. Traders should adhere to proper risk management practices, such as setting stop-loss orders and maintaining a suitable margin. Understanding the broker’s margin requirements ensures that traders have sufficient capital to maintain open positions and minimize the chance of margin calls.

Conclusion

Leverage trading allows traders to amplify their potential returns across various markets. Understanding leverage trading and applying it effectively in different scenarios, such as leverage in forex or leverage trading crypto, is vital for achieving the desired outcomes. Whether trading EURUSD, USDCAD, or cryptocurrencies, using leverage with a disciplined risk management strategy can help traders optimize their profitability while mitigating potential losses. Mastering the forex basics and understanding the nuances of pairs like AUDUSD can also contribute to a more informed and profitable leverage trading strategy.