In the world of forex trading, pips are vital in measuring price movements and potential gains or losses. Grasping the concept of pips and their role in forex trading helps traders develop strategies and understand market dynamics.

- Understand the concept of pips to measure currency pair price movements.

- Learn how pips affect profit and loss calculations and guide trading strategies.

What is a pip?

A pip, or “percentage in point,” is the smallest price movement in forex. In most pairs, a pip represents a 0.0001 change in value. For instance, if the EURUSD pair rises from 1.1200 to 1.1201, it has moved by one pip. In pairs involving the Japanese Yen, like Japanese Yen to Dollar, a pip is typically 0.01 because of the lower exchange rate.

Pips: Forex for traders

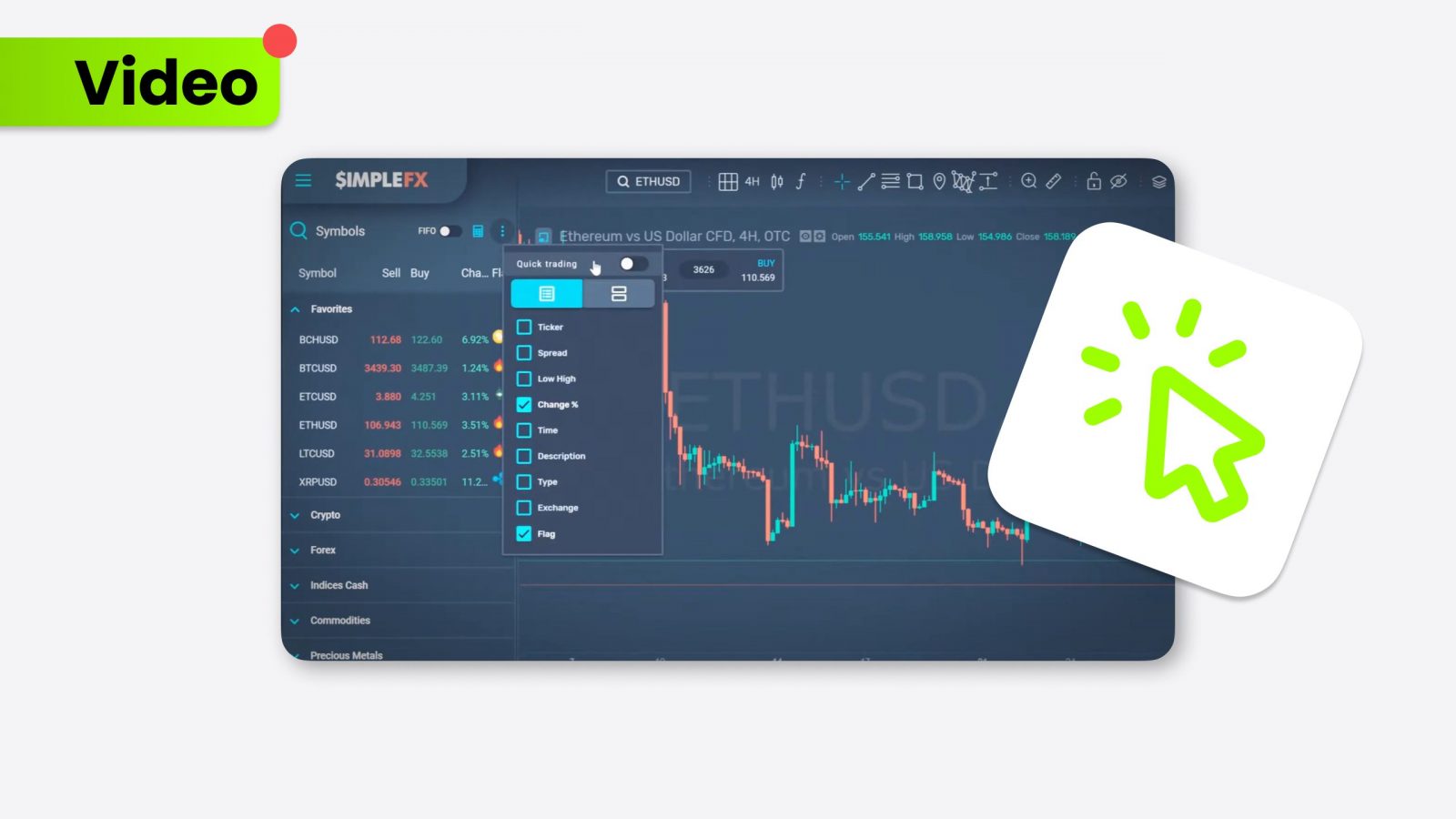

In forex trading, pips forex are used to measure fluctuations between currency pairs, helping traders determine profits and losses. They are a universal unit of measurement, allowing traders to compare movement across pairs like Euro to Dollar and USD to Mexican Peso. Tracking pips forex is fundamental to understanding market changes and developing effective trading strategies.

A pip in forex: Why does it matter?

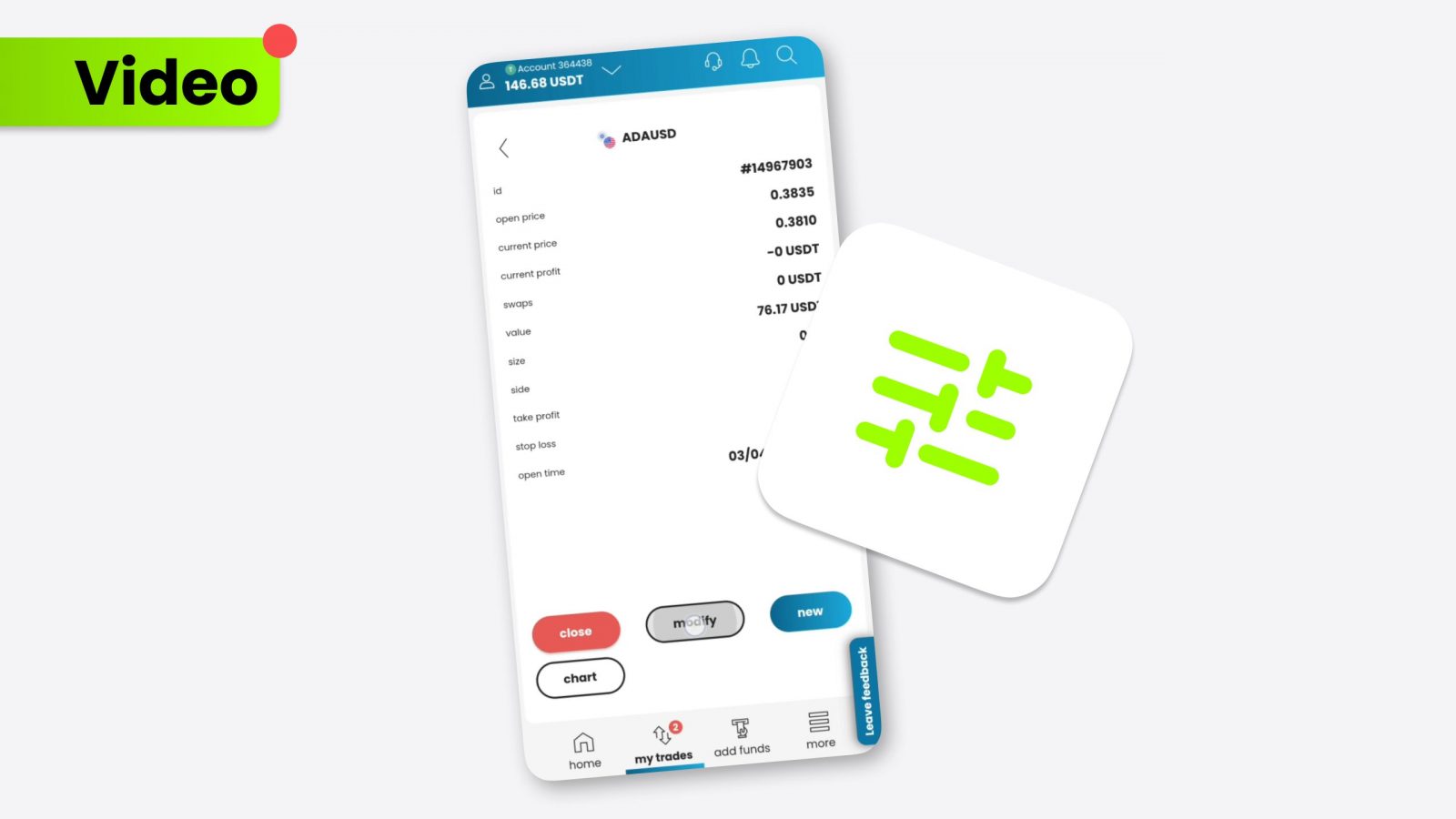

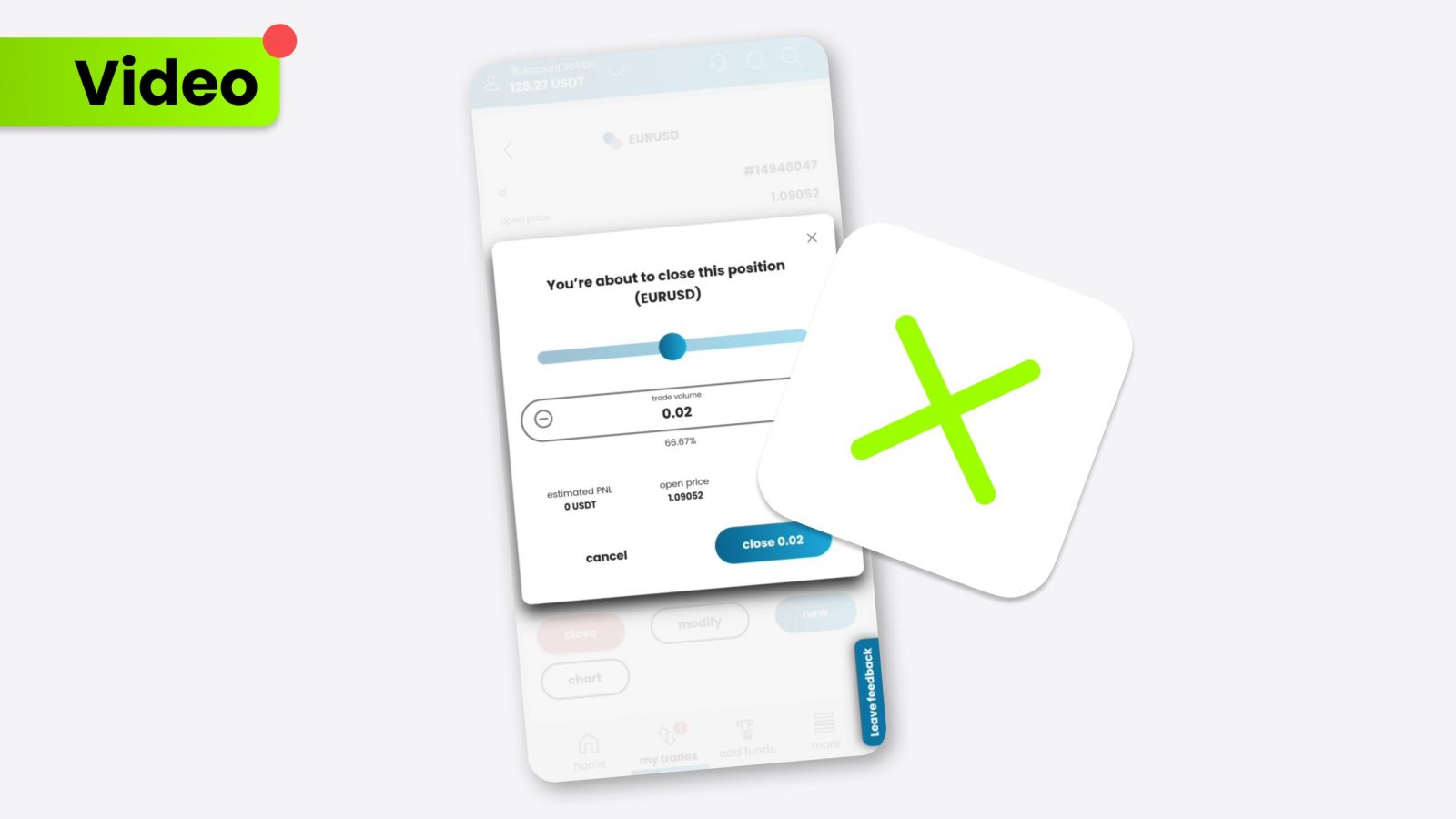

A pip in forex is crucial for evaluating market volatility and setting appropriate stop-loss and take-profit levels. By knowing how much a currency pair moves in pips, traders can estimate potential profit and loss in their trades. For example, if a trader buys EURUSD at 110.50 and sells at 110.70, the movement of 20 pips translates to a gain, depending on the lot size.

Pip in currency trading

A pip in currency trading provides a standardized way to quantify value changes, facilitating comparisons across currency pairs. For instance, in trading EURUSD, the value of a pip helps traders understand transaction costs and estimate their gains or losses. Accurately understanding pip values also aids in assessing market conditions and choosing effective trading strategies.

Conclusion

Pips are a foundational aspect of understanding forex basics and mastering currency trading. By recognizing their value in measuring price movements, traders can accurately assess market trends and navigate the complexities of forex. Whether trading Euro to Dollar, Japanese Yen to Dollar, or any other currency pair, understanding pips forex is essential for implementing successful strategies and optimizing profitability. Additionally, as the financial markets evolve with new technologies like cryptocurrency, understanding pips remains crucial for traders transitioning into alternative markets, including Bitcoin, to apply similar trading principles and refine their strategies effectively.