Cryptocurrencies have emerged as a groundbreaking innovation in the digital age, reshaping our approach to money and investments. Those new to the concept should understand digital currencies and receive a solid foundation.

- A comprehensive overview of cryptocurrencies, explaining their decentralized nature.

- Look into the unique technological advancements introduced by various cryptocurrencies.

- The factors to consider when investing in cryptocurrencies.

What is cryptocurrency?

At its core, cryptocurrency is a digital or virtual currency that uses cryptography for security, making it challenging to counterfeit. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralised networks based on blockchain technology. A blockchain is a distributed ledger that records all transactions across a network of computers, ensuring transparency and security.

But how does it work?

Imagine you’re playing a game with your friends where you trade virtual cards. Each card is unique, and whenever a trade happens, you write it down in a notebook that everyone can see. This notebook is like the blockchain. It’s a public record of all trades (transactions) that shows who owns which card at any time.

Now, let’s say you want to make sure no one can just create a copy of a card and claim it’s theirs. To prevent this, you use a special kind of puzzle (cryptography) that is very hard to solve without the correct key. Whenever a card is traded, the trade is locked with this puzzle, ensuring that only the rightful owner can unlock and use it. This is how cryptocurrencies use cryptography to secure transactions.

In this game:

– Virtual cards represent cryptocurrencies.

– The notebook is the blockchain, a transparent record of all transactions.

– The puzzle represents cryptography, ensuring security and authenticity.

Just as the notebook (blockchain) in our game is decentralized, meaning no single player controls it, the real blockchain is decentralized across thousands of computers worldwide, making cryptocurrencies secure and resistant to fraud.

Best crypto to buy

Determining the best crypto to buy depends on individual investment goals, risk tolerance, and the market’s current dynamics, which can greatly influence potential returns.

Bitcoin: The pioneer

Bitcoin, created in 2009, is the first and most well-known cryptocurrency. It was invented by an anonymous person or group of people using the pseudonym Satoshi Nakamoto. Bitcoin has paved the way for thousands of other cryptocurrencies, collectively known as altcoins.

Ethereum and beyond

Ethereum is another prominent cryptocurrency known for its smart contract functionality, which allows for the automatic execution of contracts when conditions are met. Other notable cryptocurrencies include Ripple (XRP), Litecoin (LTC), and Cardano (ADA), each with unique features and uses.

Other notable cryptocurrencies

Litecoin (LTC) is renowned for its quick transaction processing times. It aims to provide an efficient alternative for everyday purchases and peer-to-peer transactions.

Solana (SOL) distinguishes itself with exceptionally high throughput and low transaction costs, supported by its unique proof-of-history (PoH) consensus combined with proof-of-stake (PoS). This makes it a powerful platform for dApps and DeFi projects.

Injective Protocol (INJ) offers a decentralized exchange platform that enables zero-fee trading across a wide range of financial products, including futures and derivatives, facilitated by its layer-2 blockchain technology for speed and security.

Celestia stands out as a modular blockchain platform that prioritizes simplicity and scalability in developing decentralized applications. By decoupling data availability from consensus, Celestia allows for greater flexibility and ease of development in the blockchain space.

The benefits and risks of investing in cryptocurrencies

Advantages

– Decentralization: The absence of central control means less influence from traditional financial institutions and governments.

– Global Accessibility: Cryptocurrencies can be sent or received anywhere in the world with an internet connection, breaking down barriers to financial participation. This feature is particularly beneficial in regions with unstable currencies or limited access to traditional banking services.

– Transparency and Security: Blockchain technology ensures a secure and transparent transaction process.

Risks

– Volatility: Cryptocurrency prices can be highly volatile, with the potential for substantial price swings.

– Digital wallets’ safety: While the blockchain is secure, digital wallets and exchanges can be vulnerable to hacking.

– Regulatory uncertainty: The regulatory environment for cryptocurrencies is still evolving, which could impact their value and use.

Crypto news: How to explore the market?

Staying updated with crypto news is essential for anyone looking to explore the market effectively, as it provides insights into market trends, regulatory changes, and technological advancements. Utilizing reputable sources for crypto news can also aid in making informed decisions, highlighting the importance of research and education in navigating the complex landscape of cryptocurrency.

Research and education

Before diving into cryptocurrency investment or usage, conducting thorough research and understanding the basics is crucial. Familiarise yourself with different cryptocurrencies, how they work, and the technology behind them.

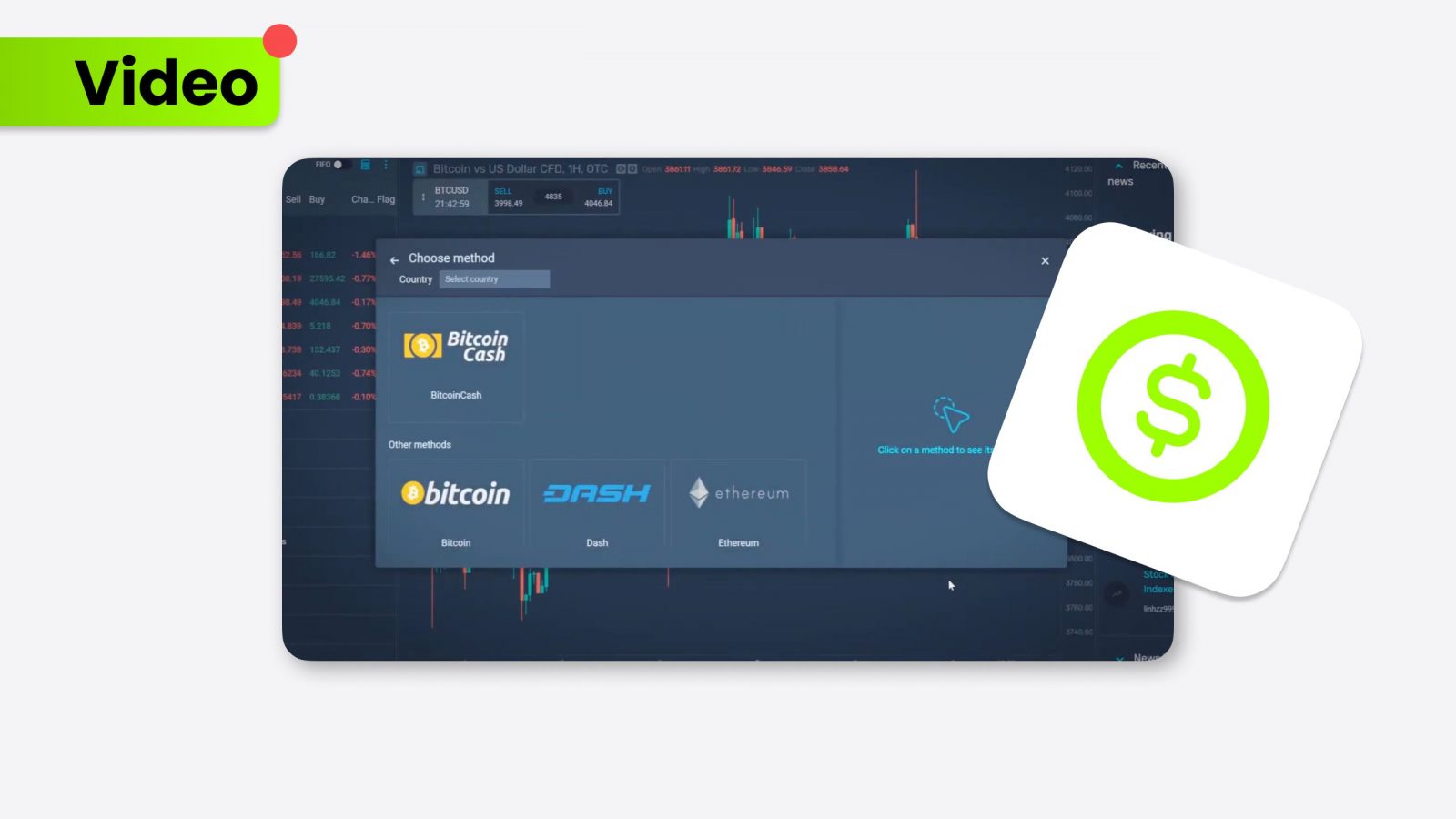

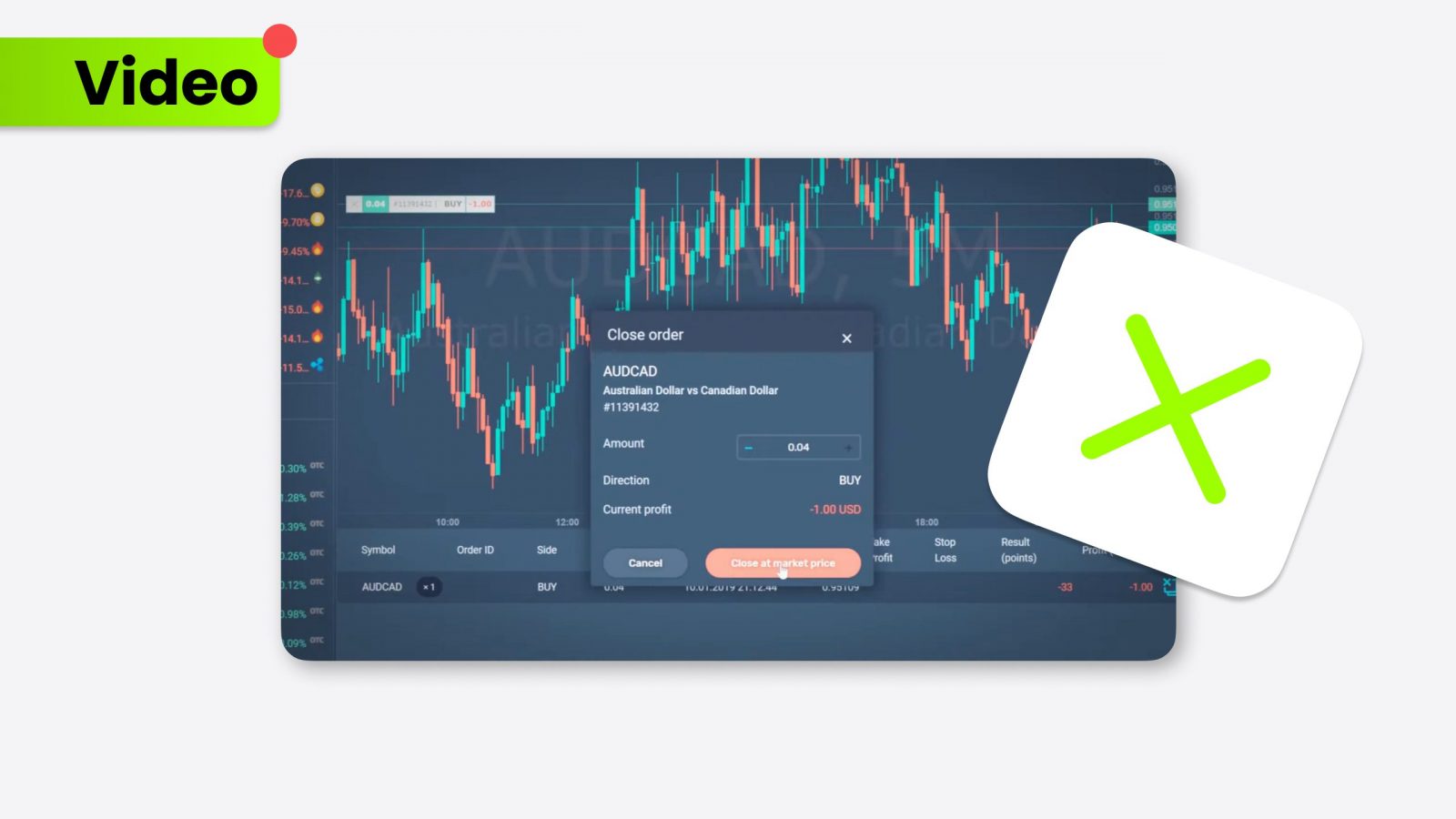

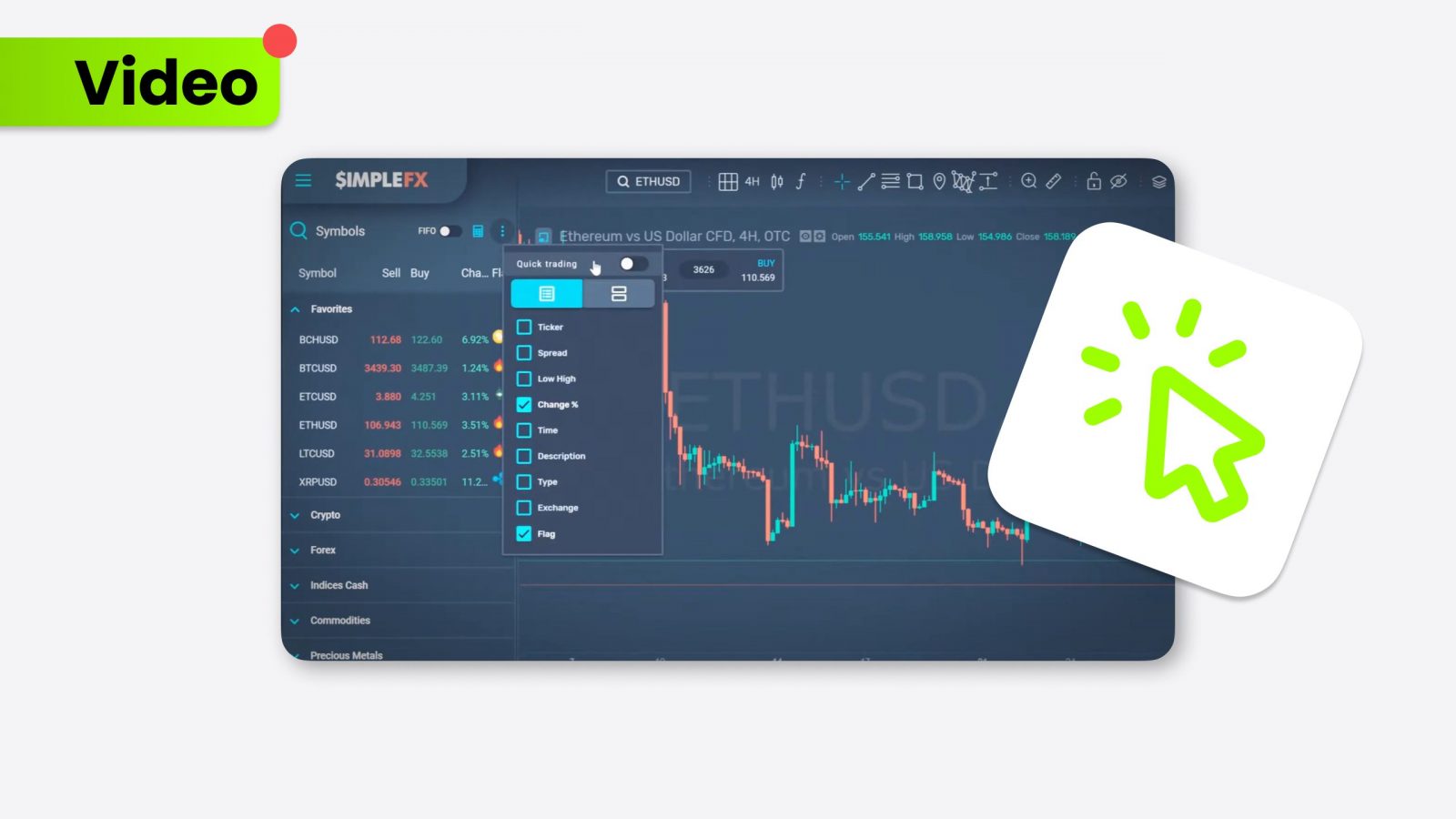

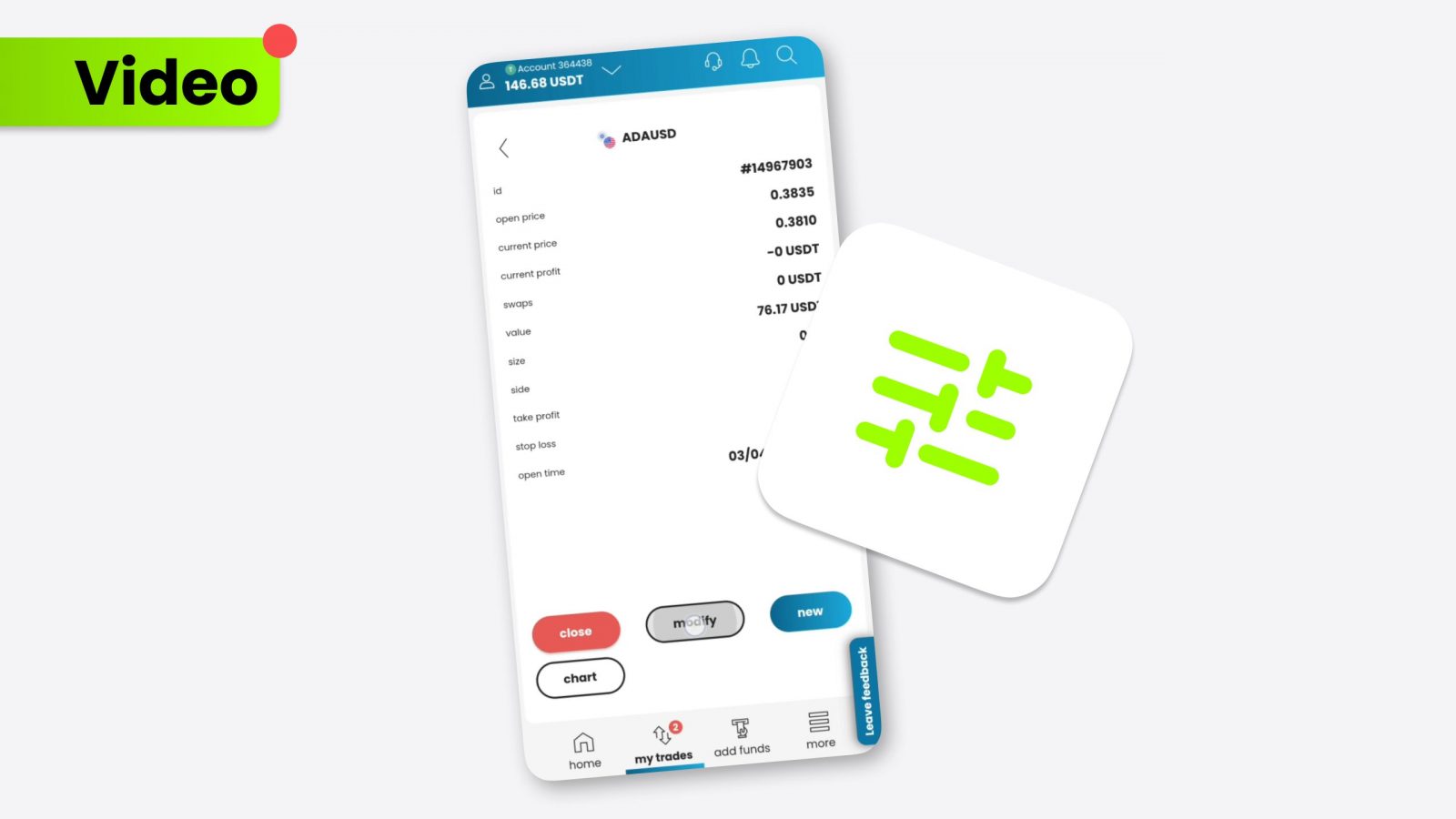

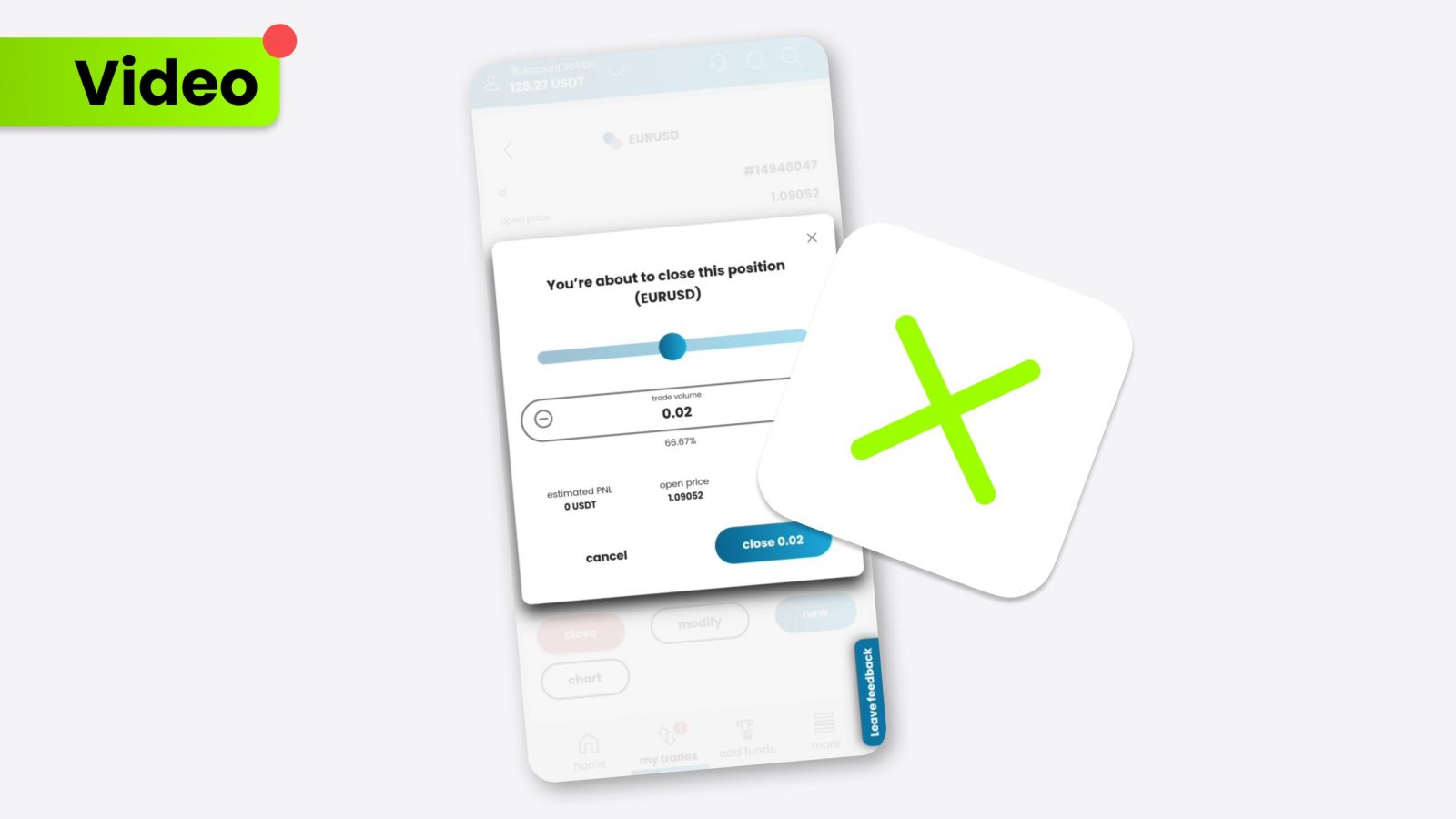

Choosing a wallet and exchange

To store and use cryptocurrencies, you’ll need a digital wallet. There are various wallets, including online, hardware, and software options, each with security features. Additionally, choosing a reliable cryptocurrency exchange is essential for buying, selling, and trading digital currencies.

Conclusion

Cryptocurrencies represent a fascinating and dynamic segment of the digital finance world. For beginners, understanding the basics of how these digital currencies work, their benefits and associated risks is the first step toward informed participation. Whether you’re considering investing in cryptocurrencies or simply curious about their potential, starting with a solid foundation will pave the way for a more rewarding experience. Remember, the cryptocurrency journey is as much about education as investment.