Trading Forex has been crucial for individuals, conglomerates, and governments. Both novice and experienced traders have to understand the basics of this market.

- The forex market enables exchanging currencies from all over the world.

- Before investing, traders have to understand technical terms such as spread, pips, and leverage.

- The U.S. Dollar is the most vital currency in the forex market.

- Forex market gives access to trading 24/5, unlike equities and indices.

What is forex about?

The forex market, short for the foreign exchange market, is where traders and investors buy, sell, and exchange currencies. It is still the largest and most liquid financial market in the world – daily trading volume exceeds $6 trillion. Trading Forex focuses on currency pair price movements. The most commonly traded currency pair is EURUSD. Based on this example, a currency pair presents a combination of two different currencies, where one is traded against the other.

Compared to cryptocurrencies, which have developed due to their decentralized nature and innovative technology, forex remains the foundation of global financial markets. It is vital to the global economy because it ties international trade and investment. Thanks to forex, companies, and governments can convert foreign earnings into their home currency. Traders can profit or lose from fluctuations in exchange rates. forex presents lower volatility than the crypto market.

Trading with forex: Most important terms

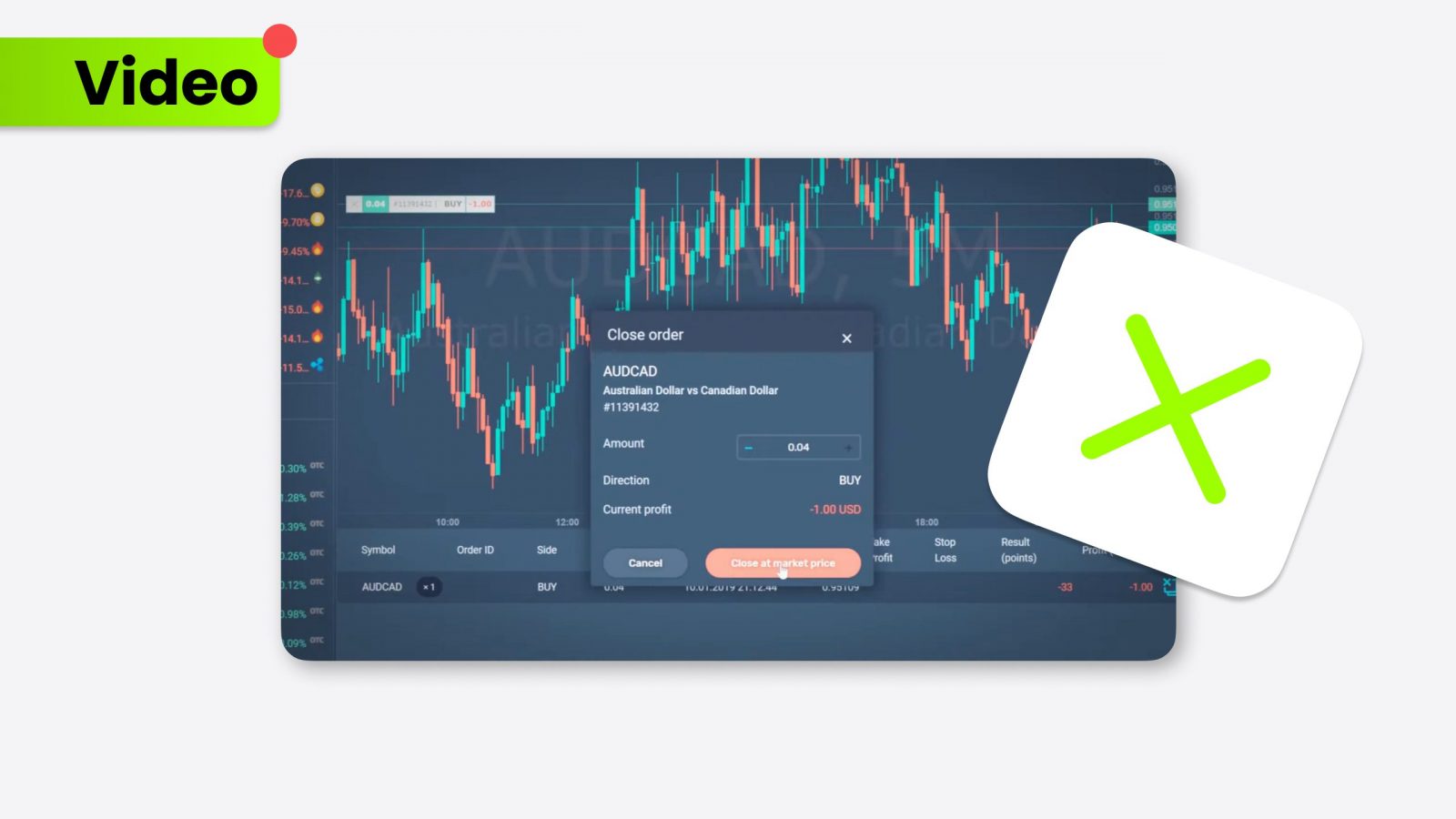

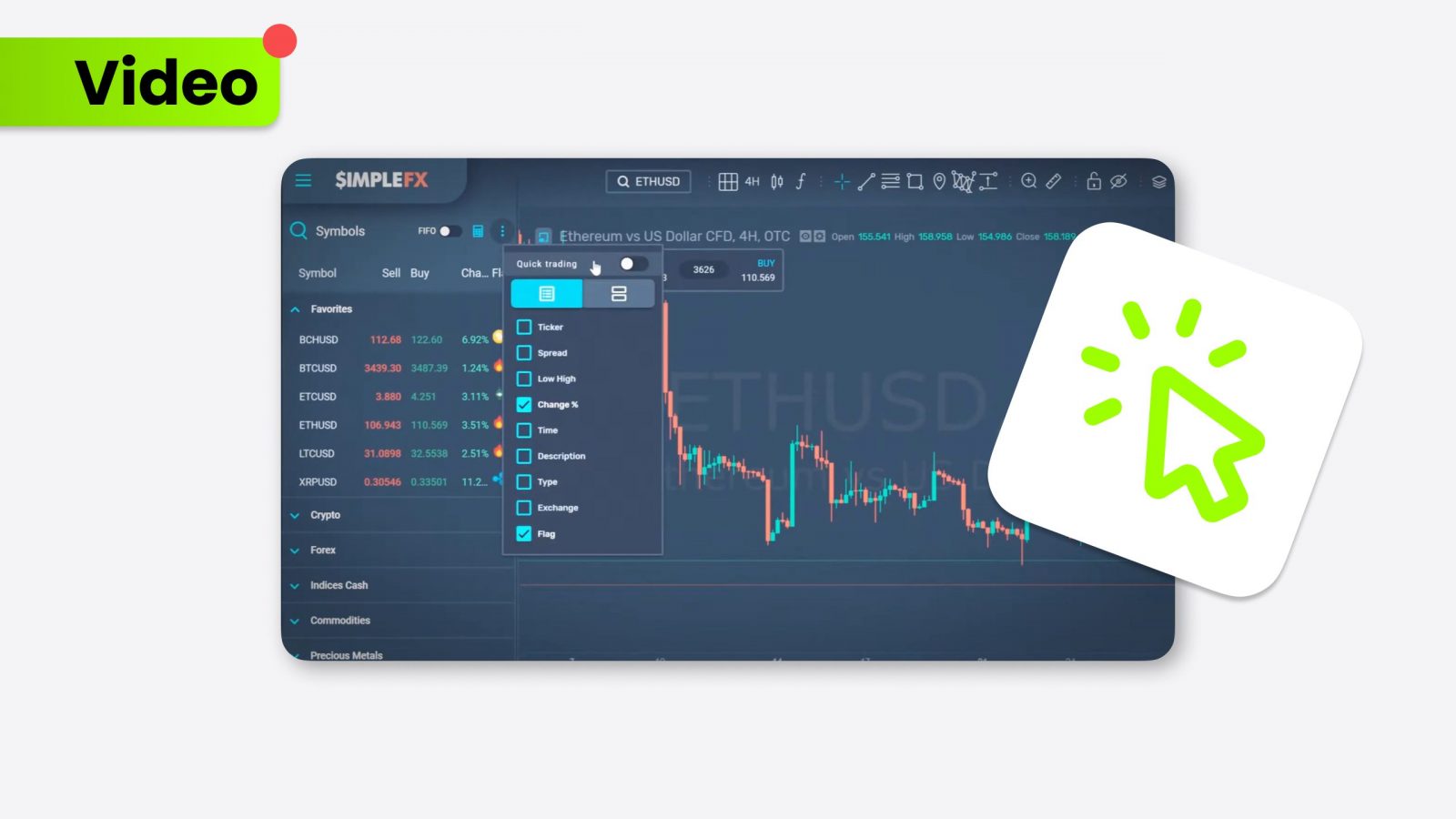

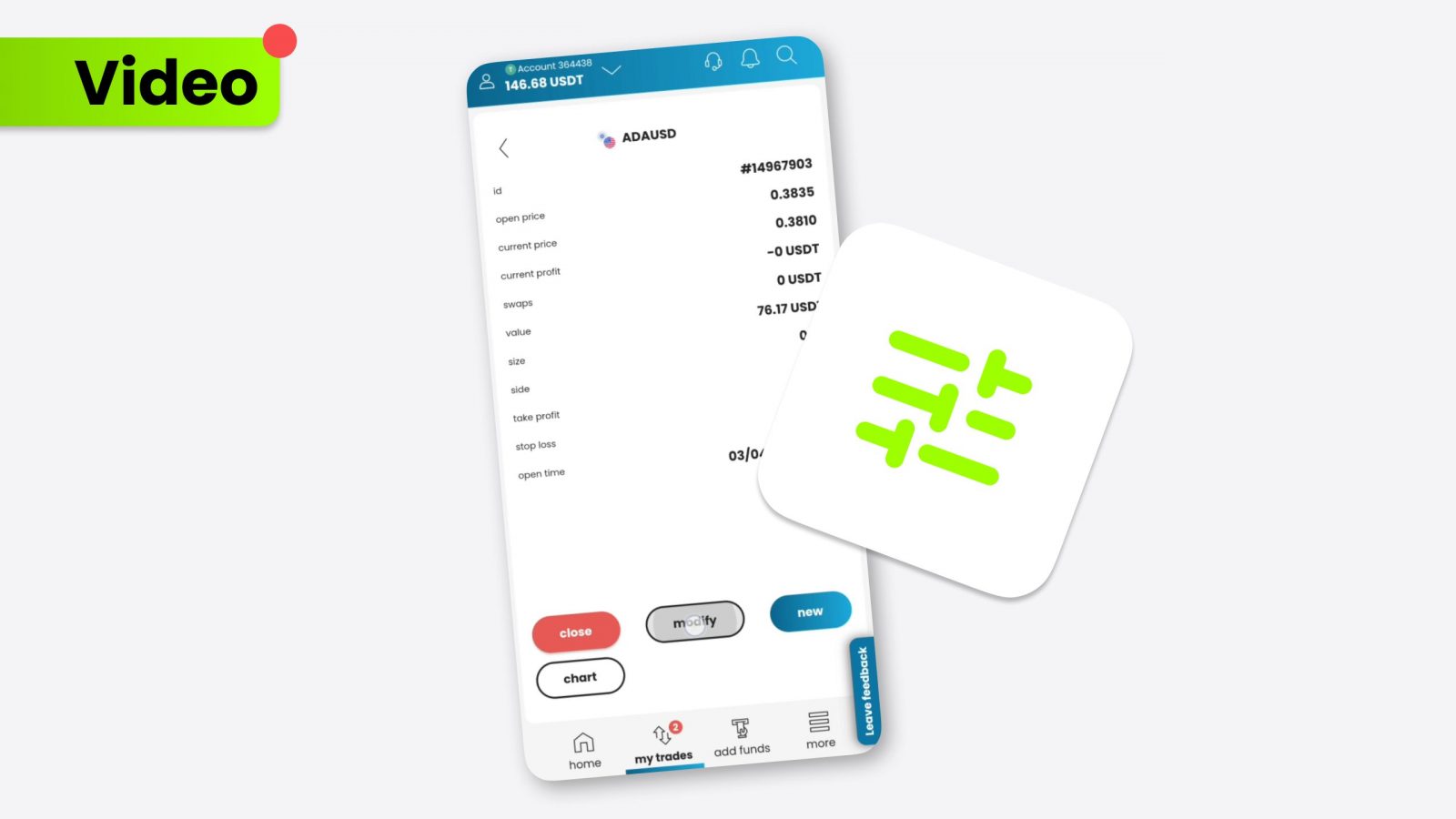

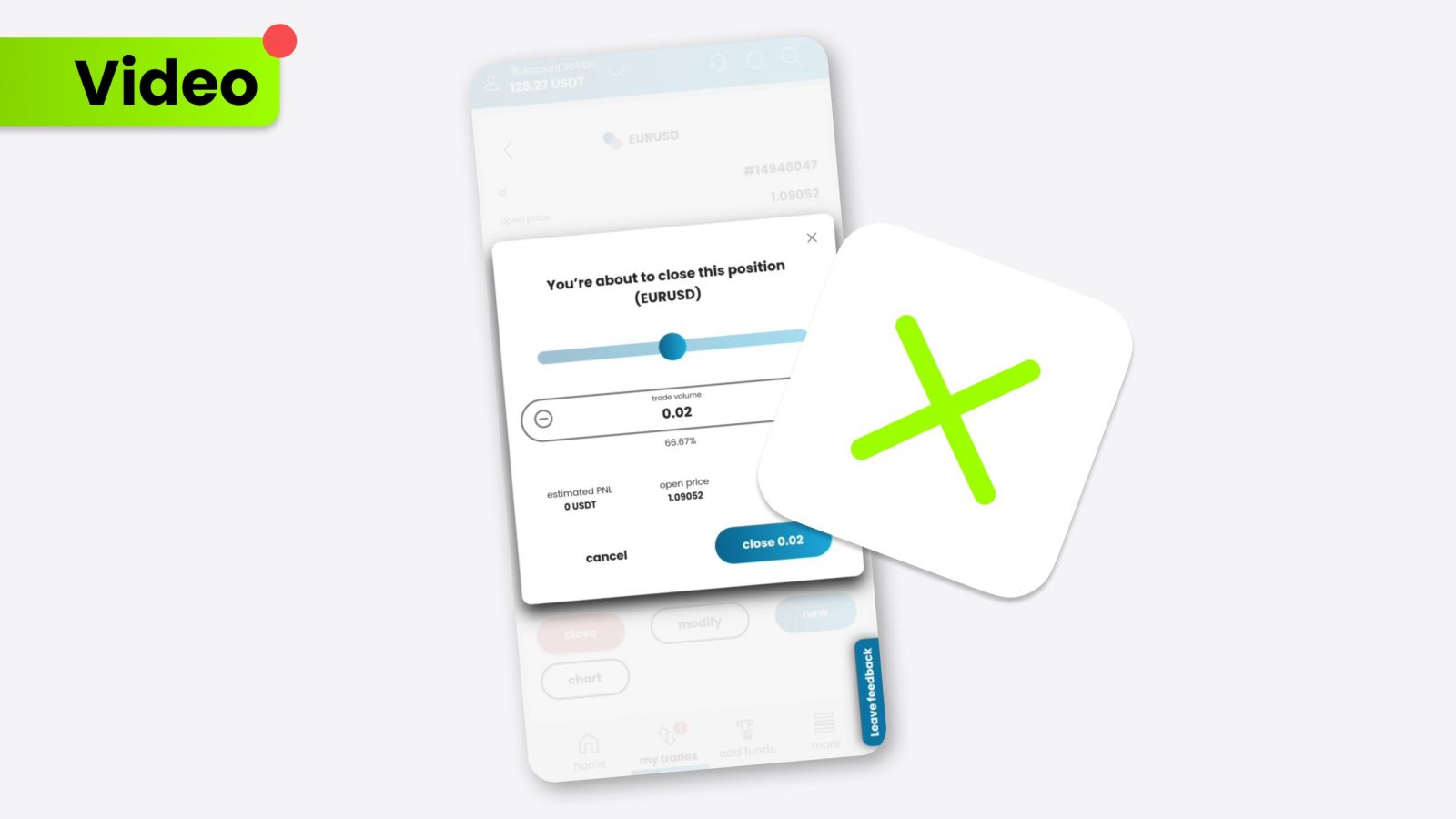

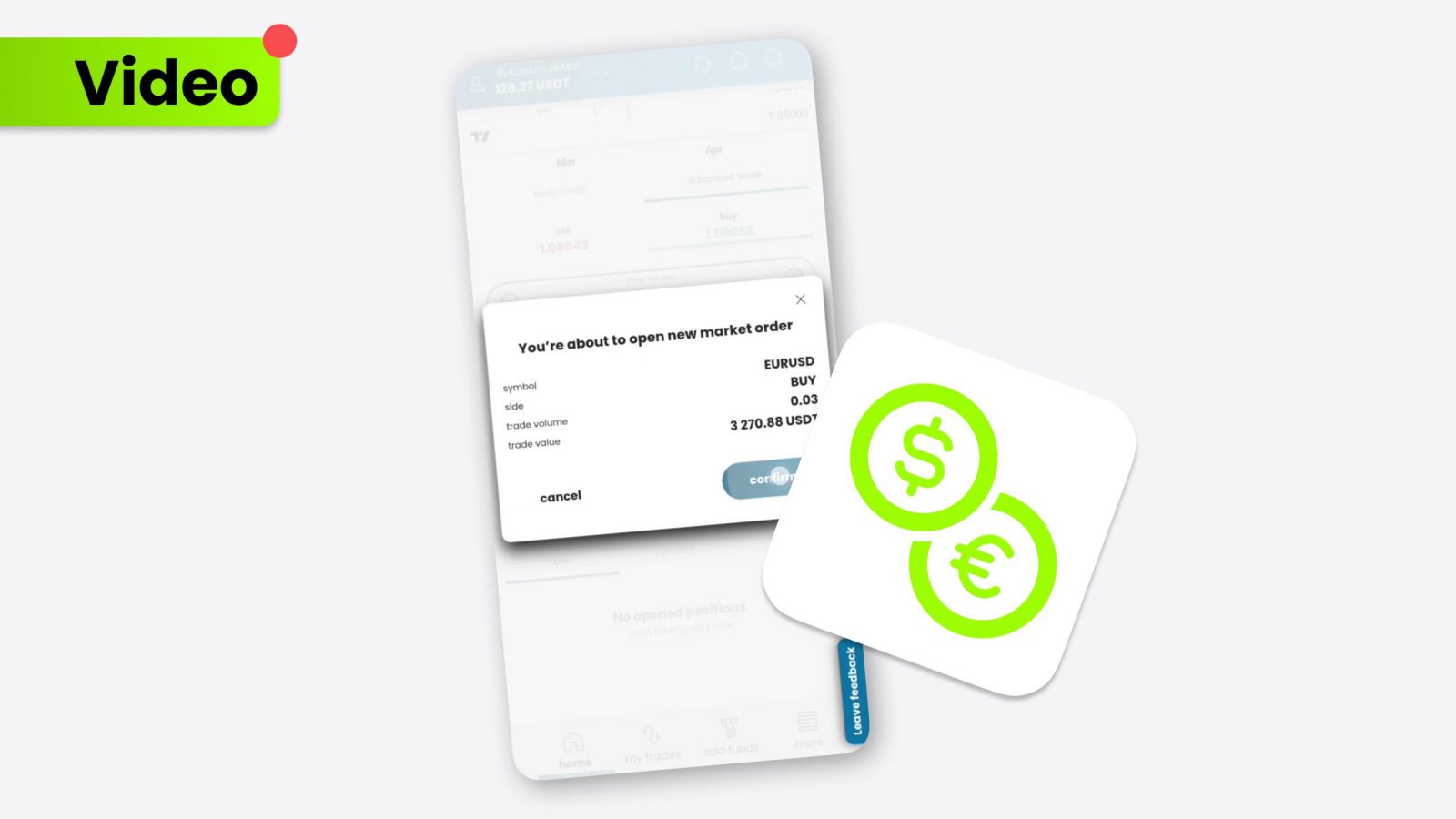

Understanding the basics of trading with forex is fundamental for anyone looking to navigate this complex market properly. Getting familiar with critical terms not only enhances the ability to make informed decisions but also equips traders with tools to manage the risk of potential losses. Both novice and seasoned investors can find multiple terms explained in video tutorials presented by SimpleFX.

One of the most essential terms in trading forex is pips, which stands for “percentage in point.” It represents the slightest price move that a currency pair can make. For example, in the USDCAD currency pair, a pip is typically the fourth decimal place of the price quote. If USDCAD moves from 1.2650 to 1.2651, a rise in value is one pip. This small unit is crucial as it helps traders measure the change in value of a currency pair and calculate potential gains or losses.

Another critical term is spread, which refers to the difference between the bid price (what buyers are willing to pay) and the asking price (what sellers are asking for). In the case of the GBPUSD currency pair, if the bid price is 1.3550 and the asking price is 1.3555, the spread is five pips. The spread is a key cost of trading and can affect the profitability of trades. A narrower spread generally means that the asset is more liquid or the trading costs are lower.

What is traded in forex?

In the forex market, currencies are traded in pairs, each representing the value of one currency against another. The most popular are known as major currency pairs, such as Euro to Dollar, where the Euro is traded against the U.S. Dollar.

Coming to the Eastern market, USDJPY presents one of the most essential assets related to Asia. These major pairs typically involve the U.S. Dollar and are known for their high liquidity and tight spreads.

On the other hand, exotic currency pairs feature one major currency and one from an emerging or smaller market. Although these pairs, like USDTRY and EURZAR, tend to have higher volatility and spreads, they offer unique potential for traders willing to navigate their specific risks.

In addition to currencies, traders often explore other financial markets like equities. Although both forex and stocks share common trading principles, they have significant differences.

Forex has much higher liquidity, allowing for faster execution and lower costs. Meanwhile, equities represent ownership in companies, offering investors a share in profits and dividends. Stocks are more affected by individual company performance, while forex trading focuses on broader economic trends and geographical factors.

U.S. Dollar: A key player in forex market

The U.S. Dollar plays an essential role in the forex market, serving as the world’s most traded and recognized currency. As the most liquid currency in the world, USD forex pairs typically offer tight spreads and high trading volumes. Moreover, it facilitates international trade and acts as a benchmark for many commodities like oil and gold. For instance, when the USD strengthens, commodities priced in dollars tend to become more expensive for foreign buyers, often resulting in a drop in demand and a subsequent price decline.

Several factors can influence the USD, ultimately impacting the entire Forex market. Economic reports like the Non-Farm Payroll (NFP) provide insights into the U.S. labor market. Interest rate changes set by the Federal Reserve are another major factor, as rising rates usually strengthen the USD by attracting more foreign investment. Geopolitical events and trade policies can also sway the dollar.

Forex hours in trading

One of the unique aspects of forex trading is that the market operates 24 hours a day, five days a week. This schedule allows traders to explore worldwide markets, starting with the opening of the Asian session on Monday morning and continuing to the New York session’s close on Friday evening. As trading hours flow from one financial center to another, liquidity and market activity follow, providing potential options around the clock.

The SimpleFX platform equips traders with several features, including award-winning support available 24/5.

Forex hours in trading differ significantly from indices like the S&P500 or STOXX50. Indices represent a basket of top-performing equities from specific markets, and their trading hours are tied to national stock exchanges opening times. For example, Dow Jones reflects the U.S. stock market, so its core trading hours align with the New York Stock Exchange (NYSE) and NASDAQ, which operate between 9.30 AM and 4.00 PM Eastern Time.

How to learn trading forex?

Staying updated on market trends and global economic events is essential for those eager to learn trading forex effectively. A crucial tool in any trader’s arsenal is the economic calendar on SimpleFX, which provides a schedule of key economic releases, policy decisions, and other events that can impact currency movements.

SimpleFX also provides traders with practical tools like leverage, enabling them to control more prominent positions with a smaller capital investment. However, leverage should be used carefully, as it can result in gains and losses. To further enhance their trading skills, users can explore the forex academy and SimpleFX blog. These resources cover foundational concepts, advanced strategies, and the latest market news.