Gross Domestic Product (GDP) is a key indicator of an economy’s performance. In the U.S., it reflects the total market value of goods and services produced domestically, influencing global markets and the U.S. Dollar. Shifts in U.S. GDP directly impact currency pairs, affecting forex and international trade.

- Analyze the significance of U.S. GDP as an economic performance indicator.

- Explore how GDP per capita reflects individual prosperity in the U.S. economy.

- Examine how the U.S. GDP impacts global markets, including key currency pairs like EURUSD and USDCAD.

U.S. GDP: Overview

U.S. GDP measures the aggregate output of the U.S. economy, including sectors like technology, agriculture, and services. As a broad economic indicator, it signals the economy’s overall health. GDP growth suggests a robust economy, while a contraction signals potential recessionary pressures. Policymakers, particularly at the Federal Reserve (FED), use GDP data to guide monetary policy decisions, including interest rate adjustments to control inflation. These decisions, in turn, affect the U.S. Dollar, influencing its performance in global markets and pairs like EURUSD.

U.S. GDP per capita

GDP per capita measures the average economic output per person, providing insights into a nation’s standard of living and economic well-being. It is often used to compare living standards between different countries or regions. Rising GDP per capita typically signals improved living standards and overall economic health. This measure also serves as a valuable benchmark for comparing the U.S.’s relative economic strength with other global economies or even states. Analysts also use key reports like the NFP (Non-Farm Payroll) to evaluate employment trends, as job creation is a significant driver of GDP per capita.

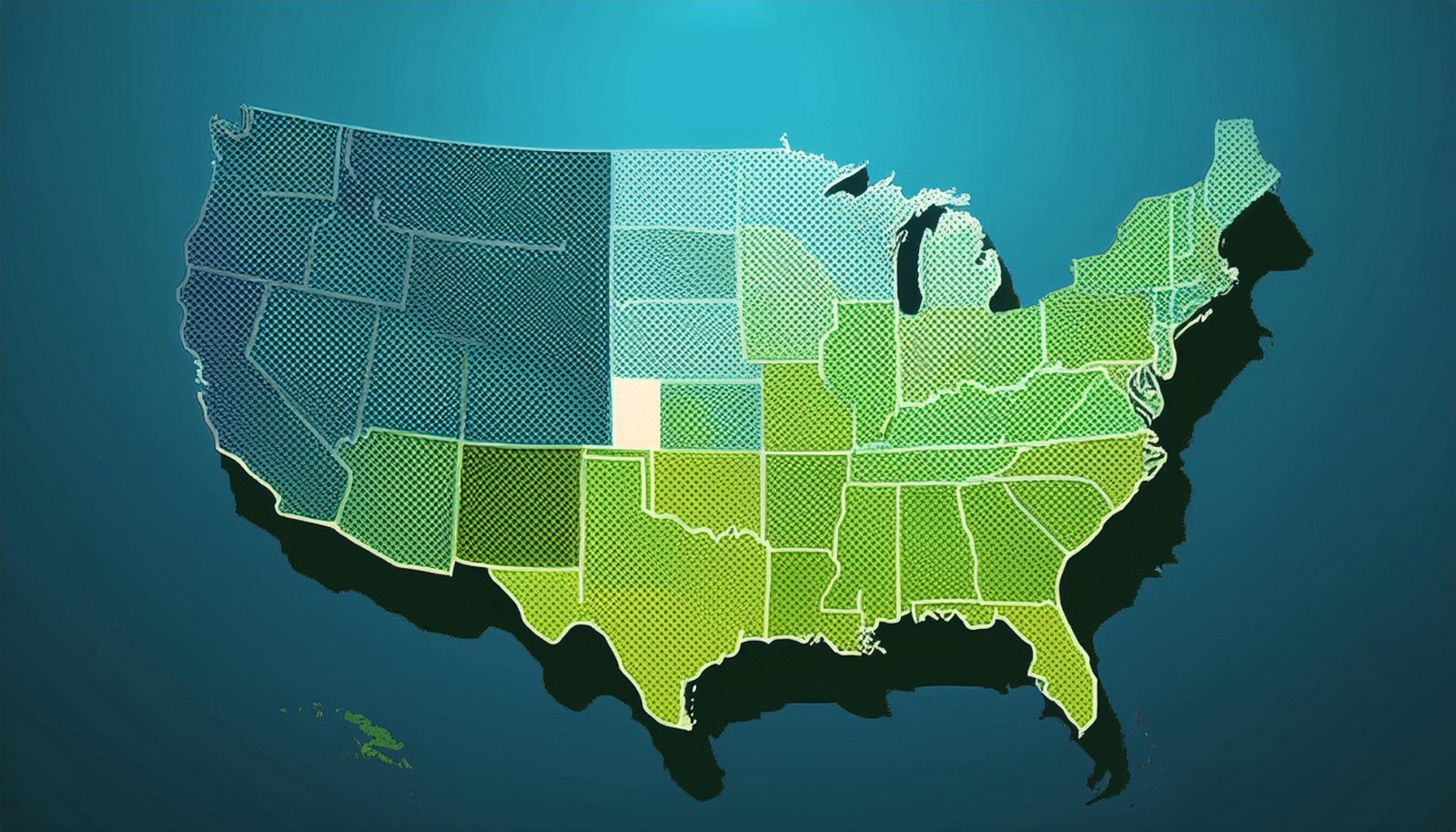

U.S. States by GDP

Certain U.S. states significantly contribute to the national GDP due to their size and industrial focus. California, Texas, and New York lead the way, with California alone accounting for a massive share of the national economy. These states are vital contributors to U.S. GDP and global markets due to their industries, such as technology in California and energy in Texas. For example, industries in California are so large that the state would rank as one of the world’s largest economies on its own. This regional diversity is crucial when considering domestic and international investment opportunities.

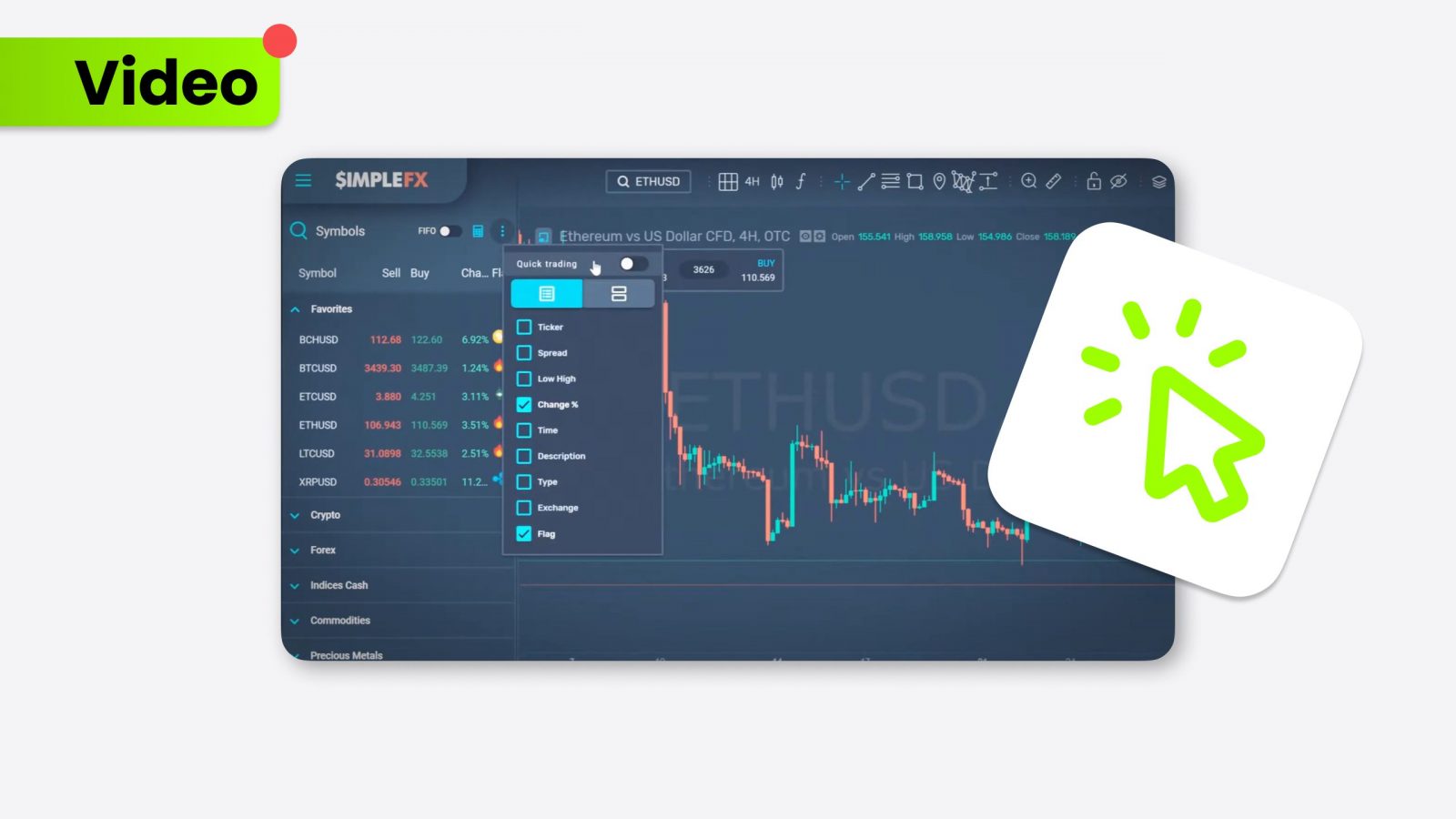

ECONOMIC INDICATORS WIDGET

U.S. GDP growth

U.S. GDP growth is driven by employment, innovation, and overall economic health. The U.S. economy typically cycles through periods of growth and contraction, with the GDP acting as a barometer for these trends. Positive GDP growth is a sign of strong consumer confidence and increased investment. Conversely, slowing growth may point to challenges like rising inflation, debt concerns, or trade imbalances, which impact both the domestic market and global forex trading. For example, fluctuations in Euro to Dollar, USDCAD, USDMXN, or USDAUD can be traced back to U.S. economic growth trends.

U.S. Debt to GDP

The U.S. debt-to-GDP ratio measures the country’s total debt in relation to its economic output, providing an essential gauge of fiscal health. A high ratio suggests the government is borrowing more relative to its economic production, which can raise concerns about long-term financial sustainability. Global institutions like the IMF closely monitor this metric as it impacts investor confidence, particularly in the U.S. Dollar. The USD history has been tied to the Bretton Woods agreement, which established the dollar as the global reserve currency in 1944, backed by gold. However, in 1971, President Nixon ended the dollar’s convertibility to gold, transforming the dollar into a fiat currency. Since then, the USD has been supported by trust in the U.S. government and economy rather than physical assets.