Oil investment can be a strategic move for those looking to diversify their investment portfolio with commodities. Understanding how to invest in oil requires knowledge of the market dynamics and the tools available for traders.

How to invest in OIL?

Investing in OIL offers various avenues, from futures contracts to stocks in oil companies. For those eager to learn how to invest in OIL, the SimpleFX platform provides a demo account where traders can practice trading in commodities markets. This simulated environment can be a solution for novice investors to familiarize themselves with market fluctuations and trading strategies without committing real money. After that, traders can transition to a live account on SimpleFX, where they will find no minimum deposit requirement and no commission on trades. This setup enables a smooth transition from practice to real-world trading, making it easier for investors to get involved in the oil market.

Is Oil a good investment?

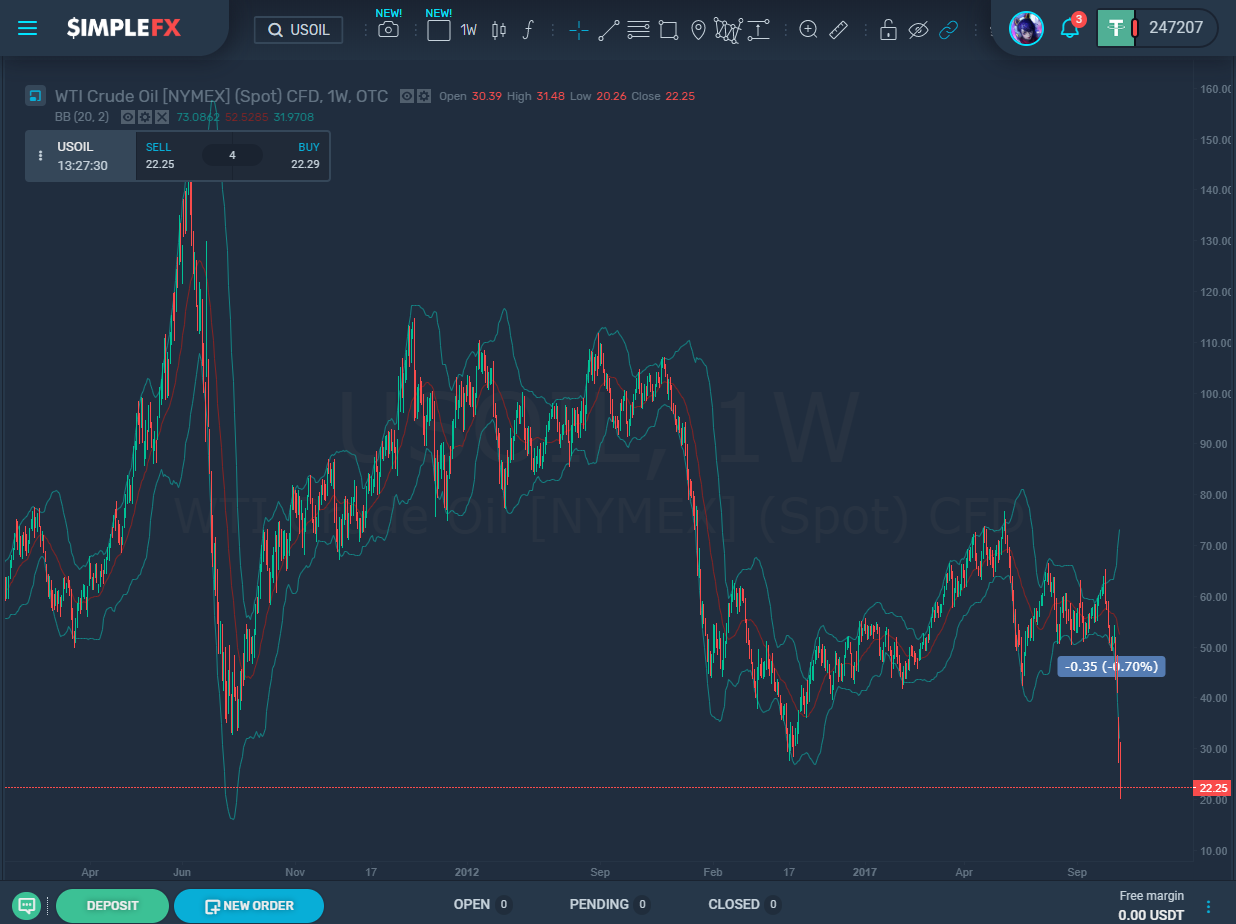

The OIL potential as an investment relies on several factors, including geopolitical developments, supply and demand dynamics, and economic indicators. Fundamental and technical analyses are essential for investors to assess the oil market. Fundamental analysis involves understanding the broader economic and political factors that influence oil prices, while technical analysis focuses on price movement and trading volumes to forecast future trends. Together, these analyses can guide investors in making informed decisions, though it’s essential to recognize that the volatile nature of the oil market means investments should be made with caution.

Is Oil a high-risk investment?

OIL investments don’t come without risks. The market is notoriously volatile, influenced by global events, political instability in oil-producing regions, and changes in energy policies. Even the most well-thought-out investment strategies can face unexpected setbacks, leading to potential losses. Investors should be aware of these risks and consider them carefully before entering the oil market. Diversification and a clear understanding of market dynamics can help mitigate some risks, but they cannot be eliminated.

Does Oil drop or rise?

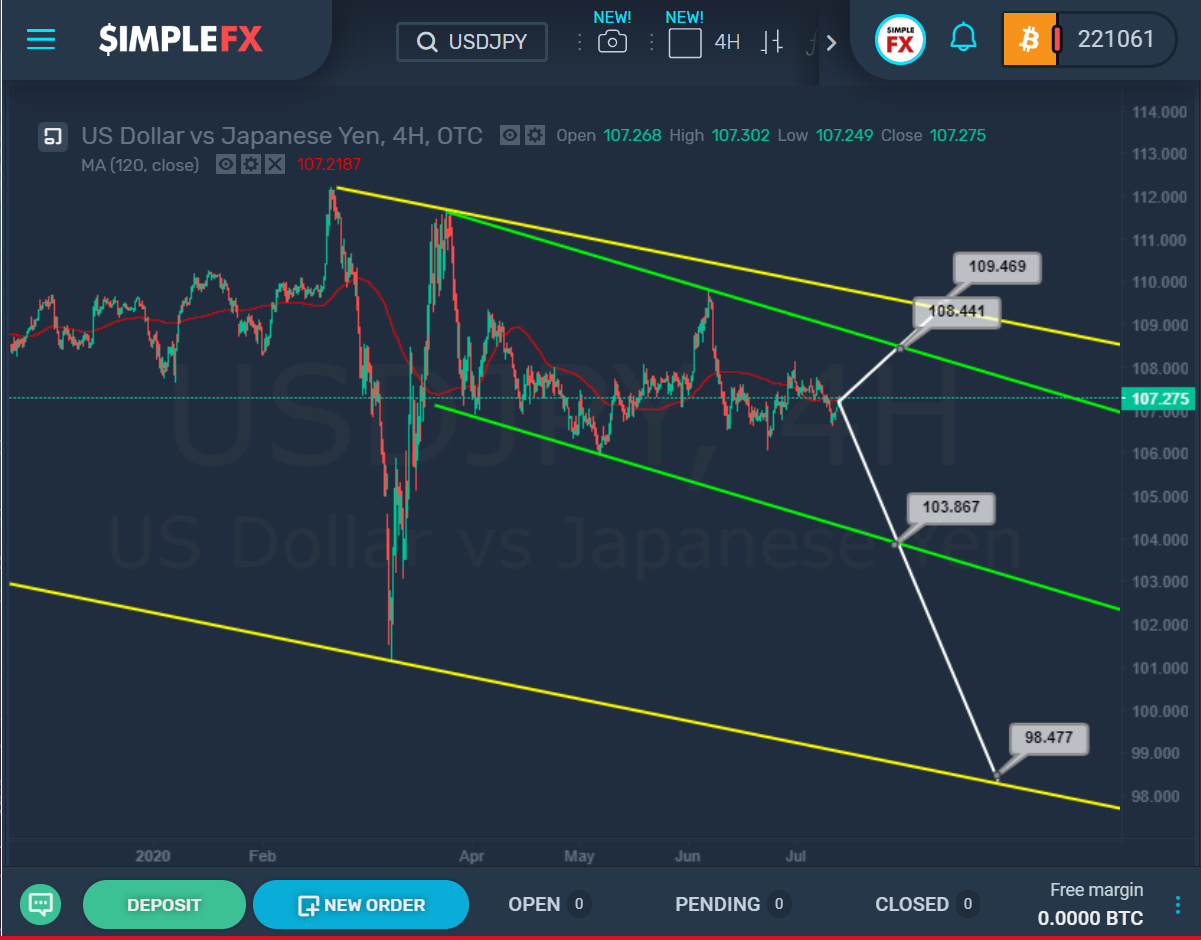

The oil market is subject to fluctuations, with prices influenced by a complex interplay of supply and demand, geopolitical tensions, and economic indicators. SimpleFX offers tools to help traders navigate these changes, including real-time chart prices, technical analysis tools available through its mobile app and Webtrader, and a wealth of resources on its blog and website. These features can aid investors in making informed decisions by providing up-to-date information and insights into price trends.

Unlock your trading potential!

Dive into our step-by-step tutorials.